Bitcoin’s Bearish Cycle: Is a Deeper Correction Unfolding?

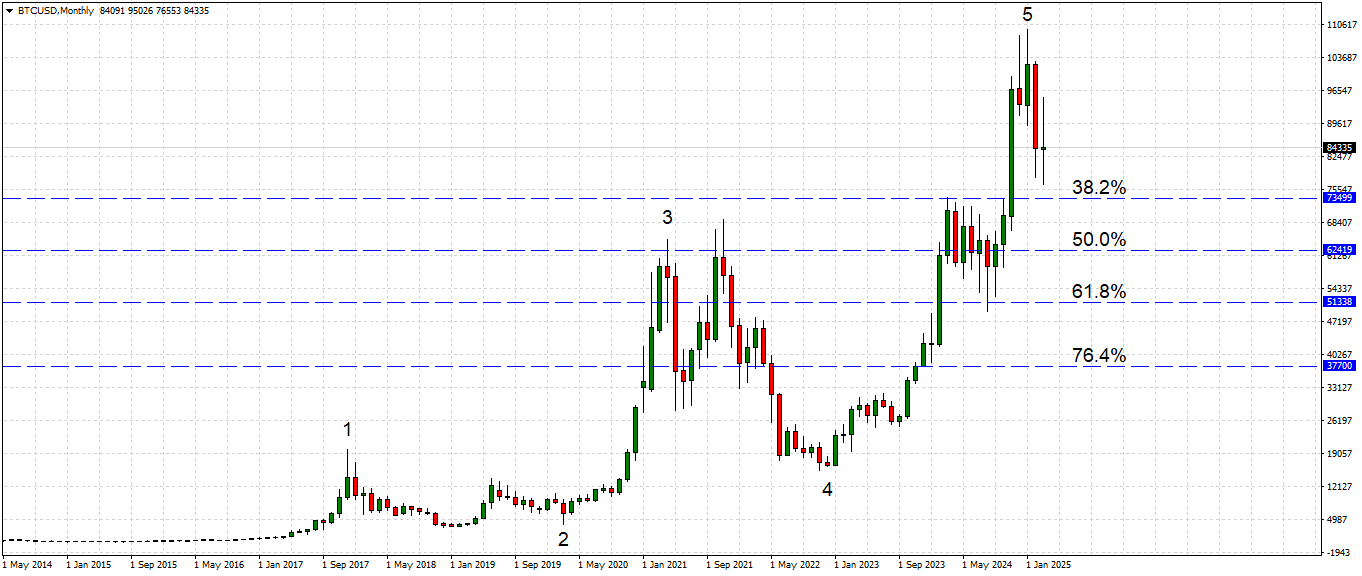

Bitcoin’s (BTC/USD) bearish momentum intensifies as the Elliott Wave 5-Wave cycle concludes at an all-time high of $110,000.

With a confirmed breakdown below $84,440, BTC is set for a deeper technical correction, targeting the next key support at $73,500. Read on for insights and updated targets.

Bitcoin (BTC) continues its bearish trajectory after confirming a significant breakdown below the $84,440 key support level. This marks a decisive shift into a deeper correction phase, reinforced by Elliott Wave theory. The 5-wave cycle has completed at the recent all-time high of $110,000, suggesting that BTC has entered an extended corrective wave, with the 38.2% Fibonacci retracement at $73,500 serving as the next major support zone.

As of today [20.03.25], Bitcoin (BTC/USD) is trading at $84,120, struggling to reclaim lost ground. The next critical downside target remains $73,500, derived from the 38.2% Fibonacci retracement, a pivotal level that may act as temporary support. Should selling pressure persist, deeper corrections toward the 50.0% retracement at $62,625 and 61.8% retracement at $51,680 could come into play. A stop-loss level is suggested around $90,000, aligned with a key resistance level from recent price action.

Bitcoin Technology, Vision, and Market Outlook

Despite the bearish technical picture, Bitcoin’s long-term fundamentals remain strong. As the leading decentralized digital asset, Bitcoin continues to redefine global finance, with increasing institutional adoption and Layer 2 advancements like the Lightning Network enhancing its scalability. However, the market is currently undergoing a technical reset following its parabolic rise to $110,000, reinforcing the need for a structured correction before any potential new uptrend.

Fundamental Catalysts

- Elliott Wave Cycle Completion: Bitcoin’s 5-wave cycle concluded at $110,000, signaling a corrective phase.

- Breakdown Below Major Support: The close under $84,440 reinforces bearish momentum.

- Fibonacci Retracement Targets: BTC’s correction aligns with the 38.2% Fibonacci level at $73,499, with potential further downside to $62,625 and $51,680.

Key Price Levels

- Previous Support (Broken): $84,440

- Next Major Support: $73,500 (38.2% Fibonacci retracement)

- Extended Downside Targets: $62,625 (50.0% Fibonacci), $51,680 (61.8% Fibonacci)

- Stop-Loss Level: $90,000

As long as Bitcoin remains below $84,440, the bearish outlook prevails, with a strong probability of deeper correction. The upcoming test at $73,500 will be critical in determining whether Bitcoin finds stabilization or extends toward lower Fibonacci retracement levels. Traders should monitor price action closely to assess potential reversal signals or further downside risks.