Tesla’s stock has experienced a sharp decline, falling over 50% from its all-time high of $488 in December 2024. This drop occurred amid a broader market selloff, with major indices like the S&P 500 and Nasdaq retreating by 10% over recent weeks. However, stocks found support this week, aided by the Federal Reserve’s dovish stance on monetary policy, which helped stabilize financial markets.

Market Rebound and Tesla’s Recovery

Investor sentiment improved as key stock indices reversed higher, with the Dow Jones Industrial Average (DJIA) gaining 1.27% for the week. Tesla shares surged 6% on Friday, closing at $248.90, following remarks from US President Donald Trump, who suggested potential flexibility on tariffs ahead of April 2 and hinted at discussions with China’s Xi Jinping. This reassurance lifted market confidence and contributed to Tesla’s rebound.

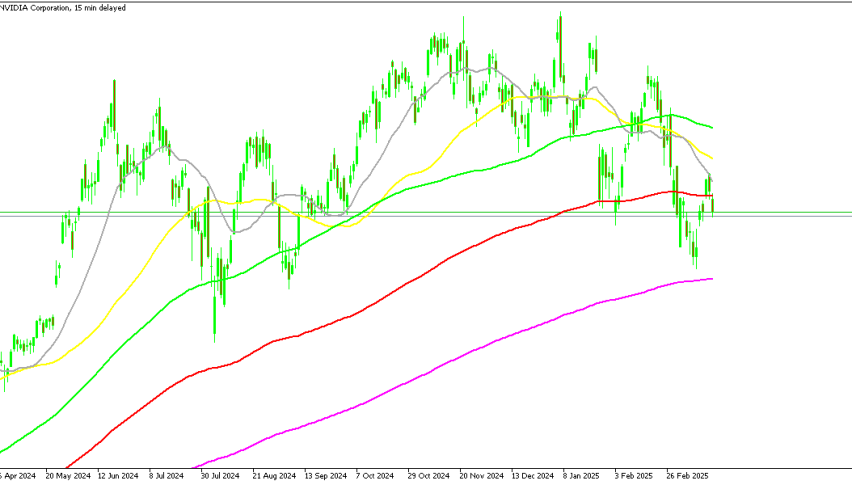

Tesla Stock Chart Daily – The Pullback Seems Complete

Tesla stock tested the $220 support zone twice in the past two weeks but failed to break below it, signaling strong buying interest at this level. The formation of two pin candlesticks on the weekly chart suggests a potential bullish reversal. Moving averages have also provided technical support, reinforcing the idea that the recent decline may be a natural pullback rather than the start of a prolonged downtrend.

Support and Market Sentiment

Commerce Secretary Howard Lutnick told Fox News that Tesla is currently a strong investment opportunity, stating, “It’s incredible that this stock is so low. It will never be this cheap again, so who wouldn’t invest in Elon Musk?”

Additionally, Trump addressed the recent wave of vandalism against Tesla stores, warning on Truth Social that anyone caught participating in such acts—including financial backers—could face up to 20 years in prison.

Elon Musk informed his team that Tesla plans to produce 5,000 Optimus humanoid robots this year. He also urged investors to remain patient and hold their shares despite the recent market downturn, which he sees as a positive long-term signal. Musk further stated that Tesla will speed up the development of Optimus by utilizing its existing self-driving technology, with pilot production set to begin in 2025. The Optimus robot is designed to perform basic tasks such as walking and handling objects.

Is This a Buying Opportunity?

Historically, Tesla shares have been highly volatile, but this recent pullback appears to be a standard correction before a potential recovery. The $220-$250 range looks like a key accumulation zone for investors betting on a bounce. However, for Tesla’s recovery to sustain, broader market conditions must continue to improve. The recent resurgence in major US stock indices offers a promising sign, but ongoing developments in trade policy and economic outlook will play a crucial role in shaping Tesla’s stock trajectory.