XRP Price Wobbles at $2.15 as SEC Chair Drama Fuels Investor Uncertainty

Ripple’s XRP is back in the hot seat. After a volatile week, the token is struggling to stay above $2.15 as investors digest growing...

Ripple’s XRP is back in the hot seat. After a volatile week, the token is struggling to stay above $2.15 as investors digest growing uncertainty around the nomination of Paul Atkins as the next SEC Chair.

The market briefly dipped to $2.06 before bouncing back, but the turbulence hasn’t gone unnoticed—especially after $220 million in capital was pulled from XRP-related markets.

Atkins, who’s widely viewed as crypto-friendly, is facing political headwinds in Congress over alleged conflicts of interest. If his nomination falls through, investors fear it could mark a shift toward stricter crypto regulation—bad news for XRP and other altcoins. Despite Ripple recently scoring a legal win over the SEC, fresh doubts about regulatory leadership have cooled the token’s momentum.

The sentiment shift is clear. Traders now assign just a 35% chance that the SEC will greenlight an XRP spot ETF by July 31—a 7% drop since questions about Atkins’ nomination began circulating. That change has fueled bearish pressure in both spot and derivatives markets.

Traders Pull $220M From XRP Futures Amid Mounting Doubts

It’s not just the spot market that’s feeling the heat. XRP futures traders are also tapping out. Data from CryptoQuant shows open interest in XRP has fallen from $1.6 billion on March 19 to $1.48 billion—a sharp $220 million drop in just 10 days.

This pullback suggests growing caution among traders, many of whom are scaling back exposure amid the regulatory noise. Historically, falling open interest is a red flag, signaling that traders are either locking in profits or exiting before potential deeper losses.

Quick Market Recap:

XRP touched a low of $2.06 before recovering to $2.15.

Futures open interest dropped by $220 million in 10 days.

Odds of an XRP ETF approval by July fell from 42% to 35%.

Atkins’ nomination faces growing pushback from lawmakers.

Regulatory uncertainty is dampening short-term sentiment.

Unless there’s a meaningful shift in tone from U.S. regulators, XRP could continue facing downward pressure.

XRP Technical Outlook: Breakdown or Breakout?

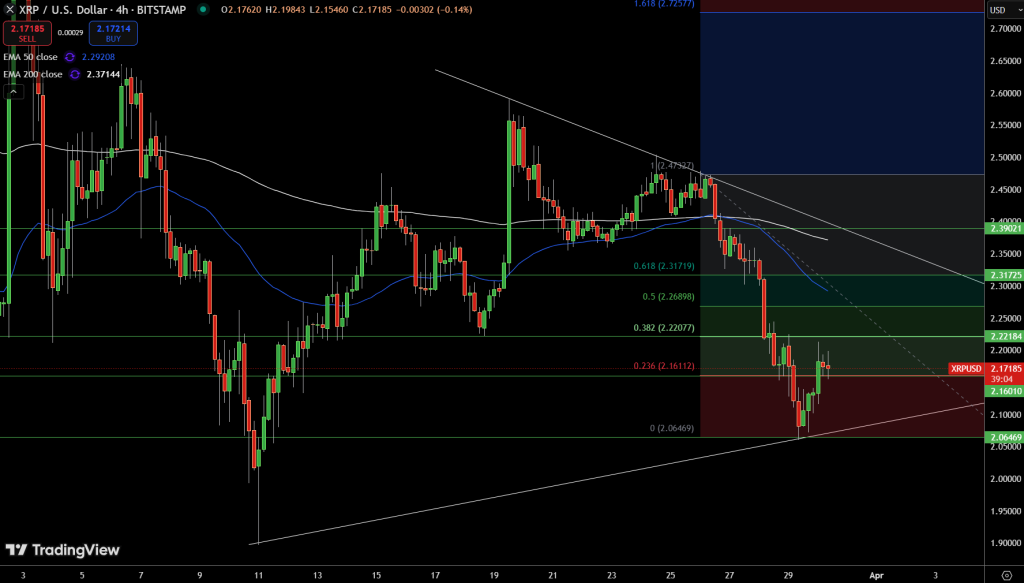

From a technical standpoint, XRP isn’t out of the woods yet. The token is currently hovering around $2.17, but it’s struggling to clear resistance from key moving averages. The 50-day SMA sits at $2.41, while the 100-day SMA looms at $2.51—levels that bulls will need to reclaim to flip the momentum.

The indicators aren’t offering much hope either. The Balanced Bollinger Percentage (BBP) is at -0.3190, hinting at sustained downward pressure. If XRP can’t hold the $2.20 support zone, a slip to the psychological $2.00 level becomes likely. And if that breaks, panic selling could push prices as low as $1.80.

On the flip side, a bullish breakout above $2.41 would challenge the bearish narrative. If volume follows through, XRP could aim for $2.60 and beyond. But until then, low buying pressure and regulatory overhangs keep the near-term outlook shaky.

Final Thoughts

XRP is walking a tightrope. While Ripple’s legal battles may be winding down, the broader regulatory landscape remains a wild card. With Paul Atkins’ nomination up in the air and ETF approval odds slipping, traders are treading carefully. The next few weeks could be pivotal for XRP—whether that means recovery or another leg down.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account