Bitcoin Struggles to Maintain Momentum Above $84,000 Amid Market Uncertainty

Bitcoin (BTC) is currently trading above $84,000, down over 1.6% in the past 24 hours as traders digest mixed signals from both regulatory

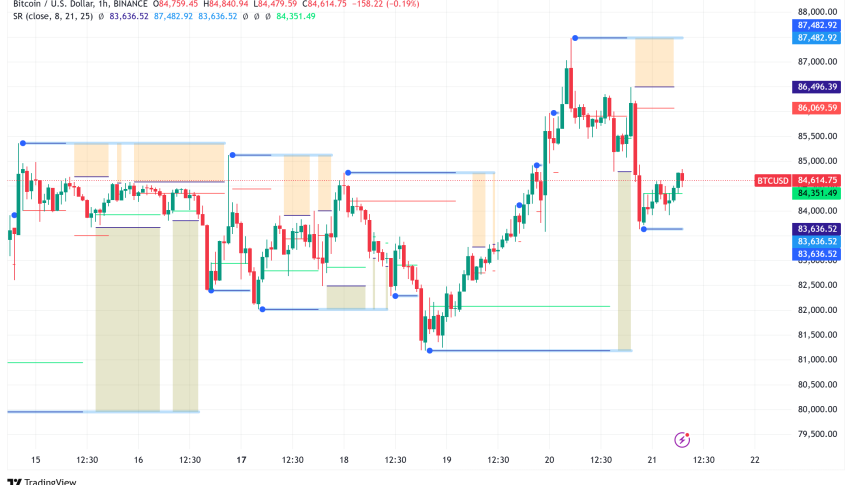

Live BTC/USD Chart

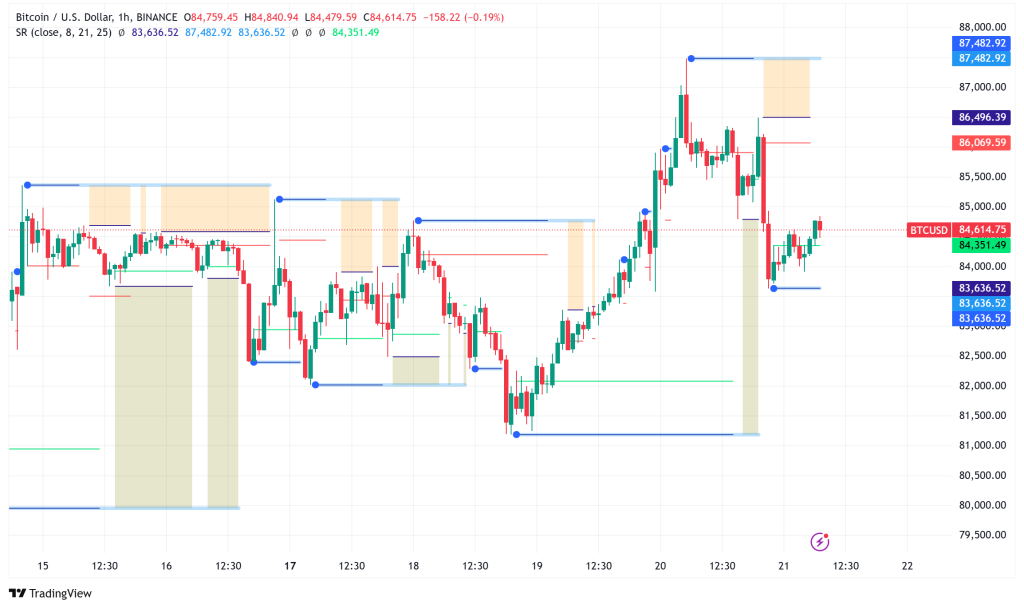

Bitcoin (BTC) is currently trading above $84,000, down over 1.6% in the past 24 hours as traders digest mixed signals from both regulatory developments and macroeconomic conditions. Despite bullish statements from U.S. President Donald Trump and positive sentiment from institutional investors, BTC/USD continues to face resistance below the $90,000 threshold.

Trump’s Bitcoin Rhetoric Continues, But Market “Buys Rumor, Sells News”

Virtual presence of President Donald Trump at the Blockworks Digital Asset Summit 2025 in New York on March 20 saw Bitcoin to surge to an intraday high of $87,453. But prices swiftly dropped to $83,655 soon after.

Rumors had floated before Trump’s speech implying he may declare 0% capital gains taxes on some cryptocurrencies or make a comment on a U.S. strategic Bitcoin reserve. Trading seemed to “sell the news” when neither rumors developed.

Trump instead urged Congress to pass clear stablecoin laws and restated his vow not to sell seized federal Bitcoin. “Together, we will make America the crypto capital of the world and the unquestionable Bitcoin superpower,” he said.

Institutional Signals: Bitfinex Longs and Coinbase Premium Point to Mixed Market Sentiment

Rising to their highest level in almost six months, bullish Bitcoin holdings utilizing leverage on the Bitfinex exchange climbed to 80,333 BTC on March 20—equivalent to $6.92 billion. This 27.5% rise in Bitcoin margin longs since February 20 has matched BTC’s 12.5% price rebound from the $76,700 low on March 11. Meanwhile, the Coinbase premium index peaked at its highest level since February 20 after BTC prices surged 5% on March 19, measuring stronger buying pressure from U.S. investors.

Still, historical data points to reason for caution. Not often have past surges in Bitfinex margin longs resulted in instant price increases. For example, big investors added 13,620 BTC in margin longs during three weeks in July 2024, although the price of Bitcoin plummeted from $65,500 to $58,000 at that time.

These professional traders show better risk tolerance and patience than typical investors, often positioning for longer-term swings rather than rapid gains. Furthermore, market-neutral arbitrage techniques find opportunities in the quite low cost of borrowing Bitcoin—currently at an annualized rate of 3.14% for 60 days on Bitfinex.

On the more optimistic side, verified CryptoQuant expert Woonminkyu claims that the 30-day EMA of the Coinbase premium index crossing above the 100-day EMA threshold points to the existence of large institutional players and whales accumulating Bitcoin. “Past trends show that when this indicator rises, BTC bull markets tend to continue,” the analyst noted.

Since Coinbase Pro was integrated into Coinbase Advanced (used by organizations like MicroStrategy and Tesla for Bitcoin purchases) in early 2024, the premium may reflect rising U.S. institutional interest—a potentially positive indicator for Bitcoin’s medium-term future.

BTC/USD Technical Analysis: Bitcoin Breaks Four-Month Downtrend

Technically, Bitcoin has lately recaptured two important moving average trend lines: the 200-day simple moving average (SMA) and the 200-day exponential moving average (EMA)—both important support components in bull markets.

More remarkably, Bitcoin has emerged from a downslope on its relative strength index (RSI), which had been in place since November 2024, implying a possible momentum change. Following their victory above the $85,000 resistance level, traders are observing whether this zone can be turned into support, therefore increasing the likelihood of a retest of the $90,000 level.

Though EMA cloud indications continue to restrain BTC below the $88,000-$90,000 range, analyst Max, founder of Because Bitcoin, remains wary, stating that “Bitcoin is uptrending on every time frame except the Daily & Weekly”.

BTC Market Volatility Rises Amid Economic Uncertainty

Reflecting increasing market anxiety among structural unknowns in the U.S. economy, Bitcoin volatility rose to 3.6% on March 19—the highest rate since August 2024. Chief revenue officer of UK-based bitcoin exchange Paybis, Uldis Tearudklans claims traders are pricing in many scenarios including the prospect of fiscal contraction amid stable or easing interest rates.

“With the founding of Elon Musk’s Department of Government Efficiency, the policy terrain is getting more complicated,” Tearudklans said. As of March 19, the program claims to have produced an estimated $115 billion for the U.S. government including staff cuts and regulatory adjustments.

Together with the Federal Reserve’s cautious approach on interest rates, this budgetary tightening “could create a mismatch in policy direction, limiting the intended stimulative effect of future rate cuts,” Tearudklans says.

Fed Decision Provides Short-Term Relief, But Risks Remain

The Federal Open Market Committee’s March 19 meeting, when it left interest rates unaltered but kept the potential of two rate cuts in 2025 on the table, helped to explain some of Bitcoin’s recent surge. Chair Jerome Powell of the Federal Reserve also indicated that the Fed’s quantitative tightening program would slow down its rate of change.

BitMEX co-founder Arthur Hayes described this as essentially the end of QT on April 1, but cautioned that “stonks prob have more pain left to fully convert Jay to team Trump so stay nimble and cashed up.”

Likewise, trading company QCP Capital cautioned that the first risk-asset bounce following the Fed’s decision might readily flip around. “The Fed’s voice sounded distinctly wary. Policymakers downgraded economy growth projections to 1.7% (a 0.4% reduction), while raising their inflation forecast to 2.8%, signaling a growing risk of stagflation,” the firm noted.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account