Solana Surges Past $130 as New Futures ETFs Launch Amid Ecosystem Growth

Solana (SOL) has continued its upward momentum, currently trading above $130 and posting a 6% gain in the past 24 hours. This rally comes as

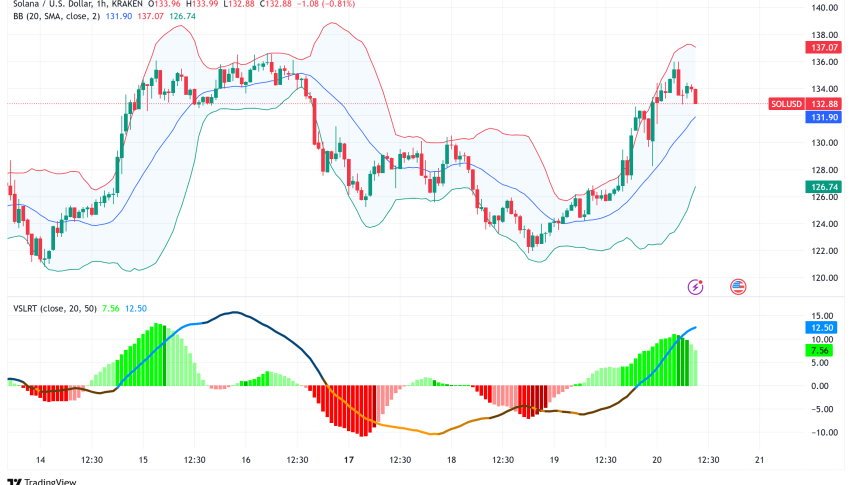

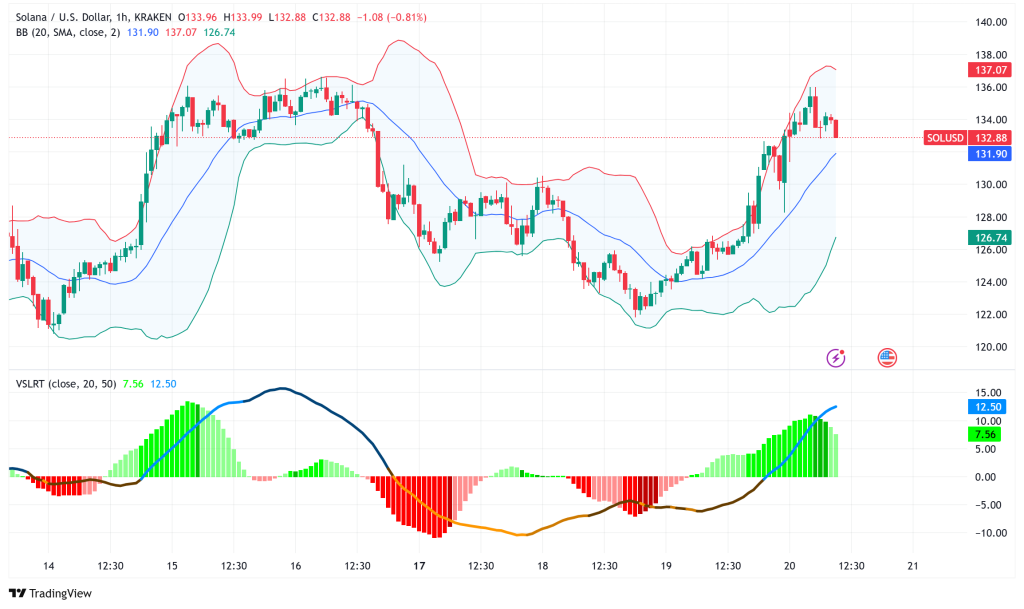

Live SOL/USD Chart

Solana (SOL) has continued its upward momentum, currently trading above $130 and posting a 6% gain in the past 24 hours. This rally comes as Volatility Shares LLC prepares to launch the first-ever Solana futures ETFs on March 20, marking a significant milestone for institutional adoption of the high-performance blockchain.

Solana Futures ETF Launch Sets Stage for Potential Spot ETF Approval

Volatility Shares LLC is launching two futures-based ETFs tomorrow: the leveraged Volatility Shares 2X Solana ETF (SOLT) with a 1.85% fee and the Volatility Shares Solana ETF (SOLZ) with a 0.95% management charge in a significant step for the Solana ecosystem.

These products track Solana futures contracts, which debuted on the Chicago Mercantile Exchange (CME) recently and attracted around $12.1 million in trading volume on their first day. Although this number is less than the $102 million of Bitcoin and the $30 million debut futures trading volume of Ethereum, it is an important stage in Solana’s development as an institutional-grade asset.

Industry analysts point out that Solana’s chances for spot ETF approval may be much affected by the debut. Based on the SEC’s set criterion demanding a strong futures market before considering spot products, Bloomberg Intelligence analysts now assess a 75% probability of spot Solana ETF approval by year-end.

Solana Ecosystem Fundamentals Remain Strong Despite Market Volatility

Solana’s fundamental metrics demonstrate amazing resiliency even if her price dropped 27% during the last 30 days. On March 17, the network’s Total Value Locked (TVL) hit 53.2 million SOL, a 10% rise from last month and the highest level since July 2022.

Nominally speaking, Solana has maintained its second-largest blockchain ranking among TVL at $6.8 billion, surpassing BNB Chain’s $5.4 billion. This expansion contrasts sharply with rivals like Tron, whose TVL dropped 8% during the same time span.

Maintaining their top ranking among the fee-generating systems, some Solana DApps have outperformed more established rivals including Ethereum’s premier staking solution and Uniswap. Among notable artists are:

- Pump.fun (memecoin launchpad)

- Jupiter (decentralized exchange)

- Meteora (automated market maker)

- Jito (staking platform)

Perhaps most remarkably, Solana’s weekly base layer costs have now exceeded Ethereum’s, despite Ethereum having a TVL of $53.3 billion.

Derivatives Market Signals Balanced Sentiment as SOL Token Unlock Fears Subside

Notwithstanding recent price volatility, SOL’s future financing rate has stayed rather neutral, suggesting a balanced demand between long and short positions. This indicates, according to analysts, that negative attitude has not become very popular even after the recent market collapse.

The lower SOL supply increase expected over the next months is one element influencing this balanced view. Although 2.72 million SOL will be unlocked in April, this number falls sharply to just 0.79 million for May and June taken together, thereby perhaps reducing selling pressure.

Solana Labs’ CEO Addresses Controversial Ad, Pledges to Avoid “Cultural Wars”

Separately, Solana Labs CEO Anatoly Yakovenko broke his silence about a divisive advertising with political messages about gender identity that had attracted lot of criticism.

“The ad was bad, and it’s still gnawing at my soul,” Yakovenko said in a March 19 X post. “I am ashamed I downplayed it instead of just calling it mean and punching down on a marginalized group – what it is.”

Yakovenko committed to keeping Solana concentrated on open-source software development and decentralization while staying “out of cultural wars,” acknowledging the need of inclusivity in the blockchain space where transgender and non-binary contributors make major contributions to open-source projects.

SOL/USD Technical Analysis Points to Potential $170 Target

From a technical perspective, analysts suggest that SOL/USD is well-positioned to reclaim the $170 level last seen on March 3. This optimistic outlook is supported by three key factors:

- The resilience in network deposits despite broader market volatility

- Lack of significant leveraged demand from bearish traders

- Reduced supply increases projected for the coming months

The cryptocurrency market’s recent movements have closely mirrored intraday patterns in the U.S. stock market, with investors turning to riskier assets ahead of Federal Reserve Chair Jerome Powell’s remarks. While interest rates are expected to remain unchanged, analysts anticipate a softer inflation outlook for 2025, potentially creating a favorable environment for risk assets like Solana.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account