Gold surged to a new all-time high as market uncertainty persisted, briefly rising above $3,000 for the first time and reaching $3,004.85 before pulling back and closing the week below that level. Despite the late decline, gold still posted a 2.5% weekly gain, indicating continued bullish momentum. Following this retreat, a buy signal was initiated, with expectations that gold will resume its upward trend in the coming week.

btc-usd

Forex Brief March 17: FED, ECB, BOE to Add More Drama to Stock markets This Week!

Skerdian Meta•Monday, March 17, 2025•3 min read

MARKETS TREND

The market trend factors in multiple indicators, including Simple Moving Average, Exponential Moving Average, Pivot Point, Bollinger Bands, Relative Strength Index, and Stochastic.

This week we have the BOJ, SNB, FED, ECB ad BOE holding policy meetings, which will add to the volatility in stock markets and forex.

Gold reached a new record high last week as ongoing financial market uncertainty drove investors toward safe-haven assets. XAU briefly surged above $3,000 for the first time, hitting $3,004.85 before pulling back and closing the week just below that milestone. Despite the late-week reversal, gold still posted a 2.51% gain for the week.

Financial markets and crude oil experienced further declines in the first half of the week, but sentiment improved in the latter half. WTI crude oil managed to recover, closing at $67.17, while some stock markets also stabilized and ended the week in positive territory.

The US dollar remained under pressure, closing lower for another consecutive week. Softer US inflation data, including both CPI and PPI readings, contributed to the dollar’s weakness. However, the upcoming Federal Reserve rate decision on Wednesday is expected to be the main market focus.

This Week’s Market Expectations

This week we have the Federal Reserve rate decision on Wednesday. In addition to the Fed’s policy announcement, investors will closely watch the release of the dot plot for insights into future rate expectations. Other central banks, including the Bank of England, Swiss National Bank, and Bank of Japan, are also set to announce their interest rate decisions this week, adding to market volatility.

Key Upcoming Economic Events

Monday, March 18

- China Industrial Production & Retail Sales – Key indicators of China’s economic strength and consumer demand. A stronger reading may signal economic recovery, while weaker data could increase concerns over slowing global growth.

- US Retail Sales – A key measure of consumer spending, which drives the majority of US economic activity.

Tuesday, March 19

- German ZEW Economic Sentiment – Measures investor confidence in the German economy, a leading indicator for European growth.

- Canada CPI (Inflation Report) – A crucial release for the Bank of Canada’s rate policy; higher inflation may reduce the likelihood of rate cuts.

Wednesday, March 20

- Bank of Japan (BoJ) Policy Announcement – Markets will be watching closely for any potential policy shifts, especially regarding interest rates and yield curve control.

- FOMC Policy Announcement – The most significant event of the week; the Fed’s rate decision and guidance on future policy moves will heavily influence market direction.

Thursday, March 21

- People’s Bank of China (PBoC) Loan Prime Rate Decision – Any changes here could impact global markets, particularly commodities and Asian currencies.

- UK Employment Report – Provides insight into the UK labor market, influencing the Bank of England’s rate policy.

- Bank of England (BoE) Policy Announcement – Another major event, with markets awaiting signals on potential rate adjustments.

- US Jobless Claims – A weekly measure of labor market health, impacting Fed policy expectations.

Friday, March 22

- Japan CPI (Inflation Report) – A key release for Japanese monetary policy, influencing yen strength and BoJ decisions.

- Canada Retail Sales – A crucial indicator of consumer spending and economic momentum in Canada.

There were several reversals in currency and commodities like gold and crude oil last week, and there was a fair amount of volatility in several sectors, including stocks and cryptocurrencies. That put traders off balance, and we had three losing signals. However, following 28 trades last week, we also closed 17 winning forex signals.

Gold Returns Below 2,900

XAU/USD – Daily Chart

EUR/USD Hesitates to Reach 1.10

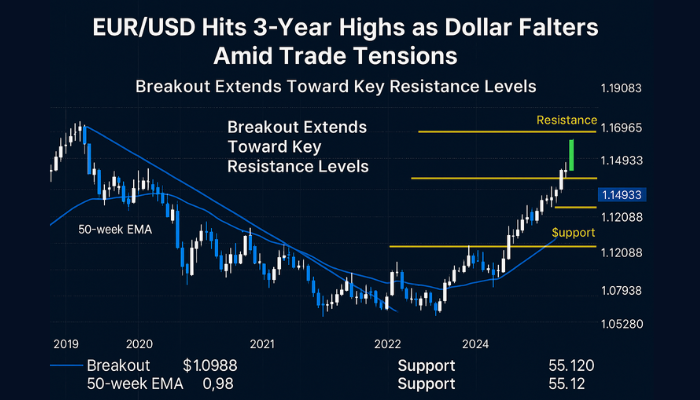

The delay in tariff implementations weakened the US dollar, allowing the euro to strengthen and push EUR/USD higher. Over the past week, the euro outperformed all major currencies, climbing four cents to a four-month high above 1.08. Notably, for the first time since November, EUR/USD broke above all key daily moving averages, signaling a potential shift in market sentiment.

EUR/USD – Daily Chart

Cryptocurrency Update

Bitcoin Breaks Faces the 200 Daily SMA As Resistance Now

Meanwhile, uncertainty surrounding global trade regulations continued to fuel volatility in the cryptocurrency market. Bitcoin initially soared to $95,000 after Donald Trump announced plans to include Bitcoin, Ethereum, Solana, Ripple (XRP), and Cardano (ADA) in a proposed US cryptocurrency reserve. However, traders remained cautious while awaiting further policy details. Selling pressure quickly returned, driving Bitcoin below its 200-day simple moving average (SMA). By Tuesday, Bitcoin had fallen to $80,000, breaking below its February low of $78,500 before staging a recovery yesterday.

BTC/USD – Daily chart

Ripple XRP Keeps Making Lower Highs

Ripple (XRP) has struggled to maintain momentum, despite a temporary spike on March 2 when Trump suggested adding it to the national cryptocurrency reserve. While XRP briefly surged past $3, buyers failed to sustain the gains, leading to a sharp pullback. This level remains a key threshold to watch, as a move above it could establish higher lows and signal a potential trend reversal.

XRP/USD – Daily Chart

Check out our free forex signals

Follow the top economic events on FX Leaders economic calendar

Trade better, discover more Forex Trading Strategies

Skerdian Meta

Lead Analyst

Skerdian Meta Lead Analyst.

Skerdian is a professional Forex trader and a market analyst. He has been actively engaged in market analysis for the past 11 years. Before becoming our head analyst, Skerdian served as a trader and market analyst in Saxo Bank's local branch, Aksioner. Skerdian specialized in experimenting with developing models and hands-on trading. Skerdian has a masters degree in finance and investment.

Related Articles

Comments

0

0

votes

Article Rating

Subscribe

Login

Please login to comment

0 Comments

Oldest

Newest

Most Voted

Inline Feedbacks

View all comments