Bitcoin Recovers Above $80,000 After Fake Tariff News Sparks Rally: Technicals Suggest Caution Remains

Bitcoin has rebounded to the $80,000 level, showing resilience despite recent market turmoil triggered by US tariff announcements. The cryptocurrency is currently trading at approximately $80,147, representing a 3.4% gain over the past 24 hours. This recovery comes after Bitcoin BTC/USD reached a four-month low of $74,500 on April 7, marking what analysts describe as potentially the largest price drawdown of the current bull market cycle.

Long-Term BTC Holders Beginning to Move Coins

The clear rise in the Exchange Inflow Coin Days Destroying (CDD) statistic, which gauges the movement of older coins that have stayed inactive for protracted durations, is a worrying trend for Bitcoin enthusiasts. With a “massive spike” in this signal, cryptoQuant contributor IT Tech suggested that long-term investors would be selling assets to exchanges with possible selling intent.

“Histologically, spikes in Exchange Inflow CDD have preceded significant price corrections,” observed IT Tech. This latest increase coincides with Bitcoin’s decline from $82,000 to $76,000, maybe indicating that experienced holders are getting ready to sell assets in view of market volatility.

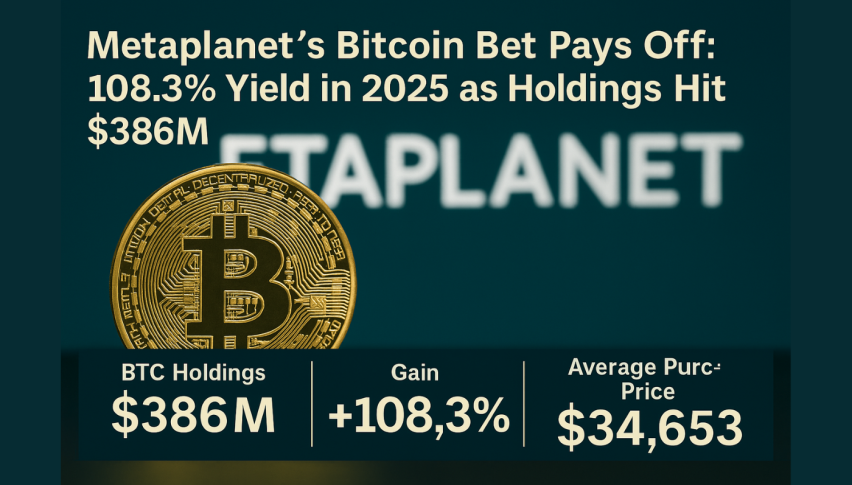

Corporate Bitcoin Treasuries Feel the Pressure

Corporate Bitcoin holders have been much affected by the current market volatility. Data from BitcoinTreasuries.net shows that following President Trump’s tariff statements, corporate Bitcoin holdings lost more than $4 billion in value overall from around $59 billion before April 2 to almost $54.5 billion by April 7.

Widely known as Michael Saylor’s de facto Bitcoin hedge fund, MicroStrategy’s shares dropped more than 13% since April 2. Notwithstanding the price drop below $87,000, the corporation briefly stopped its Bitcoin buying program between March 31 and April 6, implying possible nervousness even among the most dedicated institutional Bitcoin holders.

BTC/USD Technical Analysis Suggests Cautious Optimism

Right now, Bitcoin is testing important technical levels that might define its short-term course. Historically acting as a dividing line between bull and bear market phases, the cryptocurrency has bounced off the important 50-week exponential moving average (50-week EMA).

Market expert Ted Pillows said Bitcoin has to recover and hold above the 50-week EMA, which is presently close to $77,500, to prevent a more severe downturn. On the hourly chart, the current price action has created a bearish trend line with resistance at $80,400, implying that Bitcoin has great challenges ahead before beginning a consistent comeback.

Technical study shows that the first important resistance is close to $81,500; additional resistance comes at $82,500. Rising above these points might send Bitcoin toward $85,000.

Bitcoin vs. Traditional Markets: Signs of Decoupling?

Against conventional financial markets, Bitcoin has demonstrated astonishing resilience in spite of the general market downturn. While most US stock indices fell by more than 10% after Trump’s tariff declarations, Bitcoin has recovered faster.

“Even in the wake of recent tariff announcements, BTC has shown some signs of resilience, holding steady or rebounding on days when traditional risk assets faltered,” Binance Research said. This conduct points to Bitcoin perhaps starting to reestablish “a more independent macro identity,” hence enhancing its story as a store of value apart from conventional financial markets.

With a correlation with gold still somewhat low at 0.12 during the previous 90 days, the bitcoin’s connection with stocks is at 0.32. Still, gold is the most sought-after safe-haven asset among fund managers; 58% of the respondents said they would choose gold in trade war conditions over just 3% for Bitcoin.

The performance of Bitcoin in the next weeks will decide if it can firmly establish itself as a dependable hedge against economic instability as global markets keep adjusting to the possibility of extended trade fragmentation and geopolitical tensions.