Pump.fun Revives Controversial Livestreaming Feature as Memecoin Frenzy Fades

Solana-based memecoin launchpad Pump.fun has cautiously reintroduced its controversial livestreaming feature after a five-month suspension, implementing new moderation policies amid significantly declining platform activity and a broader memecoin market downturn.

Co-founder Alon Cohen announced on April 4 that the feature has returned with “industry standard moderation systems in place and transparent guidelines,” currently available to just 5% of users as part of a controlled rollout.

Contentious History of Livestreaming on Pump.fun

Following a string of unsettling events when users did extreme stunts, threatened violence or self-harm, and produced other terrible material to sell their tokens, the network first banned livestreaming last November. The problem got worse in February when a trader called “MistaFuccYou” sadly committed suicide during a broadcast on X following a rug pull using a Pump.fun token, igniting more criticism. She lost $500.

“There is an implicit assumption that some content — perhaps much content — generally defined as NSFW will in fact appear on pump fun,” says the platform’s new moderating policy, which forbids violence, animal abuse, pornography, and young endangerment. The policy also reserves Pump.fun the right to “unilaterally determine the appropriateness of content where necessary and to moderate it accordingly.”

Livestream Feature Returns to Pump.fun Amid Cooling Memecoin Market and Declining Platform Activity

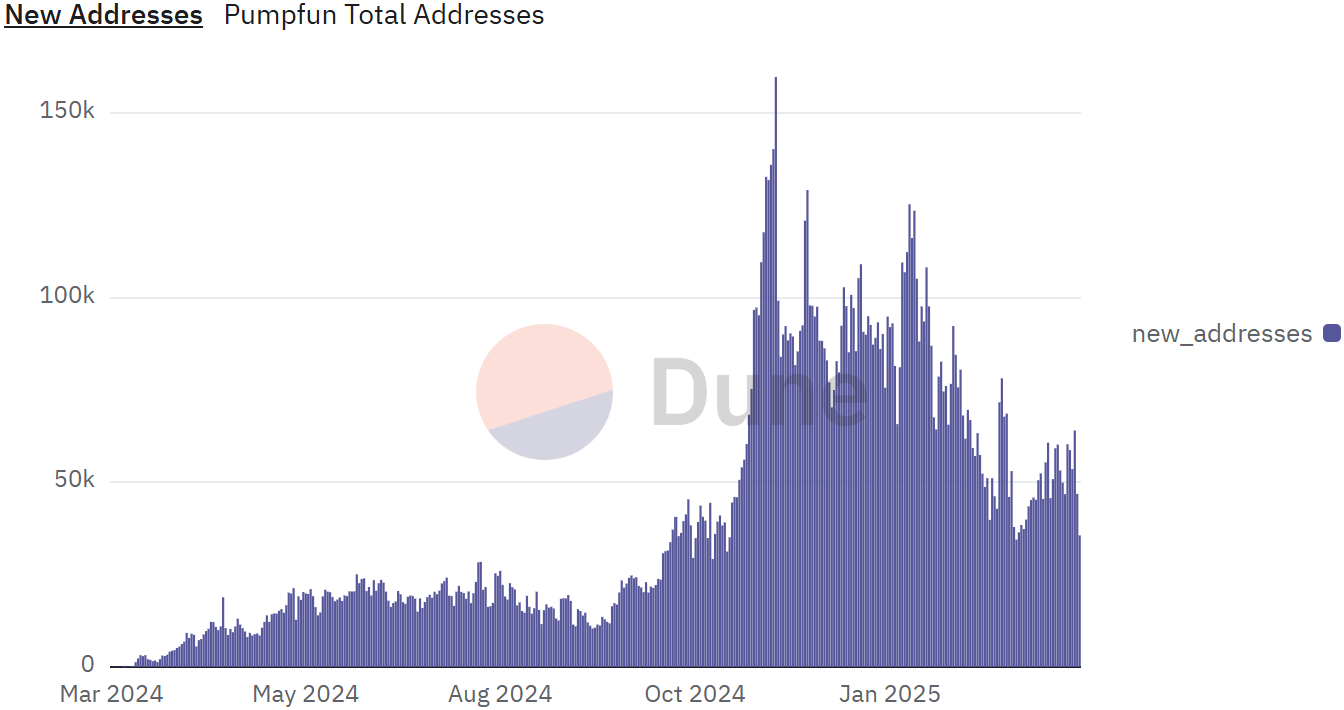

For the platform, the livestreaming comeback coincides with a difficult period. Dune Analytics reports that the “graduation rate” for tokens introduced on Pump.fun—those with enough market capitalization to become tradable on regular decentralized exchanges—has dropped below 1%, from January highs of over 1.67%. While trading volumes linked to Pump.fun tokens have crumbled by around 86% between January and March, daily transactions have dropped almost 70% since their January peak.

This drop reflects a more general slow down in the DeFi industry. Pump.fun and other Solana-based DeFi apps combined produced about $42 million in March, a 55% dip from February and a sharp 75% drop from January’s record highs. Along with the dismal performance of tokens like Trump (Trump), which has lost over 90% of its value since January, numerous well-publicized rug pulls including Libra (LIBRA) and Melania Meme (MELANIA) have had a major influence on the general memecoin market.

The wider Solana ecosystem has also suffered the effects; token releases on the network have dropped drastically Less than one-third of the 95,678 issued at the height of the memecoin frenzy on January 26—just 31,651 tokens were generated on April 5.

Previous warnings regarding the content moderation issues of the site came from industry watchers. Last November, co-founder of algorithmic trading company Trading Strategy Mikko Ohtamaa said Pump.fun will suffer closure once mainstream audiences learned of the troublesome livestreams without suitable regulation.