GameStop’s Bitcoin Gamble Sends Stock Soaring, But BTC Struggles at $87K Despite Downtrend Breakout

Bitcoin (BTC) is holding above $87,000, mostly steady over the past 24 hours, even as GameStop's announcement of its plans to purchase BTC

Live BTC/USD Chart

Bitcoin (BTC) is holding above $87,000, mostly steady over the past 24 hours, even as GameStop’s announcement of its plans to purchase Bitcoin sent the video game retailer’s stock price soaring by nearly 12%.

Despite this positive corporate adoption news and a technical breakout from a three-month downtrend, Bitcoin BTC/USD continues to face headwinds in its attempt to reclaim the $100,000 mark, while Bitcoin mining stocks experienced a downturn following news from Microsoft.

GameStop Announces $1.3 Billion Offering to Fund Bitcoin and Stablecoin Purchases

GameStop, a company that experienced a dramatic meme stock surge in 2021, revealed its intention to enter the cryptocurrency space by allocating a portion of its corporate reserves to Bitcoin and US-dollar-pegged stablecoins. The company revealed a $1.3 billion convertible senior notes issuance to help fund this approach.

This action is in line with that of other publicly traded firms such as MicroStrategy and Metaplanet, who have seen notable increases in their stock values upon including Bitcoin as a treasury asset. With $4.77 billion in cash reserves as of February 2025, GameStop has a strong basis for its new endeavor.

Bitcoin Fails to Cross $100,000 Despite Corporate Enthusiasm and Favorable Policies

Bitcoin has battled to break through the psychological barrier of $100,000 for the past 50 days despite a growing trend of corporate Bitcoin adoption and a US Strategic Bitcoin Reserve executive order authorizing BTC acquisitions under budget-neutral procedures. Given the good news flow about the asset, this price stagnation is quite remarkable.

Analysts speculate that the limited upside could be related to things like the US spot Bitcoin ETF’s cash-settlement restriction, which keeps in-kind deposits and withdrawals off-target, and the cautious attitude of some conventional financial institutions like Vanguard, which still keeps clients from trading Bitcoin ETFs.

Bitcoin Mining Stocks Under Pressure Following Microsoft Data Center News

Shares of many Bitcoin mining companies, including Bitfarms, CleanSpark, and Marathon Digital, dropped anywhere from 4% to 12% in a different development influencing the Bitcoin ecosystem. Citing a possible overstock, IT behemoth Microsoft reportedly canceled plans to invest in new artificial intelligence data centers, which preceded this slowdown.

Because mining is becoming more diversified into AI data-center hosting to augment income following the recent Bitcoin halving, this news badly affected mining stocks. One analyst, however, proposed that the pullback might be more closely related to the price stagnation of Bitcoin and great mining difficulty.

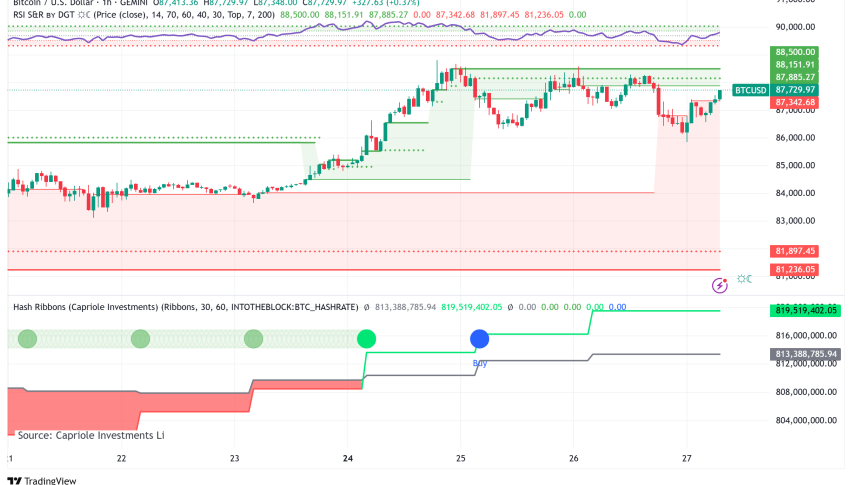

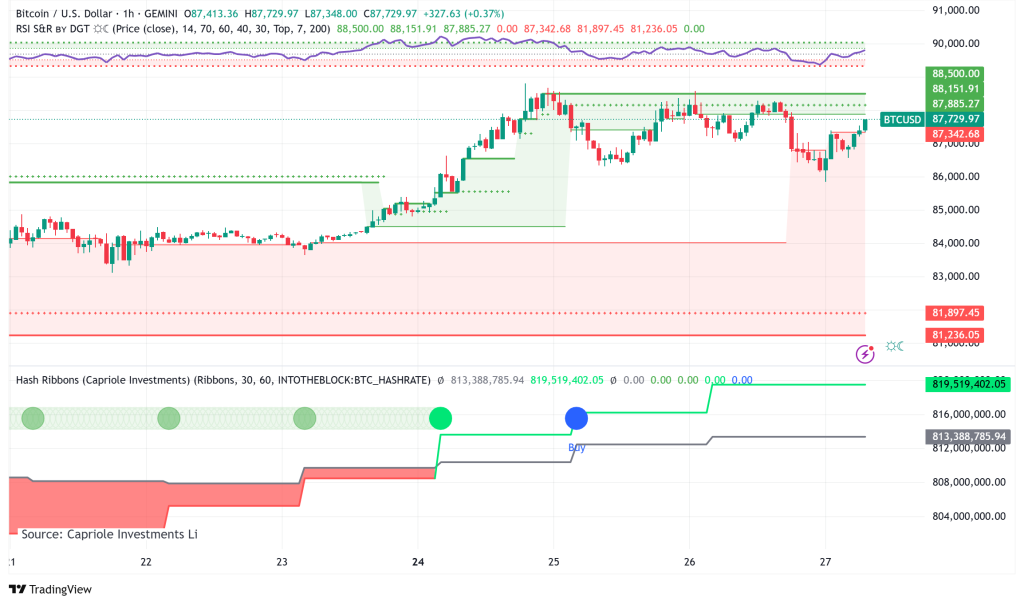

BTC/USD Technical Analysis: Bitcoin Breaks Free from 3-Month Downtrend on Daily Chart

Technically, by breaking out of a three-month declining channel on the daily chart, Bitcoin has showed a possibly optimistic trend. Popular trader Titan of Crypto highlights this breakthrough, which marks a significant change in market structure and can point to the beginning of a fresh upward trend. Other leading indicators, such as the Relative Strength Index (RSI) and the Hash Ribbon measure, which have also been providing anticipatory upward indications this week, help to reinforce this strong signal.

US Selling Pressure and Stronger Dollar Temper Immediate Bullish Outlook

Bitcoin fell below $87,000 during the US trading day, suggesting the comeback of selling pressure even with a bullish technical breakout. Usually inversely correlated with Bitcoin’s price, the US dollar index (DXY) strengthened at the same downward trend. Moreover influencing the cautious market attitude is uncertainty about possible trade tariffs from the US government.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account