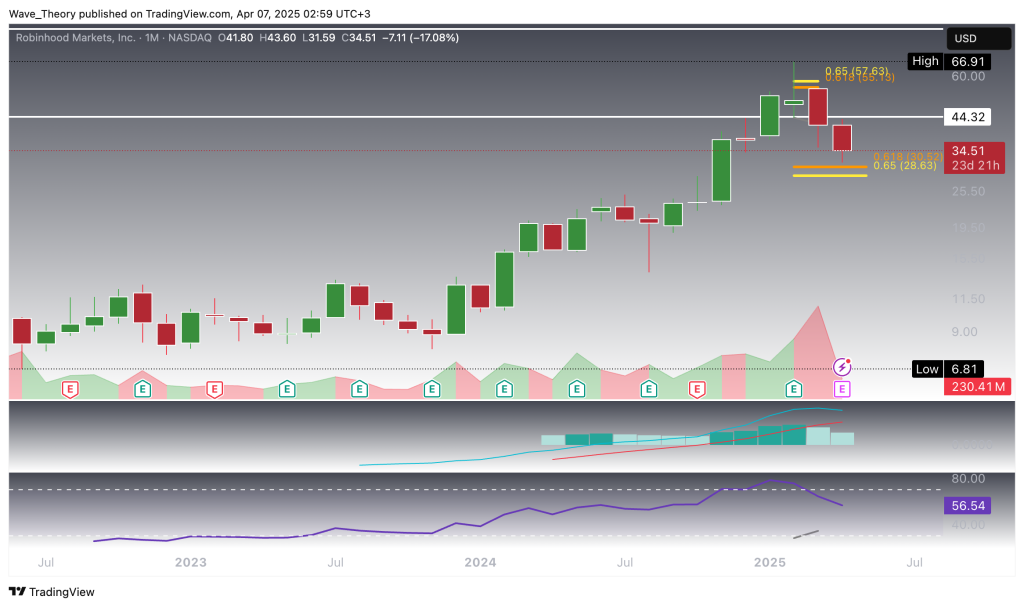

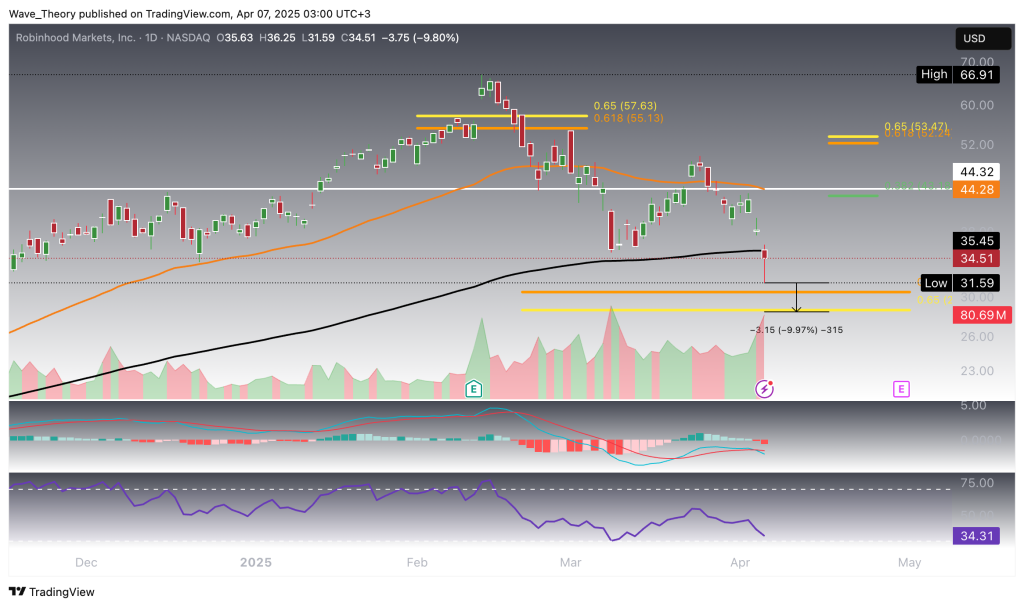

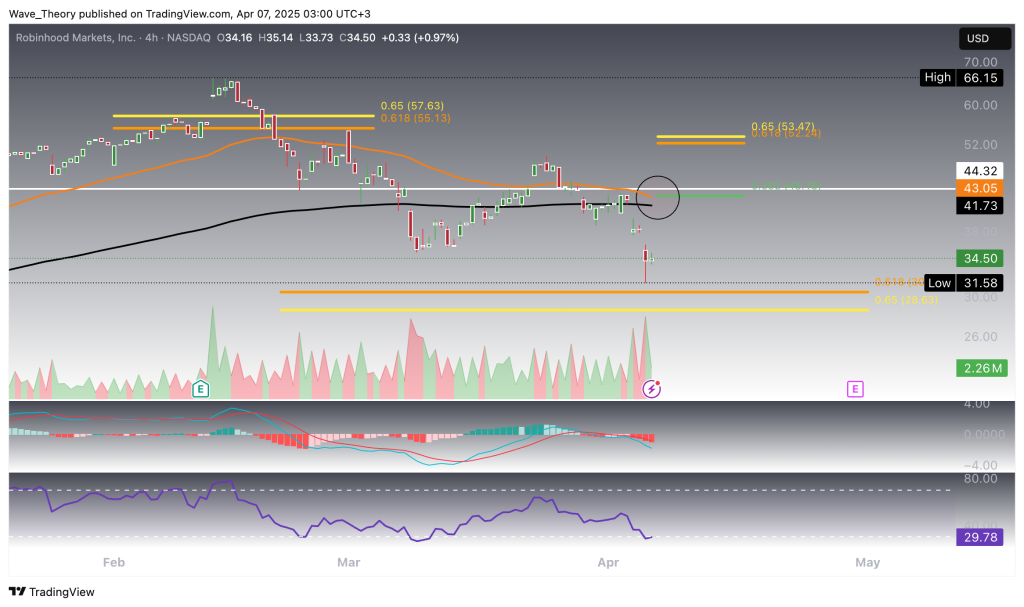

Robinhood (HOOD) Approaches Key Golden Ratio Support at $29 – Will the Bullish Trend Hold?

Robinhood (HOOD) faced a strong rejection at the golden ratio resistance around $57 last month and is now approaching a critical golden ratio support zone near $29. This level will likely act as a pivotal point for price action—so long as HOOD holds above this support, the broader bullish trend remains structurally intact.

However, caution is warranted. The MACD histogram has been trending lower over the past month, reflecting weakening momentum. Still, the MACD lines remain bullishly crossed, indicating the underlying trend has not yet shifted. Meanwhile, the RSI sits in neutral territory, giving neither bullish nor bearish confirmation at this stage.