Oil Prices at a Crossroads: Will WTI Fall to $50 if $60 Support Breaks, or Return to $70?

Crude Oil prices tumbled $10 last week as China retaliated to US tariffs, testing $60, which would open the door for $50 if broken.

A January Rebound Fizzles Out

Crude oil prices kicked off the year with a recovery, as West Texas Intermediate (WTI) crude climbed above $80 per barrel in January. While this rally hinted at a potential turnaround, it ultimately proved short-lived. The broader bearish trend—intact since June 2022—resumed in February, pushing prices lower once again.

By early March, WTI had fallen to $65, where it encountered the long-term 200-month Simple Moving Average (SMA), a technical support level that has held since 2021. Historically, each dip to this SMA has sparked a rebound in prices.

Geopolitical Optimism and Economic Worries Shape Price Action

The early-year price decline was fueled by fading risk premiums as hopes grew for ceasefires in both the Gaza and the Russia-Ukraine conflicts. Additionally, looming concerns over a global economic slowdown weighed on oil demand forecasts.

Despite mounting pressure for peace, the persistence of these geopolitical tensions triggered a brief bounce in March, reinforcing the 200-month SMA as a temporary floor. However, the upward momentum was quickly derailed in April.

US Tariffs and OPEC+ Surprise Spark Renewed Selling

The tide turned when the U.S. announced new trade tariffs, including a 10% baseline levy, a 34% duty on Chinese goods, and 20% on EU imports. While energy products were exempt, markets were spooked by fears of slowing global trade and weaker demand. China’s retaliatory measures only added to the anxiety. WTI responded by plunging nearly 10% in just two trading sessions, hitting $66.50 by Thursday.

WTI Oil Chart Daily – The 200 SMA Was Broken, But the 100 SMA Held

As if that weren’t enough, a surprise announcement from OPEC+ further rattled investors. The oil-producing bloc revealed plans to boost supply by 411,000 barrels per day—almost three times the 140,000 bpd increase analysts had expected. The announcement arrived amid already fragile market sentiment, intensifying concerns about an oversupplied market in the face of weakening demand.

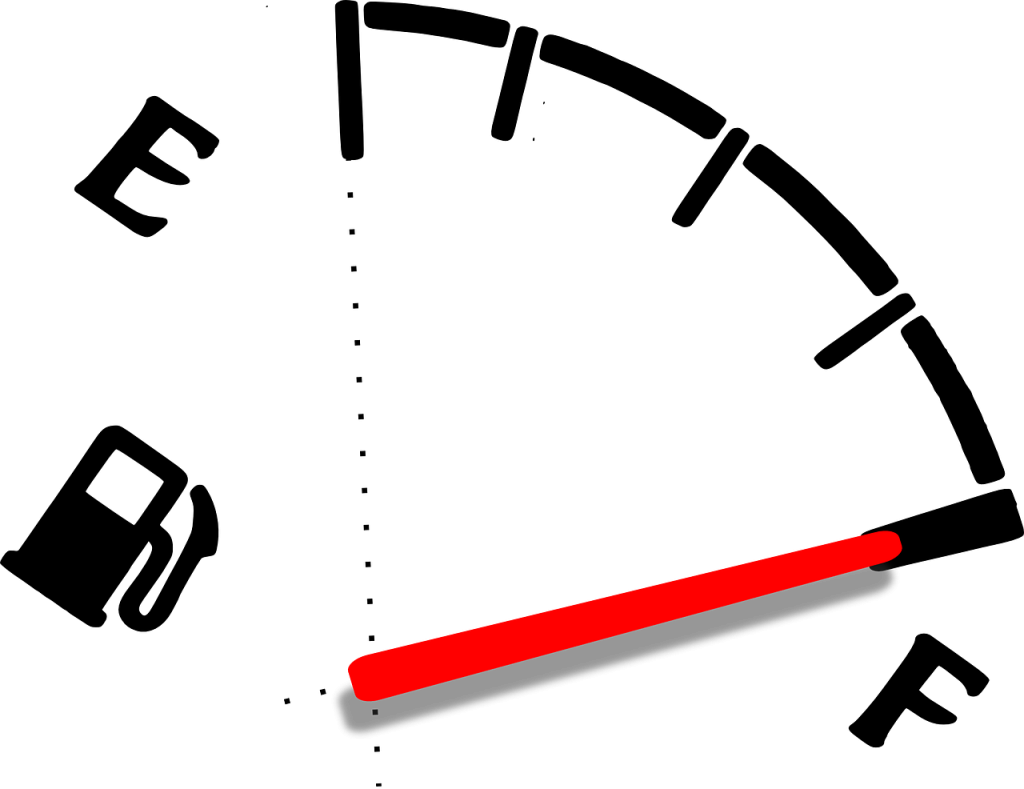

Testing Critical Support at $60

Following the OPEC+ news, WTI crude tumbled to a low of $60.50 before rebounding slightly and settling just above $62. All eyes are now on the $60 level—a crucial support zone. A decisive break below could trigger a slide toward the $50 range, as the market grapples with weakening fundamentals, rising supply, and fragile global growth prospects.

This week could prove pivotal. If buyers step in to defend the $60 mark, a short-term recovery may be possible. But if selling pressure intensifies and $60 gives way, the path toward $50 becomes increasingly likely.