6 Stocks to Buy for Trade War Protection to Shield Your Portfolio in 2025

Global trade tensions, especially between the U.S. and China, have resurfaced with new tariffs, disrupted supply chains...

Global trade tensions, especially between the U.S. and China, have resurfaced with new tariffs, disrupted supply chains, and increased currency instability. For investors, this means one thing: volatility, which can be particularly challenging during a financial crisis.

In these uncertain times, the smartest plays often come from domestically focused, recession-resistant companies—firms with strong balance sheets, essential services, and dependable cash flows that can weather economic storms.

Introduction

In times of market turbulence, investors often seek safe haven assets to protect their portfolios from steep losses. These are financial instruments that tend to retain or increase in value during economic downturns, offering security and stability amid widespread volatility.

As of March 2025, U.S.-China trade tensions have escalated once again, with the U.S. implementing a 10% tariff on all Chinese imports in February, which was subsequently raised to 20% in March. China responded with retaliatory tariffs ranging from 10% to 15% on a broad range of American goods, including agriculture, manufacturing components, and energy products.

This intensifying tariff war has triggered renewed fears of global economic deceleration and significant market volatility. In this environment, the importance of building a trade war-resistant portfolio has never been clearer. In this article, we’ll explore how to identify safe haven investments and which U.S.-centric, recession-resilient stocks could help hedge against geopolitical and macroeconomic uncertainty.

Understanding Safe Haven Investments

Safe haven investments are assets that are uncorrelated—or even negatively correlated—with broader financial markets. Their performance tends to remain stable or improve during times of economic instability, making them highly attractive when markets experience sharp downturns or systemic shocks.

These assets typically share three key characteristics:

Low volatility

High liquidity

Stable or appreciating value during crises

Common examples include:

Government bonds, especially U.S. Treasury bills

Safe haven currencies such as the U.S. dollar, Swiss franc, and Japanese yen

These instruments are favored during periods of market instability because they provide a store of value, reduce downside risk, and serve as a hedge against inflation, currency devaluation, and geopolitical uncertainty.

By incorporating these into a diversified portfolio—alongside U.S.-focused companies offering essential services and strong balance sheets—investors can significantly reduce risk and achieve greater financial resilience in uncertain times.

These trade war-resistant stocks offer protection during a market downturn:

- Minimal exposure to foreign trade risks

- Stable cash flows from essential industries

- Proven dividend growth and low volatility

- Solid fundamentals and U.S.-centric operations**

These stocks are often found in a low volatility capital market, which provides additional stability during economic uncertainties.

Whether you’re hedging against a downturn or diversifying away from global shocks, these six stocks stand tall in turbulent times—and may help shield your portfolio from the ripple effects of global uncertainty.

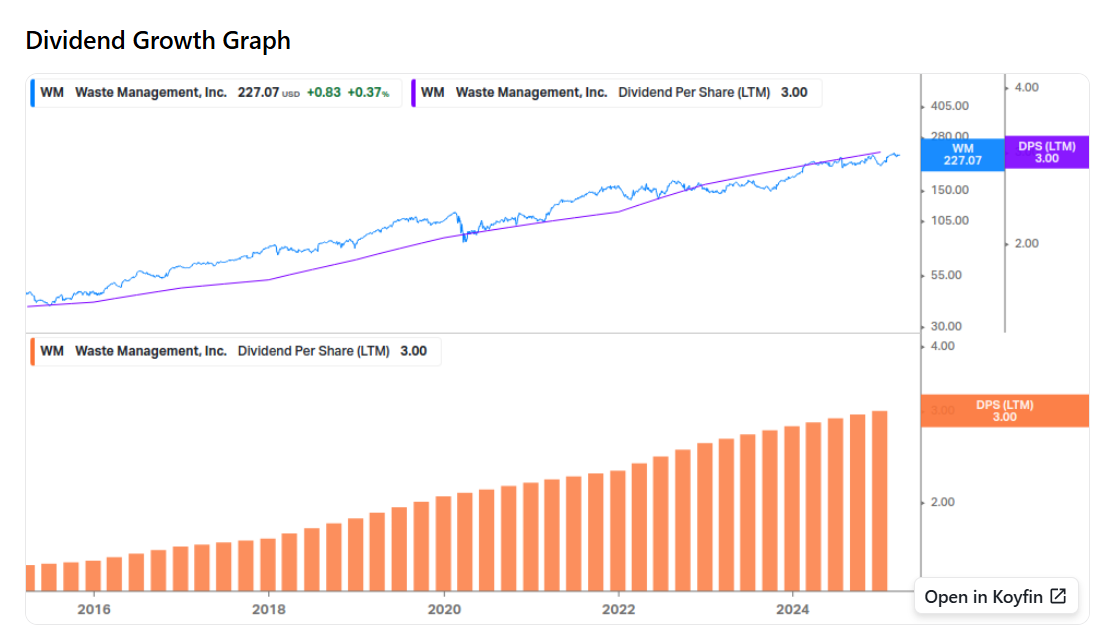

1. Waste Management (WM)

Market Value: $91.31 Billion (Approximately)

Waste Management (NYSE: WM) stands out as a defensive stock capable of weathering the uncertainties of trade wars and economic instability. As the largest waste management company in the U.S., it offers essential services—waste collection, recycling, and disposal—that remain in constant demand, irrespective of economic cycles.

This consistent need positions WM as a safe haven investment during periods of market volatility.

Key Financial Highlights:

- Market Capitalization: Approximately $91.31 billion.

- Stock Price: As of March 26, 2025, WM’s stock closed at $228.93, with a 52-week range between $196.59 and $235.81.

- Dividend Yield: The company offers a forward dividend yield of 1.45%, translating to an annual dividend of $3.30 per share.

- Dividend Growth: WM has a remarkable history of increasing dividends for 22 consecutive years, reflecting its financial stability and commitment to returning value to shareholders.

WM’s operations are predominantly U.S.-focused, reducing exposure to international trade disputes and tariffs. Its diverse customer base, encompassing residential, commercial, industrial, and municipal clients, ensures a stable revenue stream.

Furthermore, the company’s ongoing investments in renewable energy projects and advanced recycling technologies position it for sustainable growth.

In summary, Waste Management’s essential services, consistent dividend growth, and strategic focus on sustainability make it a compelling choice for investors seeking stability and resilience amid market turbulence.

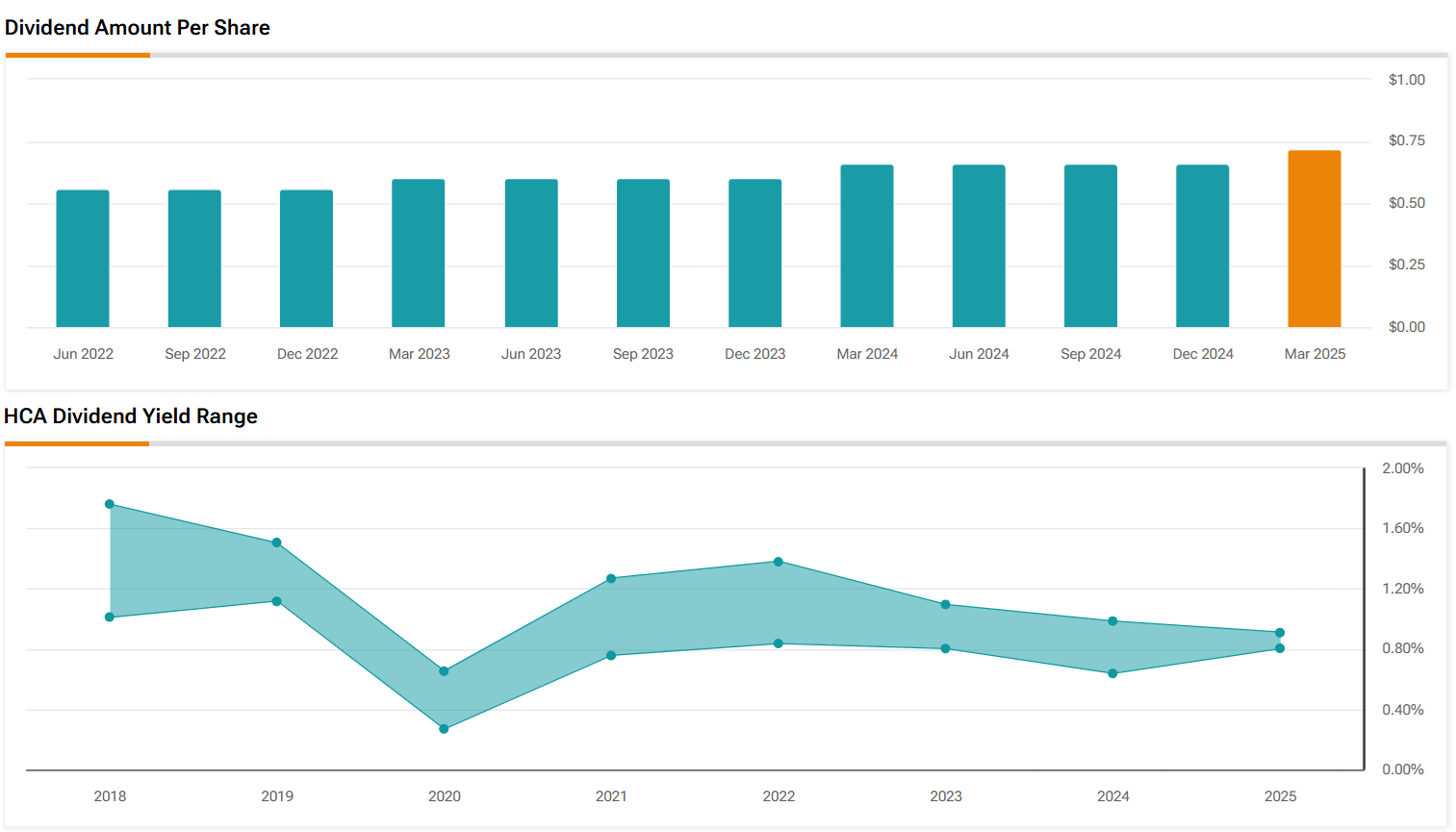

2. HCA Healthcare (HCA)

Market Value: $83 Billion (Approximately)

HCA Healthcare Inc. (NYSE: HCA) stands as a defensive stock amid trade tensions, providing essential healthcare services that remain in demand regardless of economic conditions.

HCA’s financial stability is further supported by its investments in debt securities, which provide fixed returns and are considered low-risk.

As the largest hospital operator in the U.S., HCA manages over 180 facilities across 20 states, ensuring a steady revenue stream insulated from international trade disruptions.

Key Financial Highlights:

- Market Capitalization: Approximately $83.04 billion.

- Stock Performance: As of March 27, 2025, HCA’s stock is priced at $337.29, with a 52-week range between $196.59 and $340.49.

- Dividend Yield: The company offers a forward dividend yield of 0.8%, with a quarterly dividend of $0.72 per share.

- Dividend Growth: HCA has consistently increased its dividends over the past seven years, demonstrating financial stability and a commitment to shareholder returns.

HCA’s comprehensive range of inpatient and outpatient services, coupled with its focus on domestic operations, positions it well against trade-related market volatility. The company’s ability to maintain profitability during economic downturns makes it an attractive option for investors seeking stability and resilience.

In summary, HCA Healthcare’s essential services, consistent dividend growth, and strong financial performance underscore its suitability as a trade war-resistant investment.

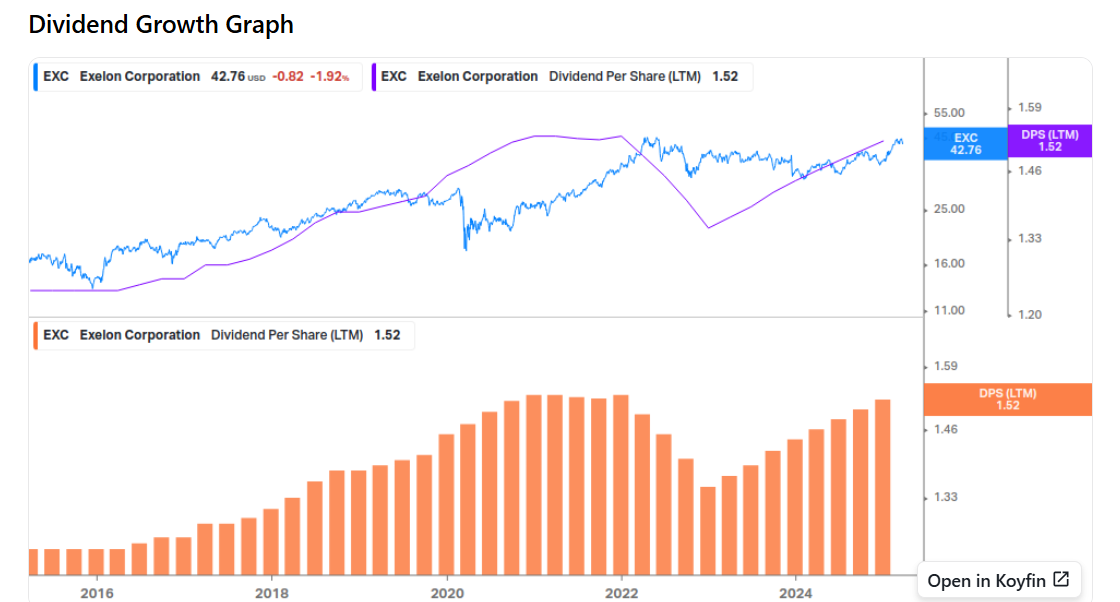

3. Exelon (EXC)

Market Value: $44 Billion (Approximately)

Exelon Corporation (NYSE: EXC) stands as a defensive stock, offering essential electricity and natural gas services across the United States.

Its operations span multiple states, including Delaware, Illinois, Maryland, New Jersey, Pennsylvania, and Washington, D.C., ensuring a steady demand insulated from international trade disruptions.

Exelon’s focus on domestic operations reduces its exposure to foreign assets, making it less vulnerable to international trade disruptions.

Key Financial Highlights:

- Market Capitalization: Approximately $44 billion.

- Stock Performance: As of March 27, 2025, Exelon’s stock closed at $44.02, with a 52-week range between $42.76 and $45.20.

- Dividend Yield: The company offers a forward dividend yield of 3.74%, equating to an annual dividend of $1.60 per share.

- Dividend Growth: Exelon has increased its dividends for three consecutive years, reflecting financial stability and a commitment to shareholder returns.

Exelon’s diverse energy portfolio includes nuclear, natural gas, wind, solar, and hydroelectric power, positioning it for sustainable growth amid evolving energy demands. The company’s focus on renewable energy investments and infrastructure enhancements further solidifies its resilience during economic uncertainties.

In summary, Exelon Corporation’s essential services, consistent dividend growth, and strategic emphasis on renewable energy make it a compelling choice for investors seeking stability and resilience amid market volatility.

4. Diamondback Energy (NASDAQ: FANG)

Market Value: $7.3 Billion (Approximately)

Diamondback Energy, Inc. (NASDAQ: FANG) stands out as a resilient investment amid trade tensions, focusing on domestic oil and natural gas exploration and production in the Permian Basin of West Texas and New Mexico.

This strategic concentration insulates the company from international trade disruptions and positions it as a defensive stock during periods of economic uncertainty. The company’s stability is further enhanced by its operations in the U.S., a country with a safe haven currency, which provides additional protection during economic uncertainties.

Key Financial Highlights:

- Market Capitalization: Approximately $47.2 billion as of March 26, 2025.

- Stock Performance: As of March 27, 2025, Diamondback’s stock is trading at $163.09, with an intraday high of $165.20 and a low of $162.00.

- Dividend Yield: The company offers a forward annual dividend yield of 4.68%, with a dividend rate of $8.29 per share.

- Production Growth: In 2024, Diamondback reported an average daily production of 598,000 barrels of oil equivalent per day (BOE/d), reflecting its efficient operations and focus on high-quality assets.

Diamondback’s disciplined capital allocation and operational efficiency have resulted in solid free cash flow and a strong balance sheet. The company’s emphasis on low debt levels further enhances its financial stability, making it an attractive option for investors seeking exposure to the energy sector without significant international risk.

In summary, Diamondback Energy’s strategic focus on the Permian Basin, robust financial performance, and commitment to shareholder returns position it as a compelling choice for investors aiming to fortify their portfolios against trade-related market volatility.

5. Amazon (AMZN)

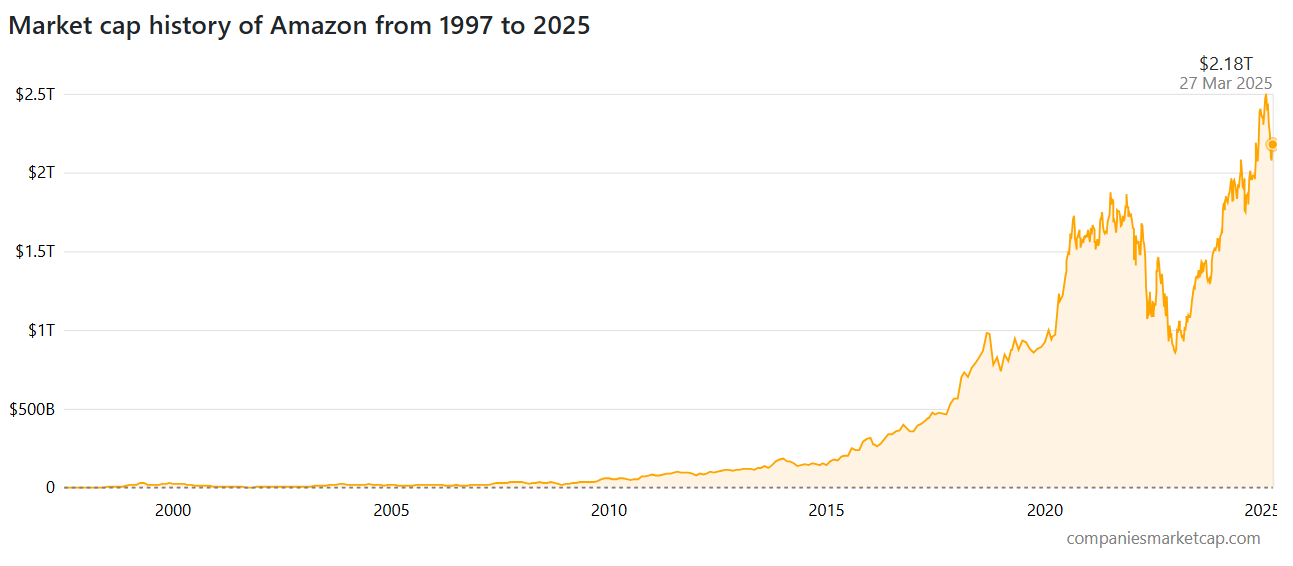

Market Value: $2.18 Trillion (Approximately)

Amazon.com Inc. (NASDAQ: AMZN) continues to demonstrate resilience amid global trade tensions, leveraging its diversified business model and dominant market position to navigate economic uncertainties effectively. Amazon’s diversified business model allows it to perform well even during stock market fluctuations, providing a reliable investment option.

Key Financial Highlights:

- Market Capitalization: As of March 2025, Amazon’s market cap stands at approximately $2.18 trillion, positioning it as the world’s fourth most valuable company.

- Stock Performance: On March 25, 2025, AMZN shares closed at $205.84, with a 52-week range between $151.61 and $242.52.

- Revenue Growth: In 2024, net sales increased by 11% to $638.0 billion, up from $574.8 billion in 2023.

- Net Income: The company reported a net income of $59.2 billion in 2024, a 95% increase compared to $30.4 billion in 2023.

Amazon’s diverse revenue streams, including its e-commerce platform, Amazon Web Services (AWS), advertising, and subscription services, contribute to its robust financial performance. Notably, AWS accounted for 15.8% of sales in 2023, highlighting its significance within the company’s portfolio.

The company’s substantial investments in artificial intelligence (AI) and cloud infrastructure further bolster its competitive edge. In 2025, U.S. tech giants, including Amazon, are projected to spend $302 billion on AI infrastructure, significantly outpacing the $51 billion investment anticipated from Chinese counterparts.

In summary, Amazon’s strategic diversification, consistent financial growth, and commitment to innovation position it as a compelling choice for investors seeking stability and resilience amid market volatility.

6. Boyd Gaming (BYD)

Market Value: $5.70 Billion (Approximately)

Boyd Gaming Corporation (NYSE: BYD) has demonstrated resilience amid trade tensions by focusing on regional markets across the United States, including Las Vegas, Illinois, Iowa, Kansas, Louisiana, and Mississippi.

This strategic emphasis on domestic operations insulates the company from international trade disruptions and positions it to capitalize on the expanding U.S. gaming and sports betting markets. Boyd Gaming has attracted so much money from investors due to its strong financial performance and strategic focus on regional markets.

Key Financial Highlights:

- Market Capitalization: Approximately $5.70 billion.

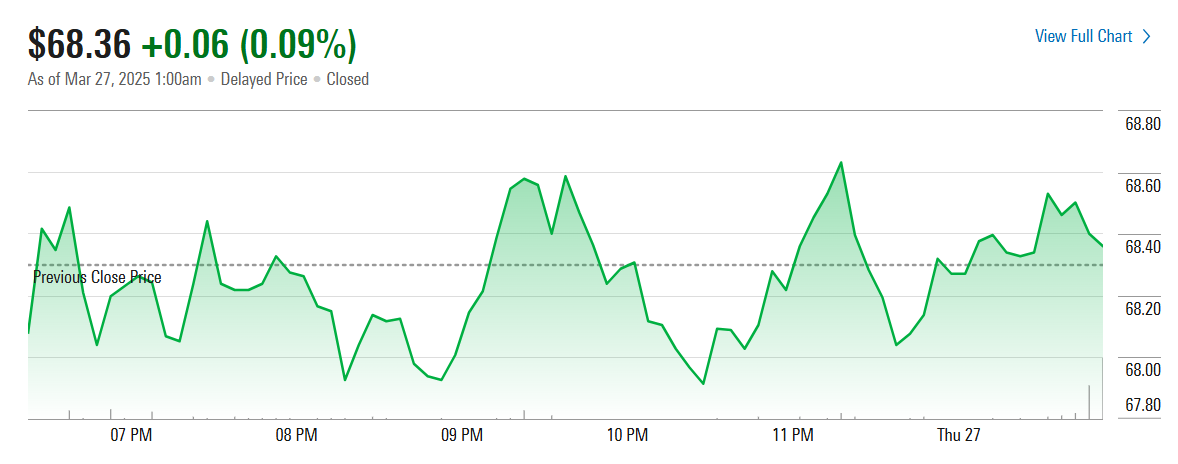

- Stock Performance: As of March 27, 2025, BYD shares are trading at $68.36, with an intraday high of $68.94 and a low of $67.87.

- Dividend Yield: The company offers a forward annual dividend yield of 1.05%, with a trailing annual dividend rate of $0.68 per share.

Boyd Gaming’s regional focus allows it to benefit from the ongoing expansion of sports betting in the U.S., following the Supreme Court’s decision to permit states to legalize the practice. The company’s strategic acquisitions and organic growth initiatives further strengthen its market position. Analysts have responded positively to Boyd Gaming’s trajectory, with Argus raising the price target to $95 from $90 in February 2025.

In summary, Boyd Gaming’s emphasis on regional markets, consistent financial performance, and strategic positioning in the growing sports betting industry make it a compelling choice for investors seeking stability and growth potential amid market volatility.

If global tensions persist or escalate, these companies could act as financial shock absorbers in your portfolio. As always, diversify wisely and consult a financial advisor before investing.

Building a Trade War-Resistant Portfolio

In the face of a trade war, constructing a trade war-resistant portfolio involves diversifying investments and including safe haven assets to mitigate potential losses.

Diversification helps spread risk across various asset classes and sectors, reducing the overall exposure to market volatility. Some stocks that are considered safe haven assets include Alexion Pharmaceuticals, Amazon.com, Boyd Gaming, Energen, Exelon, and Pioneer Natural Resources.

These companies have a strong domestic presence, limited exposure to international trade, and are less likely to be affected by a trade war.

By focusing on such resilient stocks, investors can build a portfolio that withstands the adverse effects of global trade tensions and economic uncertainties.

Conclusion

In conclusion, safe haven investments are an essential component of a diversified investment portfolio, providing a hedge against market volatility and stability during times of economic uncertainty.

By understanding the characteristics of safe haven investments and building a trade war-resistant portfolio, investors can reduce their exposure to losses and protect their investment portfolios.

As the trade war continues to unfold, it is crucial to stay informed and adapt investment strategies to mitigate potential risks. By doing so, investors can navigate through market turbulence with greater confidence and resilience.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account