Binance Coin (BNB) Takes a Hit: Bears Aim for Sub-$580 Levels

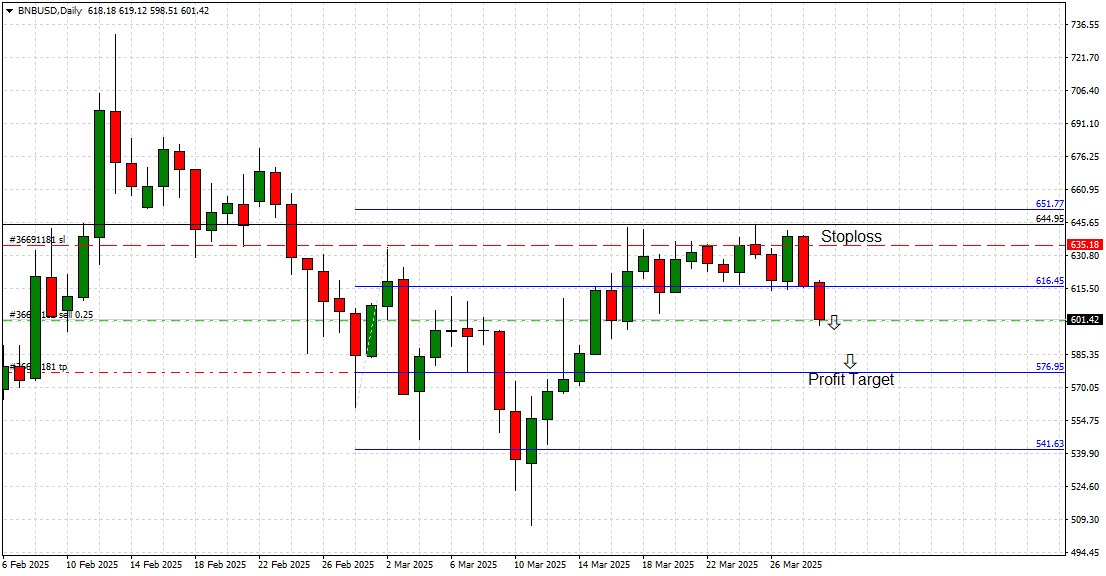

Binance Coin (BNB) is facing strong selling pressure after failing to maintain momentum above the $616.45 support level.

The cryptocurrency has been struggling against broader market weakness, and today’s sharp drop confirms a bearish continuation pattern. With sellers in control, BNB is now eyeing a potential decline toward the next major support zone around $576.95, with an even deeper downside target near $541.63. Can bulls regain strength, or is BNB heading toward new monthly lows? Let’s break down the latest market action and key levels to watch.

Technology & Vision

Binance Coin (BNB) remains one of the most influential assets in the crypto market, serving as the backbone of Binance’s massive ecosystem. The coin fuels transactions on the Binance Smart Chain (BSC), supports trading fee discounts, and is used across numerous DeFi and NFT projects. Despite its strong fundamentals, BNB has not been immune to the latest market downturn. With regulatory challenges still surrounding Binance and declining market sentiment, BNB’s short-term outlook remains bearish, despite its long-term value proposition.

Market Sentiment & Key Levels to Watch

BNB is currently trading around $605.84, marking a significant breakdown below the $616.45 support level, which had previously acted as a key defense zone for bulls. This breakdown signals an increase in selling pressure, making lower price levels more likely in the near term.

- Immediate Resistance: The $616.45 level has now flipped into resistance. If BNB attempts a recovery, it must reclaim this zone to regain bullish traction. The area around $635.20, can act as a stop-loss level for short positions.

- Immediate Support: The next key support level to watch is $576.95. If bears push the price lower, this could be the first line of defense for bulls.

- Deeper Downside Target: A confirmed break below $576.95 could open the door for further declines toward $541.63, which marks a crucial long-term support zone.

The market’s rejection from key resistance levels and the formation of consecutive bearish candles indicate that sellers remain firmly in control. With no immediate bullish catalyst in sight, BNB’s price action suggests a further downside move is likely in the coming days.

Conclusion

BNB’s latest price action paints a clear bearish picture. The failure to hold above $616.45 and the subsequent drop confirm that sellers are driving the market lower. With downside targets at $576.95 and potentially $541.63, traders should brace for further volatility. If BNB fails to hold above its next support, we could see extended losses across the board.

For now, bears are in charge, and any short-term rebounds may be limited unless bulls manage to reclaim $616.45. Keep an eye on price action near $576.95, as it will determine whether BNB stabilizes or extends its downward spiral. Stay tuned for further updates on Binance Coin’s trajectory in the coming sessions.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account

Hitting Profit Target! Case is still open…