US Gas Prices Falling as Oil Weakens Amid Global Uncertainty, Ukraine Resolution

Oil and gasoline prices have retreated this week, as the global economy slows, adding here the resolution of the Ukraine conflict.

Live USOIL Chart

Oil and gasoline prices have retreated this week, as the global economy slows, adding here the resolution of the Ukraine conflict.

Gas Prices Drop for the Fourth Week

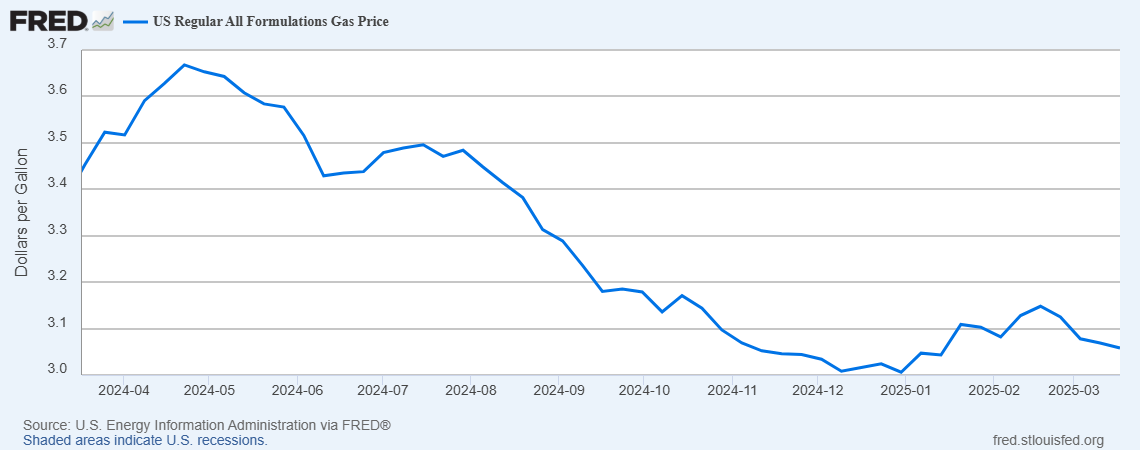

After a slight increase in the first two months of 2025, US gasoline prices have been steadily declining for the past month, mirroring the overall weakness in crude oil. The average retail gas price now stands at $3.184 per gallon, down from $3.197 last week, $3.206 in early March, and $3.492 a year ago. This marks an 8.8% year-over-year decline and a 0.4% drop from last week.

Gas Chart – The Decline Has Resumed After the 2-Month Hike

The drop in crude oil prices has played a key role in this decline, as a weakening global economy, ongoing market uncertainty, and the resolution of the Ukraine conflict have significantly reduced the risk premium on oil and energy prices.

WTI crude oil plunged to $65 last Tuesday, following a stock market downturn that erased gains from January, when prices had briefly spiked above $80 per barrel. However, WTI oil quickly reversed higher, rallying by $3.50 to reach the 20 SMA (gray) on the H4 chart, a level that has served as resistance since late January.

WTI Crude Oil Chart Daily – Rejected at the 20 SMA Again

Despite a short-lived breakout—driven in part by China’s latest economic stimulus measures—oil prices failed to sustain their gains and dropped again, losing $2 in a single session. The candlestick pattern on the charts suggests a potential for further downside, as the latest retracement higher failed to establish a stronger bullish breakout.

Earlier today we had the EIA crude Inventories.

US EIA Weekly Storage Report – Week Ending March 14

Crude Oil Inventories:

- EIA crude oil stockpiles increased by +1.745 million barrels, significantly above the expected +512K barrels.

- The prior week’s build was +1.448 million barrels, indicating a continued rise in inventories.

- Private API data released yesterday showed an even larger build of +4.593 million barrels in crude stockpiles.

Gasoline Inventories:

- EIA reported a build of +1.745 million barrels, contrary to market expectations of a -5.737 million barrel draw.

- Private API data showed a smaller draw of -1.708 million barrels, suggesting some divergence between the two reports.

Distillate Inventories:

- EIA reported a decline of -2.812 million barrels, surpassing the expected -1.559 million barrel draw.

- API data also showed a draw of -2.146 million barrels, aligning with the overall trend.

Refinery Utilization:

- Refinery utilization increased by +0.4%, beating expectations of a -0.6% decline, signaling stronger refinery activity.

Conclusion:

The larger-than-expected crude oil build suggests weaker demand or increased production, which could put downward pressure on oil prices. The surprise gasoline build adds to concerns over demand softness, contradicting market expectations of a strong seasonal draw. However, the notable draw in distillates and improved refinery utilization indicate resilient refining activity. Traders will watch economic data, global demand trends, and geopolitical developments to assess the potential impact on energy markets in the coming weeks.

Oil and Gas Outlook: More Downside for Oil and Gas Prices Ahead?

With global demand concerns weighing on crude oil, the downward momentum in both gasoline and crude prices could persist. If oil prices remain pressured below key resistance levels, US gasoline prices may continue their steady decline, offering relief to consumers but adding to concerns over weaker economic activity. Traders will closely monitor economic developments in China, market sentiment, and geopolitical factors to assess whether oil can mount a more sustained recovery.

US WTI Crude Oil Live Chart

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account