Caterpillar, Apple, and JPMorgan Stocks Tumble as U.S.-China Trade Tensions Rattle Wall Street

Caterpillar, Apple, and JPMorgan stocks drop sharply amid renewed U.S.-China tariffs and rising fears of an economic slowdown.

The stock market took a hit this week, with heavyweight names like Caterpillar, Apple, and JPMorgan Chase leading the losses.

Concerns over the escalating trade war between the U.S. and China—and what it means for the broader economy—have spooked investors and triggered a wave of selling.

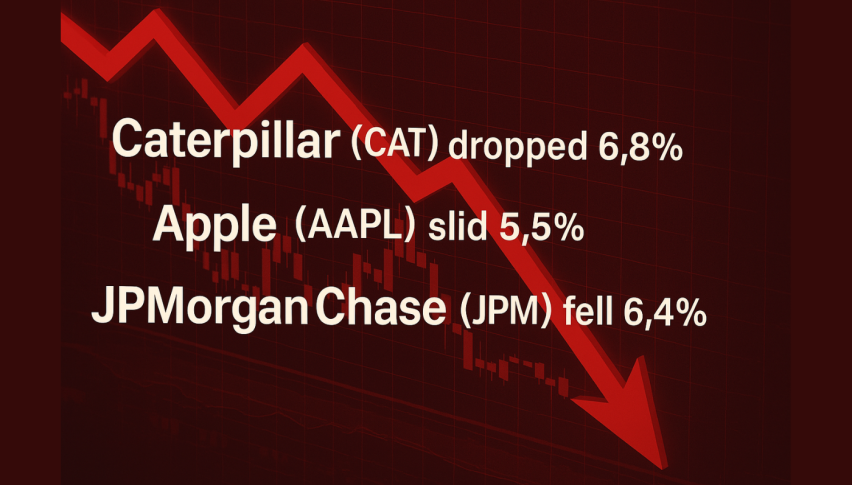

Caterpillar (CAT) dropped 6.8%

Apple (AAPL) slid 5.5%

JPMorgan Chase (JPM) fell 6.4%

Let’s break down what’s going on.

Caterpillar Feels the Weight of New Tariffs

Caterpillar, often seen as a bellwether for global industrial demand, is highly exposed to international trade—especially with China. With the latest round of tariffs now in place, including a 34% levy on U.S. imports from China, fears are mounting that Caterpillar’s sales of construction and mining equipment will take a hit.

Investors worry the tariffs will dampen global demand and weigh on future earnings. As a result, the stock took a steep dive, reflecting broader concerns over the health of the global manufacturing sector.

Apple Hit by China Exposure and Supply Chain Woes

Apple’s stock also dropped sharply—down 5.5%—as tensions with China raise red flags about supply chain stability and consumer demand. China remains a critical market for Apple, both in terms of sales and manufacturing. Any disruption there could spell trouble for the tech giant’s bottom line.

The tariffs also threaten to increase Apple’s production costs, which could squeeze margins at a time when the company is already navigating sluggish demand and tight component supplies.

JPMorgan Chase Sinks as Recession Fears Grow

The banking sector wasn’t spared. JPMorgan Chase, one of the largest financial institutions in the world, saw a 6.4% drop in its stock price. The reason? Mounting fears of an economic slowdown.

Banks like JPMorgan are especially vulnerable when market volatility rises and lending slows down. With global trade disruptions fueling inflation concerns and threatening growth, the outlook for corporate profits—and by extension, bank earnings—is getting murkier.

The Bigger Picture: Market Sentiment Turns Risk-Off

The renewed tariffs have wiped billions in market value, and investors are growing increasingly wary of what lies ahead. Supply chain disruptions, inflationary pressures, and the threat of a global recession are driving risk aversion across the board.

For companies like Caterpillar, Apple, and JPMorgan Chase, the road ahead looks bumpy—at least until trade tensions ease or the Federal Reserve steps in with clearer policy support.

Bottom Line:

As U.S.-China trade frictions heat up and macroeconomic concerns take center stage, even the biggest names on Wall Street are feeling the pressure. For now, volatility may remain the norm as investors search for stability in an increasingly unpredictable market.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account