Meta (Facebook), Tesla Stock and Nvidia (NVDA) Lead Big Tech Fall

Today the leaders in big tech, such as Nvidia, Meta and Tesla stock suffered some considerable losses once again as tech stock keep sliding.

Live TSLA Chart

[[TSLA-graph]]Today the leaders in big tech, such as Nvidia, Meta and Tesla stock suffered some considerable losses once again as tech stock are not finding a footing.

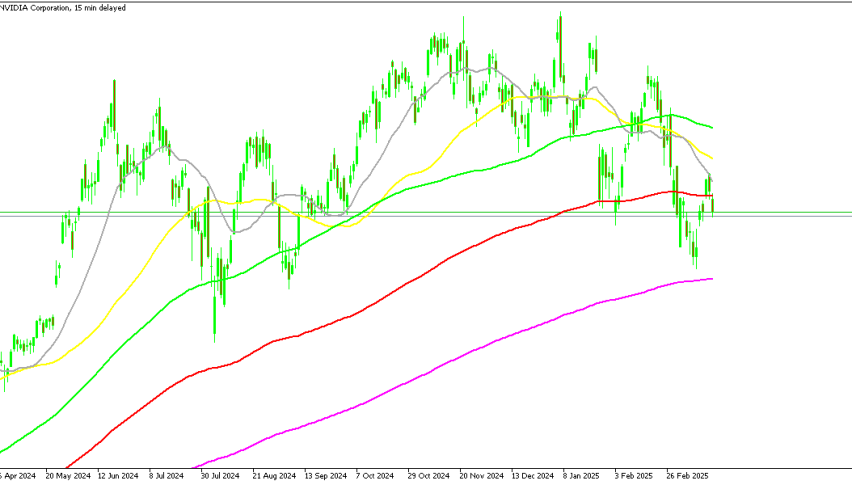

Nvidia shares were rejected by the 20 daily SMA on Monday

Nvidia Struggles Despite Recent Rebound

Nvidia (NVDA) has been on a steady decline since reaching a peak of over $153 two months ago, losing approximately 26% of its value. The stock has consistently formed lower highs, signaling that the bearish trend remains intact.

Last week, Nvidia briefly showed signs of recovery, bouncing nearly 15% after dropping below $105, but the rally was short-lived. This week, NVDA is down 6.5%, including a 4% drop today, after failing to break above the 20-day simple moving average (SMA). Investor enthusiasm surrounding Nvidia’s GTC 2025 conference and CEO Jensen Huang’s keynote speech was short-lived, leading to further selling pressure, pulling Nasdaq index lower too.

Tesla Stock Faces Continued Volatility

Tesla (TSLA) also took a hit, declining about 5% today. The company’s stock has long been known for its high volatility, and despite ongoing protests and anti-Tesla demonstrations, today’s drop is largely seen as part of its long-term price cycle.

TSLA shares have fallen over 53% from their December peak of $488, reflecting broader weakness in the electric vehicle sector. Given that Tesla surged 350% in 2023—from $140 in April to its all-time high of $488 in December—this pullback could present a buying opportunity for investors eyeing long-term gains.

Meta Shares Dive as Regulatory Concerns Grow

After a strong 20-day rally, Meta (META) has lost 21.5% in the past month, following its peak near $740 in mid-February. The decline has been partly fueled by growing regulatory scrutiny, as WhatsApp became subject to stricter EU rules after surpassing 45 million active users in Europe.

The broader stock market downturn also accelerated Meta’s decline, dragging its stock down to $574 today, where it tested the 100-day SMA for support. Despite an initial bounce, Meta closed nearly 4% lower.

Other Major Tech Stocks Face Losses

The tech sell-off wasn’t limited to just Nvidia, Tesla, and Meta—other major tech names also posted losses:

- Microsoft (MSFT) fell 1.33%, reflecting growing investor caution amid uncertainty surrounding the tech sector’s outlook.

- Oracle (ORCL) dropped 2.96%, as concerns over enterprise software demand weighed on sentiment.

- Google (GOOG) plunged 4.53%, pressured by advertising revenue concerns and increased regulatory scrutiny.

Conclusion: Is This a Buying Opportunity or the Start of a Deeper Correction?

The ongoing tech sell-off is raising concerns among investors, with major companies experiencing sharp declines amid regulatory uncertainty, market volatility, and shifting sentiment.

With Nvidia, Tesla, and Meta leading the losses, traders will be watching support levels and upcoming earnings reports to determine if this is a temporary pullback or a signal of a deeper correction in tech stocks.

S&P 500 Live Chart

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account