Ethereum Eyes $2,500 Recovery as Final Pectra Test Succeeds, Fundamentals Strengthen

Ethereum (ETH) is currently holding above $2,000 despite a slight dip in the past 24 hours, with strong fundamentals and the successful

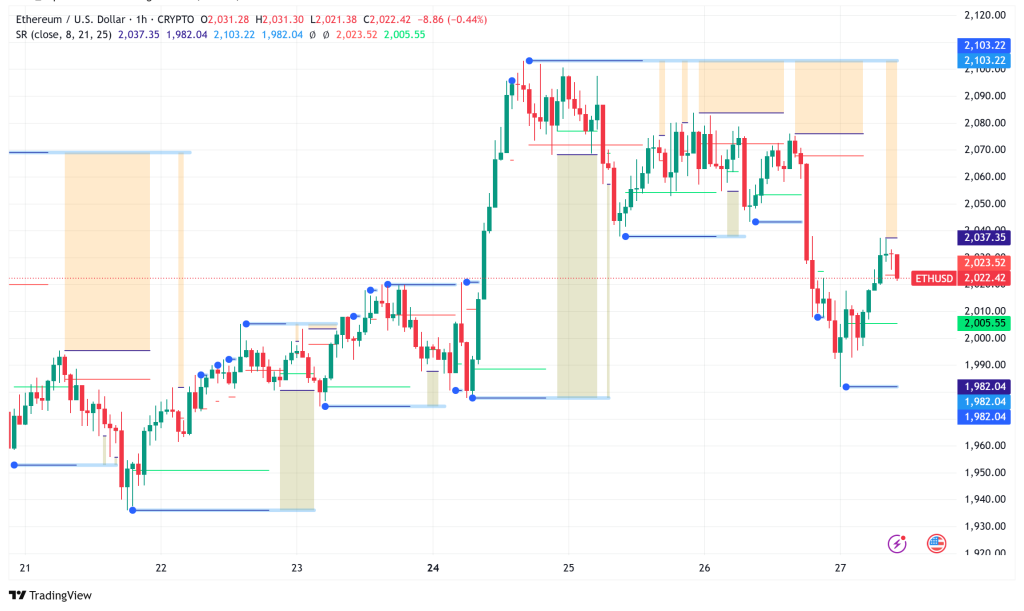

Live ETH/USD Chart

Ethereum (ETH) is currently holding above $2,000 despite a slight dip in the past 24 hours, with strong fundamentals and the successful completion of the final test for its highly anticipated Pectra upgrade fueling optimism for a potential rally back towards the $2,500 mark. The upgrade, coupled with rising total value locked (TVL) and declining exchange supply, signals growing strength in the Ethereum ecosystem.

Ethereum’s Pectra Upgrade Clears Final Hurdle on Hoodi Testnet, Mainnet Launch Imminent

On the new Hoodi test network, Ethereum developers have effectively finished the last dress rehearsal for the Pectra upgrade. This important phase marks a turning point since past failures on the Holesky and Sepolia test networks indicate the successful completion on Hoodi. The most significant update in more than a year, the Pectra upgrade seeks to improve user-friendliness and developer experience by including smart contract capability for wallets, therefore allowing gas charge payment in other cryptocurrencies. Pectra should be watched for roughly thirty days before its activation on the Ethereum mainnet once the last test passes.

Grayscale Ethereum ETF Adjusts Index Constituents Amid Regulatory Developments

In other news, based on liquidity concerns, the Grayscale Ethereum ETF has changed the members of its index; Bullish is now a constituent trading platform and LMAX Digital is taken out. This change captures the ETF’s attempts to faithfully depict the market and the continuous change of the Ethereum trading scene. Furthermore under consideration by the SEC are options trading for spot Ethereum ETFs including Grayscale’s, therefore indicating a possible increase in ETH investment possibilities.

ETH/USD Technical Analysis: ETH Faces Resistance at $2,111

Technically, Ethereum’s ETH/USD comeback is now seeing strong opposition on the daily chart near the $2,111 breakdown level. This suggests still some control by bears.

On the other hand, should the price rise and beyond this $2,111 mark, it would invalidate the immediate bearish view and create the path for a possible rally towards the 50-day Simple Moving Average (SMA) at $2,325 and eventually the $2,550 level. Such an action would imply that the $1,504 mark might have formed around a temporary low.

Ethereum’s Path to $2,500 Bolstered by Pectra Upgrade, Surging TVL, and Shrinking Exchange Supply

Three main fundamental elements support Ethereum’s possible return to the $2,500 mark. By double block data capacity, adding smart accounts for increased wallet functionality, and streamlining staking procedures, the forthcoming Pectra upgrade is expected to solve long-standing issues with user experience and scalability.

With its TVL of $52.5 billion, Ethereum’s DeFi ecosystem also keeps flourishing and much exceeds rivals like Solana. Moreover, the dropping ETH supply on exchanges—which is already almost at a five-year low—indicates strong long-term holding mood among investors.

Ethereum Price Prediction: Analyst Eyes Breakout Beyond $2,100

Complementing the positive view, analyst Crypto Patel has found a configuration pointing to a possible Ethereum breakout beyond $2,100 with a goal of $2,128. Strong rising momentum following a bounce from a crucial “mitigation block” signaling considerable buying demand bases this forecast.

Time Freedom ROB, another expert, has also made a striking analogy between the present weekly price trend of Ethereum and the interval between 2018 and 2020, which preceded a large price rise. With the $2,200 to $2,400 range indicated as fundamental for verifying a return to an upward trend on the weekly chart, this comparison implies that the recent dip below $2,300 and test of lower trendlines could be the final dip before a significant upward rise.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account