Ethereum Holds Above $1,500 Amid Options Expiry and Whale Activity, Hong Kong Staking Approval a Bright Spot

Ethereum (ETH) is currently trading above the $1,500 mark, despite a 4% dip in its price over the past 24 hours. ETH/USD price action is being influenced by a variety of factors, including the expiration of significant options contracts, notable selling activity from a long-term holder, and the positive development of staking approval for spot ETFs in Hong Kong.

$2.5 Billion in Crypto Options Expire Today as ETH Battles Volatility

For both Bitcoin BTC/USD and Ethereum ETH/USD, today marks a turning point as over $2.5 billion worth of options contracts expire; Ethereum options alone have notional value of $283.6 million.

According to Deribit data, 183,468 expiring Ethereum contracts have a put-to-call ratio of 0.92, with a maximum pain point around $1,700, far higher than the present trading price of almost $1,550. The second-largest cryptocurrency by market capitalization is trying to create support following recent market volatility, hence this options expiry is quite vital to determine near-term trends.

Early ETH Investor’s Liquidations Add Selling Pressure

Further adding to market volatility is an early Ethereum investor from the 2015 ICO phase returning to active selling. Reportedly buying 100,000 ETH at roughly $0.31, this “OG investor” offloaded almost 4,100 ETH (value around $7.05 million) in April alone. For the early investor, the most recent 664 ETH move to Kraken yields a profit of almost $1 million.

ETH whales’ continuous selling has alarmed traders about further possible downward pressure on Ethereum prices. Following the whale’s recent moves, trade volumes on Kraken rose by 5%, suggesting more market activity in reaction to these movements.

Ethereum Pectra Upgrade Mainnet Launch Expected on May 7

Ethereum developers have confirmed May 7 as the anticipated date of the Pectra update rollout amid these prevalent volatile market conditions. The Pectra upgrade will introduce 11 major changes aimed at improving Ethereum network’s scalability and efficiency for layer-two protocols like Arbitrum.

Designed to simplify the validator pool and prioritize bigger, more efficient node operators, a key development entails raising the validator staking requirement from 32 ETH to 2,048 ETH. Given Ethereum’s 53% yearly drop, market players are keenly watching how this upgrade can change Ethereum’s competitive posture versus other smart contract blockchain networks like Solana, which have been gaining popularity.

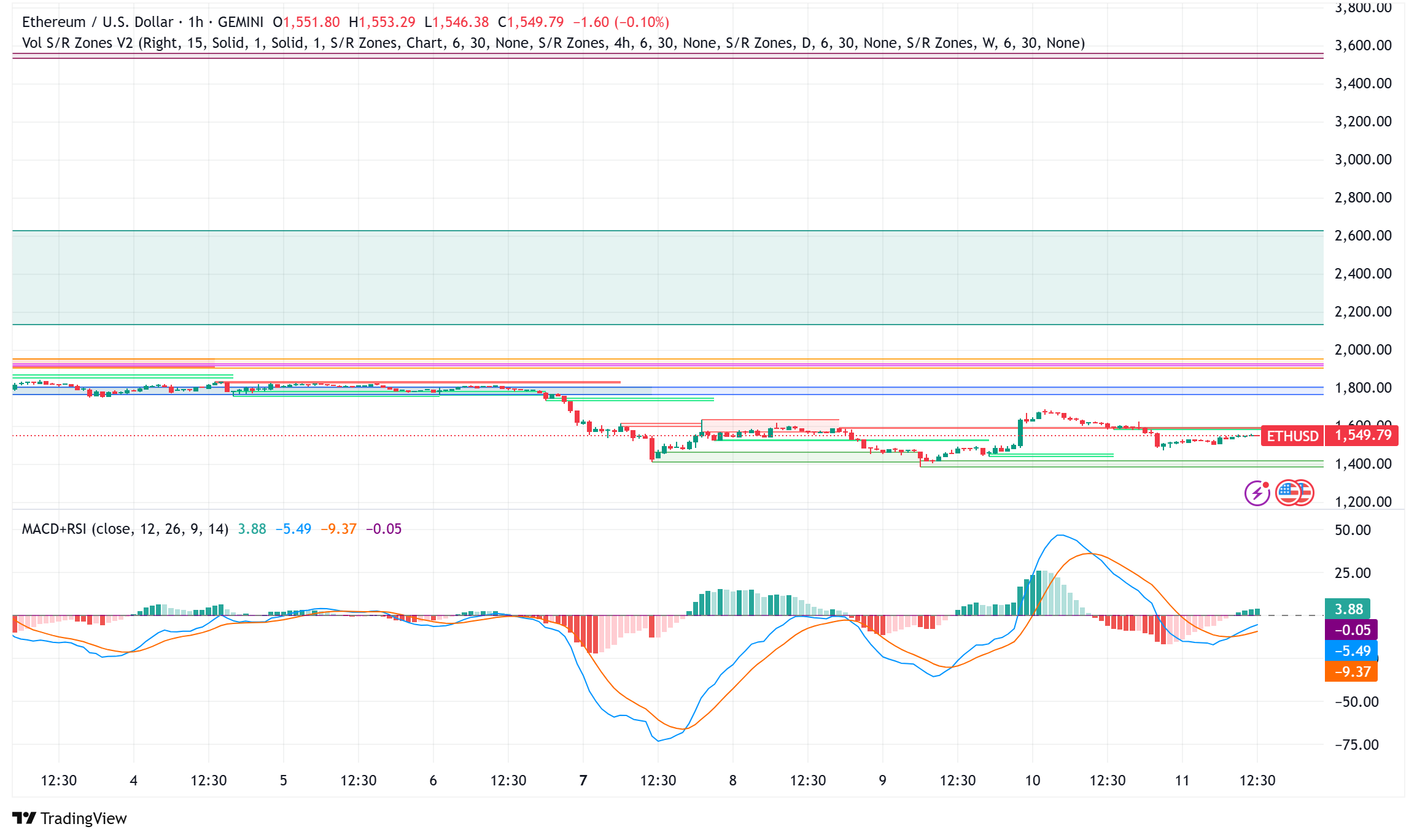

ETH/USD Technical Indicators Show Mixed Signals

Technically, Ethereum has been creating what experts describe as a possible double bottom following notable support around the $1,370-$1,480 level. Market analysts say that this comeback from important support levels has stopped what might have be “a catastrophic drop to its lowest level since December 2022”.

According to the hourly chart, ETH is presently testing the lower range of a rising wedge pattern that started on Tuesday. While shorter timescale show bearish divergence with the RSI around 18% below the signal line, momentum indicators provide a mixed picture with the Relative Strength Index (RSI) near 60, indicating bullish sentiment without hitting overbought territory.

Before the rally maybe starts, market watchers estimate ETH might first fall to $1,510 to balance a supply shortfall. Important resistance levels to keep an eye on are $1,580-$1,600; a breakthrough might let retest $1,680.

ETH/BTC Analysis: Ethereum’s Relative Performance Against Bitcoin Weakens

Underperformance of Ethereum compared to Bitcoin is highlighted by Santiment statistics showing a worrying 77% drop in ETH/BTC ratio since December 2021. Currently trading at about 0.023 BTC, this ratio shows declining strength against the market leader from 0.035 BTC in early April.

Positive on-chain indicators, however, give some promise; weekly transaction volume rises 12% to $14.5 billion while network growth spans 1,200 to 1,500 new addresses between April 1 and 10.