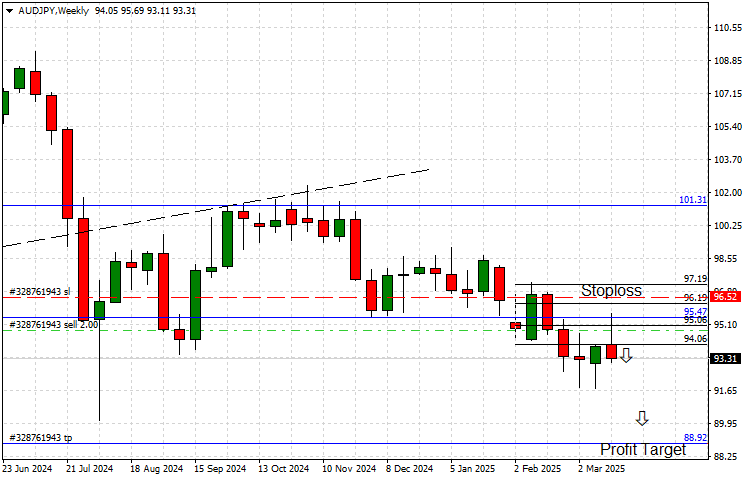

AUD/JPY Bearish Outlook: Breakdown Below 94.06 Signals Further Downside Potential

The AUD/JPY pair has confirmed a decisive bearish breakdown below key-support of 94.06, reinforcing the potential for extended downside moves.

With key resistance at 95.47 intact, sellers are in control as the pair eyes the next major support level at 88.92. Read on for key technical insights.

AUD/JPY continues its downward trajectory after confirming a breakdown below the critical 94.06 support level, a key technical development reinforcing the bearish outlook. The sustained rejection at 95.47 resistance has further strengthened selling pressure, leading to a firm continuation of the downside trend. With momentum favoring the bears, AUD/JPY is now on course toward its next major support zone.

As of [20.03.25], AUD/JPY is trading at 93.56, struggling to reclaim lost ground amid persistent downside pressure. The breakdown below 94.06 marks a significant shift in market structure, acting as a strong confirmation that the bearish cycle remains dominant. The next key profit target is set at 88.92, a major support level derived from previous price action, signaling the potential for an extended move lower.

AUD/JPY Market Drivers and Fundamentals

Despite temporary rebounds, the broader fundamentals remain bearish for AUD/JPY. Recent risk-off sentiment, coupled with weaker demand for risk-sensitive assets, continues to weigh on the Australian dollar. Meanwhile, the Japanese yen benefits from its safe-haven appeal, reinforcing downward pressure on the pair.

With global uncertainty persisting and central bank policies influencing forex trends, the Australian dollar remains vulnerable to further downside risks. Unless AUD/JPY can reclaim key resistance levels, the current bearish structure is likely to persist.

Key Technical Levels to Watch

- Resistance (Stop-Loss Level): 96.50

- Key Level (Broken Support Turned Resistance): 94.06

- Primary Profit Target (Major Support): 88.92

The failure to hold above 94.06 is a clear bearish confirmation, keeping the focus on lower price targets. Sellers remain in control as long as this level remains unchallenged, with a further decline toward 88.92 likely in the coming sessions.

Bearish Sentiment Persists

Given the confirmed breakdown, traders should remain cautious of any short-term rebounds, as they are likely to face strong selling pressure near key resistance zones. As long as 94.06 holds as resistance, the bearish trend remains intact, with the next major test at 88.92 acting as the ultimate downside target. The 96.50 level serves as an invalidation point for this bearish forecast, beyond which the market structure may shift.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account