Cardano (ADA) Bearish Momentum Builds Following Support Breakdown

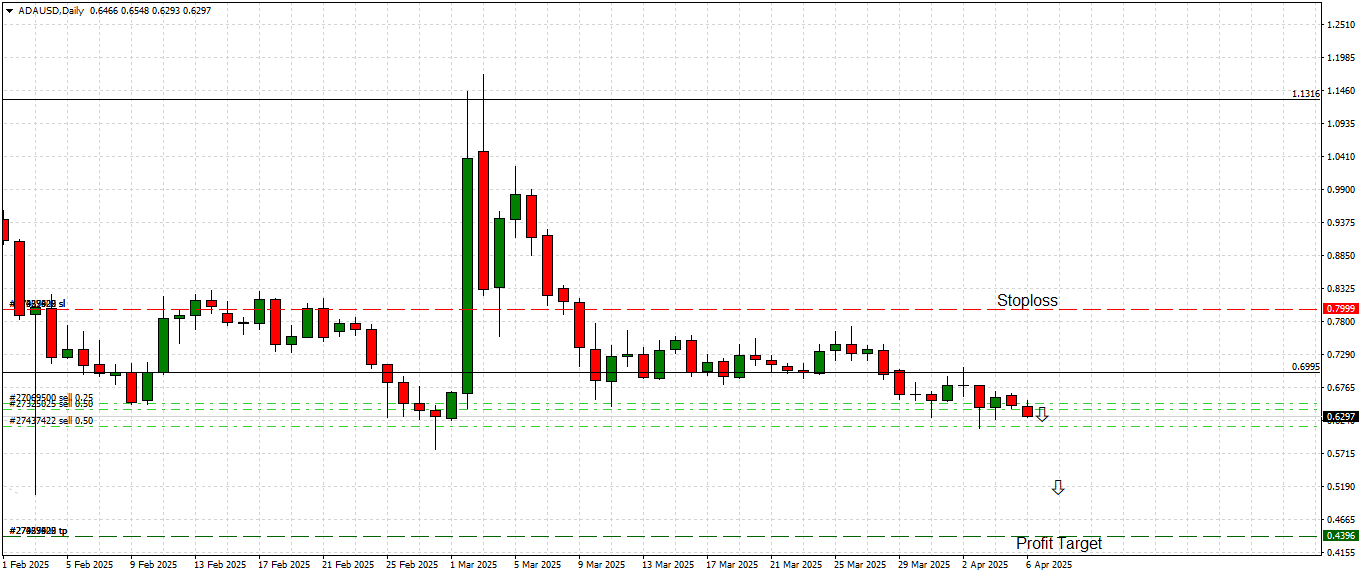

Cardano (ADA) has entered a renewed phase of selling pressure following a critical breakdown below the $0.6995 support level — a structural level that had acted as a floor since early March 2025.

This breach signals a bearish continuation pattern, with traders increasingly eyeing the next major support at $0.4400 as the likely target for this leg lower.

The broader crypto market remains under pressure amid cautious sentiment and liquidity outflows from altcoins, and ADA appears to be particularly affected, slipping further into a clear downward trend. The technical breakdown suggests the selling may not yet be done.

Technical Overview: Support Breakdown Opens Path to $0.4400

The daily chart shows a well-defined bearish structure, with price action confirming a sequence of lower highs and lower lows. The decisive break below $0.6995 — a previously well-defended support level — acts as the primary catalyst for this forecast. This level had repeatedly provided a floor for ADA throughout March but has now flipped into resistance.

The rejection from $0.6995 and failure to sustain even minor rallies indicate a lack of buyer conviction. This, combined with persistent bearish candlesticks and decreasing volume on green days, reinforces the idea that bears are in control. With momentum building to the downside, the next critical area of interest lies at $0.4400 — a major historical support that aligns with the April 2023 consolidation base.

A stop-loss for bearish positions remains well-placed at $0.8000 — just above the last key swing high and the upper end of recent consolidation. As long as price trades below this level, the risk-to-reward ratio continues to favor short positioning.

ADA Technology and Vision: Fundamentals vs. Price Action

Cardano remains one of the most fundamentally sound projects in the crypto space, even as its token price trends lower. Built on peer-reviewed research and academic rigor, Cardano was developed with a long-term vision in mind — emphasizing sustainability, scalability, and security.

The platform operates on a layered architecture, separating the settlement and computation layers to enhance performance and modularity. Its consensus mechanism, Ouroboros — a provably secure proof-of-stake protocol — has helped ADA remain energy-efficient and highly decentralized. This is crucial in an environment where environmental concerns are reshaping investor preferences.

Cardano also supports smart contracts through its Plutus framework and is actively expanding its DeFi and NFT ecosystems. With a strong developer community, active treasury, and continuous updates (including the Hydra scaling solution), Cardano is laying the groundwork for future mass adoption.

However, despite these robust fundamentals, ADA’s price continues to reflect market psychology and risk-off sentiment — rather than its technological merit. This divergence between fundamentals and price is not uncommon in crypto, especially during broad altcoin corrections.

Potential Scenarios and Trading Strategy

Bearish Scenario: A sustained move below $0.6995 opens the door for a continuation toward the $0.4400 support level. This level is also a realistic profit target for current short positions. If $0.44 fails to hold, further downside potential could follow in an extended bearish environment.

Bullish Scenario: A Weekly close back above $0.6995 would invalidate the immediate bearish bias. To trigger a larger reversal, bulls must reclaim the $0.73-$0.80 zone, which would signal strength and potentially pave the way for a broader recovery.

Conclusion

Cardano’s price action paints a clear bearish picture following the breakdown below $0.6995. While the project’s fundamentals remain strong and long-term adoption prospects are promising, the current market conditions and technical signals continue to favor downside potential. The next major support at $0.444 is now in focus as the primary bearish target. Unless the price quickly reclaims lost ground and regains key resistance levels, traders are advised to remain cautious and align with the prevailing trend.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account