Nvidia Stock (NVDA) Starts Week Right With 3.5% Jump, As Tech Sector Receives Boost

The tech sector is seeing a decent recovery today, with Nvidia gaining 3.5%, benefitting from Jack Ma and Trump's announcements.

Live NVDA Chart

[[NVDA-graph]]The tech sector is seeing a decent recovery today, with Nvidia gaining 3.5%, benefitting from Jack Ma and Trump’s announcements.

Tech Sector Drives Market Gains

Tech companies are fueling a strong rally in the US stock market today, even as European indices closed lower. Positive headlines regarding President Trump’s more targeted approach to tariffs, coupled with encouraging tech developments, have provided a boost to investor sentiment.

Nvidia Daily Chart – NVDA Attempts to Reverse Downtrend

Nvidia (NVDA) has been struggling since reaching a high of $153 in early January, losing nearly 30% as it dropped below key moving averages. The stock has been forming lower highs, signaling an ongoing bearish trend. However, earlier this month, NVDA showed a strong bullish reversal, gaining over 15% from a low below $105.

Now, investors are attempting to push the price above last week’s high, which could mark the beginning of a sustained recovery. So far today, Nvidia is up around 3.5%, trading above $122 while the Nasdaq has gained 2.2%.

US President Trump’s Tariff Adjustments Boost Sentiment

Investor confidence received an additional lift after reports emerged that US President Donald Trump is set to revise his trade policy. The administration is expected to narrow the list of trading partners subject to retaliatory tariffs by April 2. Additionally, planned tariffs on key industries, including autos and semiconductors, may be reduced or delayed, easing concerns among investors.

Jack Ma’s AI Advancement Adds to Market Optimism

Another significant factor fueling the rally in tech stocks today is a major artificial intelligence breakthrough from China’s Ant Group. The company has successfully developed and trained cost-efficient AI models using a mix of domestically produced Chinese processors and AMD chips. This achievement underscores the growing AI arms race between China and the US, as companies push the boundaries of innovation to reduce dependency on foreign technology while enhancing AI capabilities.

The development further strengthens optimism in the semiconductor and AI sectors, as it demonstrates the increasing accessibility and affordability of advanced AI technologies. Investors view this as a signal that AI-related demand will continue to surge, benefiting chipmakers and cloud computing firms alike. With global AI competition heating up, breakthroughs like these could drive further advancements and investment in AI infrastructure across key markets.

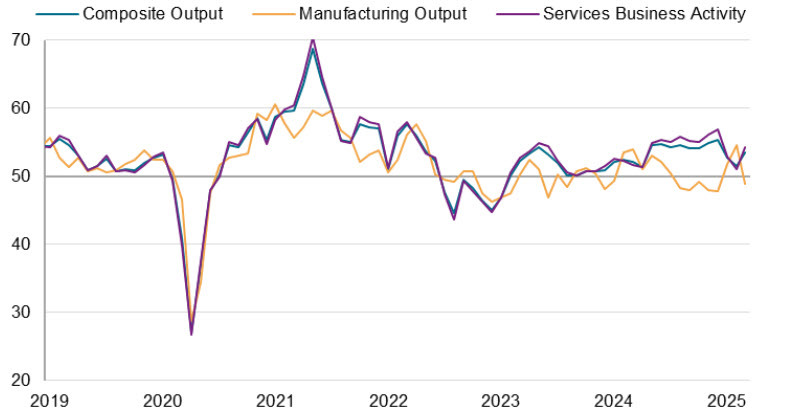

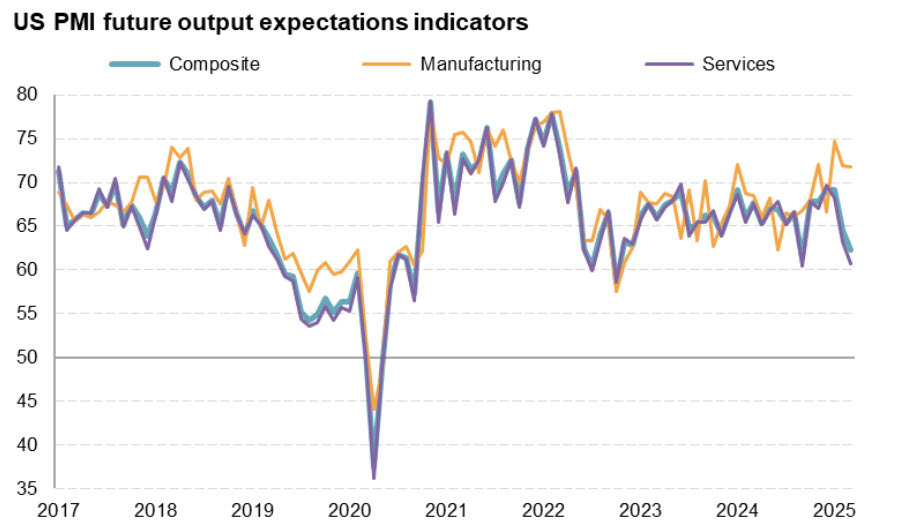

US Services PMI Rebounds, Manufacturing Weakens

The latest US services PMI data showed a strong rebound, after peaking near 57 following the election and then declining in recent months due to trade concerns. While manufacturing dipped below the 50 threshold, signaling contraction, the services sector remains the dominant force in the US economy. However, S&P cautioned that while the latest PMI figures are encouraging, they do not necessarily indicate rapid economic expansion.

US Services and Manufacturing PMI from S&P Global![US flash PMI SPGlobal]()

US March Flash Services PMI: 54.3 (higher than 50.8 expected, up from 51.0 in February).

US March Flash Manufacturing PMI: 49.8 (lower than 51.7 expected, down from 52.7 in February).

Composite PMI: 53.5 (higher than 51.6 in February).

Key Insights:

Services Sector: Optimism about future growth declined for the second consecutive month, now at its second-lowest level since October 2022.

Manufacturing Sector: Confidence remained strong despite the decline in PMI.

Employment: Slight increase in April, indicating moderate labor market growth.

Input Costs: Sharpest increase in 23 months, signaling rising inflationary pressures.

The services sector continues to expand, driving overall economic growth, but optimism is fading. Meanwhile, manufacturing struggles with contraction, and rising input costs may impact inflation and future Fed policy.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account