Gold Prices Surge Over 1% Amid Escalating U.S.-China Trade Tensions

Gold prices climbed more than 1% on Thursday as investors sought refuge in safe-haven assets following the U.S. administration's decision...

Gold prices climbed more than 1% on Thursday as investors sought refuge in safe-haven assets following the U.S. administration’s decision to increase tariffs on Chinese imports.

U.S. Raises Tariffs on Chinese Imports

On Wednesday, President Donald Trump announced an immediate increase in tariffs on Chinese imports from 104% to 125%, intensifying the ongoing trade conflict between the world’s two largest economies. This move follows a series of reciprocal tariffs exchanged over the past week. Conversely, the administration authorized a 90-day pause on tariffs exceeding 10% for other countries, aiming to provide a window for negotiations.

Analysts Predict Further Gains for Gold

Edward Meir, an analyst at Marex, suggests that a period of slowed economic growth could lead to lower interest rates, potentially boosting gold prices. He forecasts that gold could reach $3,200 by the end of the month.

Federal Reserve Expresses Concerns Over Inflation and Growth

Minutes from the Federal Reserve’s recent meeting reveal that policymakers are increasingly concerned about the dual risks of rising inflation and slowing economic growth. Some officials noted that “difficult tradeoffs” might be necessary in the future.

Upcoming Economic Indicators to Watch

Investors are now turning their attention to forthcoming economic data, including the U.S. Consumer Price Index (CPI) and Producer Price Index (PPI), scheduled for release later this week. These indicators are expected to provide further insights into inflation trends and potential impacts on monetary policy.

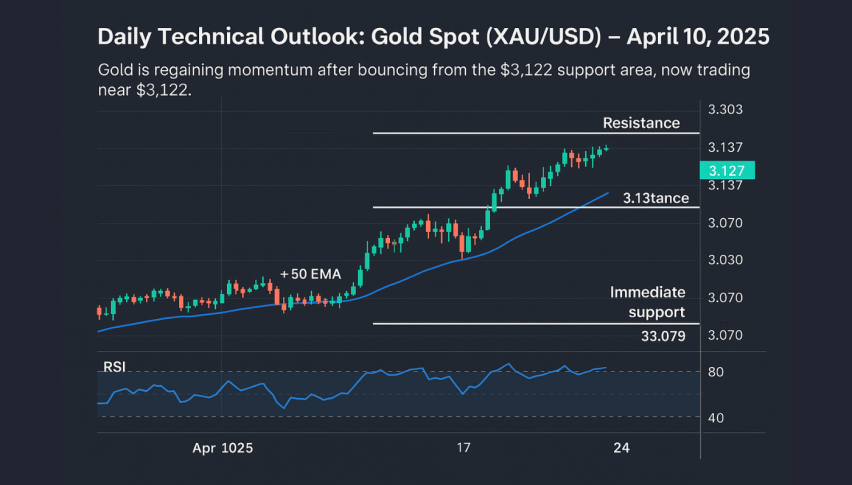

Daily Technical Outlook: Gold Spot (XAU/USD) – April 10, 2025

Gold is regaining momentum after bouncing from the $3,008 support area, now trading near $3,122. The recovery was fueled by a clean break above the 50 EMA ($3,057), suggesting renewed bullish interest. However, price is now approaching key resistance at $3,137.

A break above this level could clear the path toward $3,167 and even $3,203. On the downside, immediate support lies at $3,079, with stronger footing at $3,043 and $3,008. The RSI is climbing near 65, approaching overbought conditions but still showing strength. The trend leans bullish above the 50 EMA, but bulls need to overcome $3,137 for a continued rally.

Conclusion

Gold has reclaimed key technical levels, and momentum favors buyers above $3,057. A break above $3,137 could spark another leg higher.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account