Ethereum Whale Offloads $16.86M in ETH — What It Means for the Market

This week an Ethereum (ETH) whale who had been inactive for more than 2 years sold 10,702 ETH, cashing out $16.86 million just as the market started to show signs of life.

The sale came as ETH briefly went above $1,600, sparking questions about the timing and motive behind the move.

What’s interesting is that this whale bought their ETH back in 2016 at $8 per token and didn’t sell during the last bull run even when ETH went past $4,000. Now as prices are under pressure in 2025 long term holders like this are starting to exit, adding to the selling pressure and debate about Ethereum’s short term direction.

ETH at a Technical Crossroads: Reversal or More Downside?

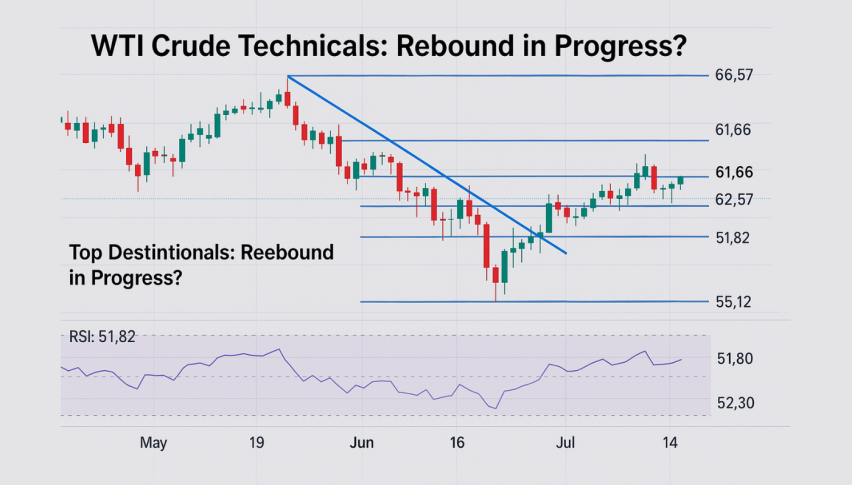

After bouncing 13% from $1,400 ETH is now trading at $1,591 but the picture is mixed. The price was rejected at $1,605 which is the 50 period EMA and a descending trendline—a key resistance zone.

This zone is a pivot. A breakout above $1,605 could take ETH to $1,688 and restore short term bullishness. But if ETH can’t hold above $1,590 analysts warn that a drop to $1,520 or even a retest of $1,412 could follow.

The RSI is at 52 which is neutral—neither overbought nor oversold. This reflects the market is getting indecisive as traders wait for a clear breakout or another rejection at the trendline to guide their next move.

Why This Whale Sale Matters

The sale of $16.86 million ETH adds to the trend: long term holders are capitulating. It’s not just retail traders feeling the pressure. Even seasoned investors who held through the last cycle are starting to exit as Ethereum struggles to get back on its feet.

So was this a smart exit or a panic move? Either way it’s a signal: even those who held ETH for the long term are hedging their bets.

Institutional Demand Could Be Ethereum’s Savior

Despite the bearish tone some bullish catalysts are on the horizon. Most notably the SEC approval of options trading on spot Ether ETFs is opening the door for more institutional participation. This could be a game changer for Ethereum’s long term outlook—stabilizing price action and bringing in new liquidity.

Also technical analysts like Luciano_BTC point out a falling wedge pattern on Ethereum’s chart. This is often a precursor to bullish breakouts especially when combined with price action stabilizing at key support levels like $1,590.

Key Points:

Ethereum whale sold 10,702 ETH worth $16.86M, exited after 2 years of dormancy

ETH rejected at $1,605, $1,591 is now the pivot

A break above $1,605 could take ETH to $1,688; a drop below $1,590 risks $1,520 or lower

RSI at 52 is neutral—market waiting for confirmation

Institutional interest rising with SEC-approved ETH ETF options trading

A falling wedge pattern could mean a bullish reversal ahead

Conclusion:

Ethereum is stuck in a tug of war between selling pressure from long term holders and potential bullish catalysts from institutional developments. With price action at a key resistance zone the next few days will be crucial.

If ETH breaks above $1,605 with volume we may finally see the momentum to challenge higher levels. But until then expect the market to be cautious—watching for any signs of strength or another wave of capitulation.