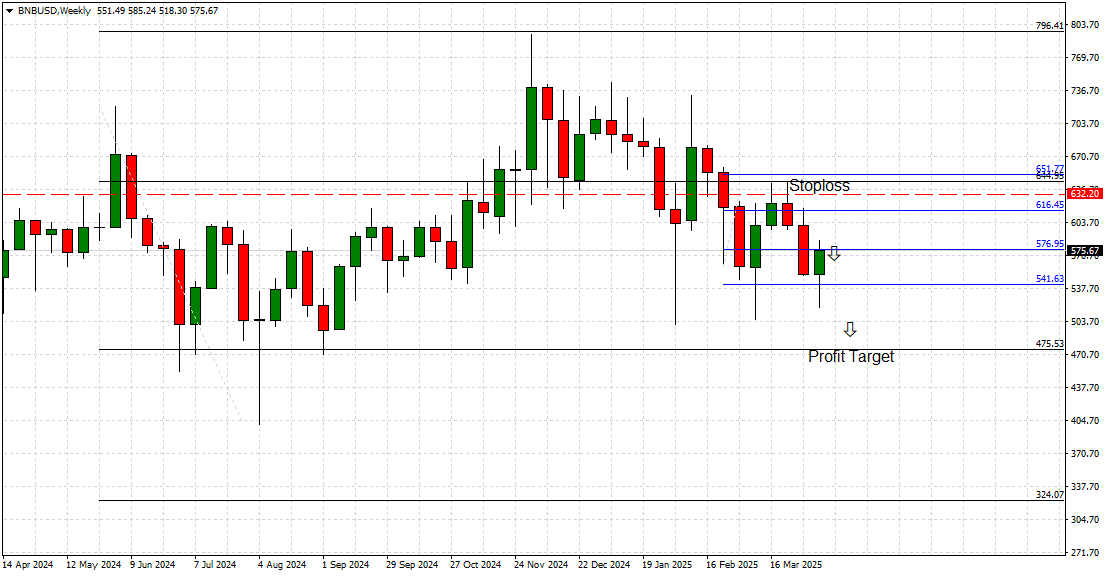

Binance Coin (BNB) – Bearish Momentum Builds as $576.95 Resistance Holds Firm

The bearish sentiment surrounding Binance Coin (BNB) may continue to deepen, following the market’s failure to reclaim the critical resistance level at $576.95.

After several weeks of consolidation, BNB’s price action is now tilting toward a continuation of the downtrend as sellers regain control.

Despite a brief attempt to break higher, the rejection from the $576.95 resistance zone has once again confirmed the dominance of bears, signaling potential for further losses. With this failure, BNB risks heading toward its next key support levels as downward momentum gains strength.

Technical Outlook: Support Zones in Focus

From a technical standpoint, the market structure continues to favor the downside. The inability to reclaim $576.95—a level that now acts as firm resistance—indicates a lack of buying strength. This bearish stance is further validated by the broader weekly structure, which shows a consistent pattern of lower highs and lower lows since the peak in late 2024.

The immediate support to watch is located at $541.63, which previously acted as a springboard for BNB during earlier corrections. However, if this level breaks under renewed bearish pressure, the path toward the major key support at $475.50 becomes wide open.

We have designated $475.50 level as our primary profit target, representing a key structural low and the next major support key-level. A break below this zone could trigger an accelerated downside volatility, potentially towards the previous major low (Aug 2024) around the low levels of $400.

Meanwhile, the stop-loss level for short positions remains logically placed just above the previous local resistance range, above 616.45, which would signal an invalidation of the bearish thesis if reclaimed.

Key Levels to watch:

Imminent Resistance: $576.95

Local Support 1: $541.63

Major Support 2 (Profit Target): $475.50

Stop-Loss (Invalidation): $632.20

Sentiment & Price Action: Bears in Control

BNB’s weekly candlestick pattern shows clear signs of rejection from upper resistance zones, as seen on the chart. Bearish engulfing patterns and lackluster bullish follow-through confirm a shift in sentiment. With market-wide risk appetite showing signs of fatigue, altcoins like BNB are especially vulnerable to extended corrections.

Unless buyers manage to close above the $576.95 zone in the coming sessions, sellers are likely to maintain control, dragging prices lower in search of stronger demand.

Binance: Technology and Vision

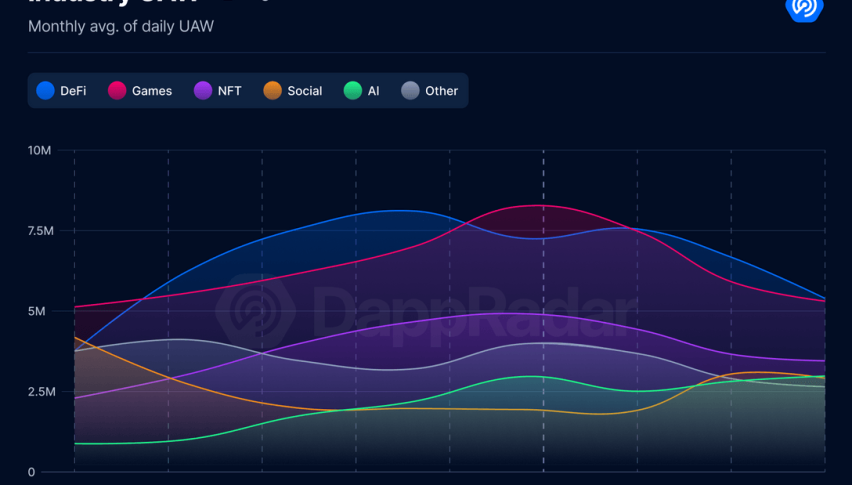

While price action currently leans bearish, Binance remains one of the most impactful and innovative ecosystems in the crypto space. Through Binance Smart Chain (BSC), the platform has established a robust infrastructure that supports thousands of decentralized applications (dApps), staking protocols, and NFT marketplaces.

BNB, as the native token of the ecosystem, plays a pivotal role by reducing trading fees, powering BSC gas transactions, and enabling staking and participation in launchpads. Binance’s global outreach, coupled with its fast transaction throughput and low-cost model, continues to attract developers and retail participants alike.

Nonetheless, short-term price dynamics are influenced more by technical positioning and macro liquidity flows than the underlying fundamentals—highlighting the importance of distinguishing between long-term conviction and tactical trading setups.

Conclusion: Downside Risks Remain

With BNB failing to recover above the $576.95 resistance and downward momentum intensifying, traders should brace for additional weakness. The $541.63 support now serves as a critical inflection point—its breach could lead to an accelerated drop toward $475.50, which serves as our primary profit target.

Until bulls prove their strength with a decisive break and close above $576.95, the broader outlook remains bearish.