FOMC Meeting Preview: Key Factors to Watch as Dow Jones Pulls Back

Stock markets such as Dow Jones average (DJIA) are retreating before the FOMC, but what will be the main points to watch out for?

Market Expectations and the Fed’s Projections

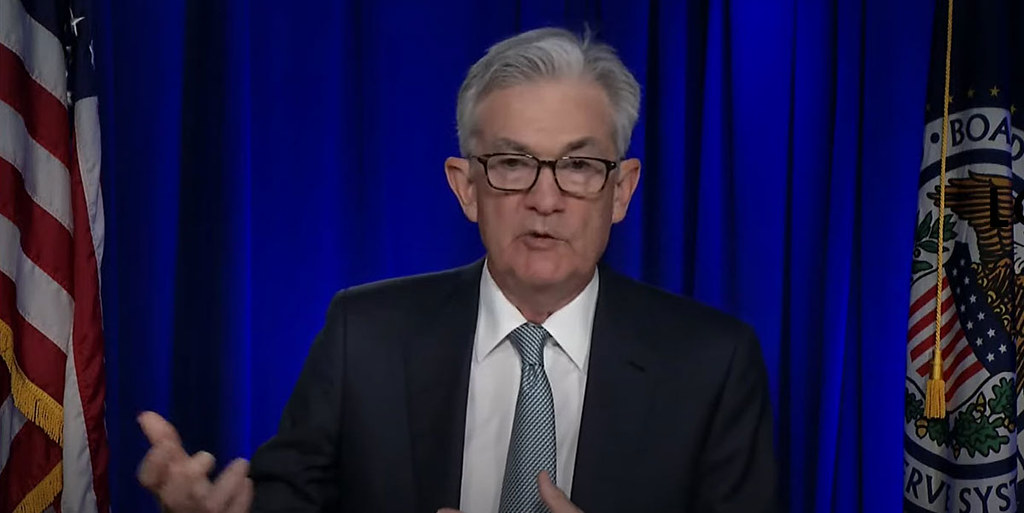

The Federal Reserve is not expected to make any immediate changes to interest rates, but today’s meeting will still be pivotal as markets react to the Fed’s updated economic projections and dot plot. While some may dismiss these forecasts as fluid and data-dependent, they still provide insight into policymakers’ expectations for growth, inflation, and rate cuts.

In December last year, the growth forecast for 2025 ticked higher from 2.0% to 2.1%, but with the lower GDP revisions from different surveyors, a downward revision is likely. The range of growth estimates currently stands at 1.6% to 2.5%, meaning any shift lower could signal a weakening economic outlook.

Dow Jones Chart H1 – Rejected at the 100 SMA

Inflation remains a central concern, with PCE inflation projections increasing from 2.1% to 2.5% in December. The upper range of the previous forecast stood at 2.9%, which is now closer to consensus expectations. Tariff-related cost increases could further complicate inflation estimates, pushing Fed officials to focus on longer-term inflation trends rather than short-term distortions.

Unemployment and Interest Rate Outlook

The labor market remains a key variable. February’s non-farm payrolls report showed unemployment ticked higher to 4.1%, slightly above the Fed’s 4.0% forecast. Projections for unemployment in 2025, 2026, and 2027 remain at 4.3%, though downside risks persist. While a one-tick change in unemployment might not significantly impact policy, it could gain importance if accompanied by hawkish commentary from Fed Chair Jerome Powell.

Interest rate expectations will be closely watched. The median dot plot for 2025 sits at 3.9%, compared to market pricing at 3.77%. While the difference seems minor, market participants always price in some level of uncertainty or “black swan” risks. The Fed may also signal greater caution about future rate cuts, potentially revising 2026 and 2027 projections of 3.4% and 3.1%, respectively.

Conclusion: Will the Fed Shift Its Tone?

With markets pricing in approximately 83 basis points of rate cuts by year-end, any hawkish surprises from the Fed could rattle stocks and push yields higher. Conversely, if Powell acknowledges rising downside risks and signals greater flexibility on cuts, it could stabilize markets and ease the pressure on the Dow Jones and other indices. Investors will closely analyze the Fed’s tone, policy statement, and Powell’s press conference to gauge whether a policy pivot is truly on the horizon.

Dow Jones Industrial Average Live Chart