Buying Gold Price Dip Below $3,000, GBP/USD Falls After Negative UK GDP

Gold broke below $3,000 today and we decided to buy the retreat below $3,000, while GBP/USD has reversed after the soft UK GDP report.

Gold Dips Below $3,000 After Record High, GBP/USD Slips on Weak UK GDP

Gold has been on a strong bullish run, driven by global trade tensions and shifting Federal Reserve expectations. Yesterday, XAU/USD broke its previous record, reaching an all-time high of $2,994.90, supported by weaker-than-expected US CPI and PPI inflation data.

Gold Prices Chart H1 – The 20 SMA Holding As Support

The ongoing risk-off sentiment in markets has fueled demand for GOLD as a safe-haven asset, with investors hedging against market volatility. Today, gold briefly climbed above $3,000, reflecting growing fears that trade disputes between the US, Canada, and the EU could escalate further.

Gold’s rally has been impressive, rising from $2,000 in early 2024 to a high of $2,956 in late February, before surpassing that level yesterday. The latest surge was triggered by increased trade tariffs, pushing gold to $3,004.85. However, during the US trading session, gold saw a pullback, dropping below $3,000 after forming doji candlesticks, which are often bullish reversal signals. The price eventually found support near the 20-SMA on the H1 chart, prompting a buying opportunity for gold traders looking to capitalize on the potential rebound.

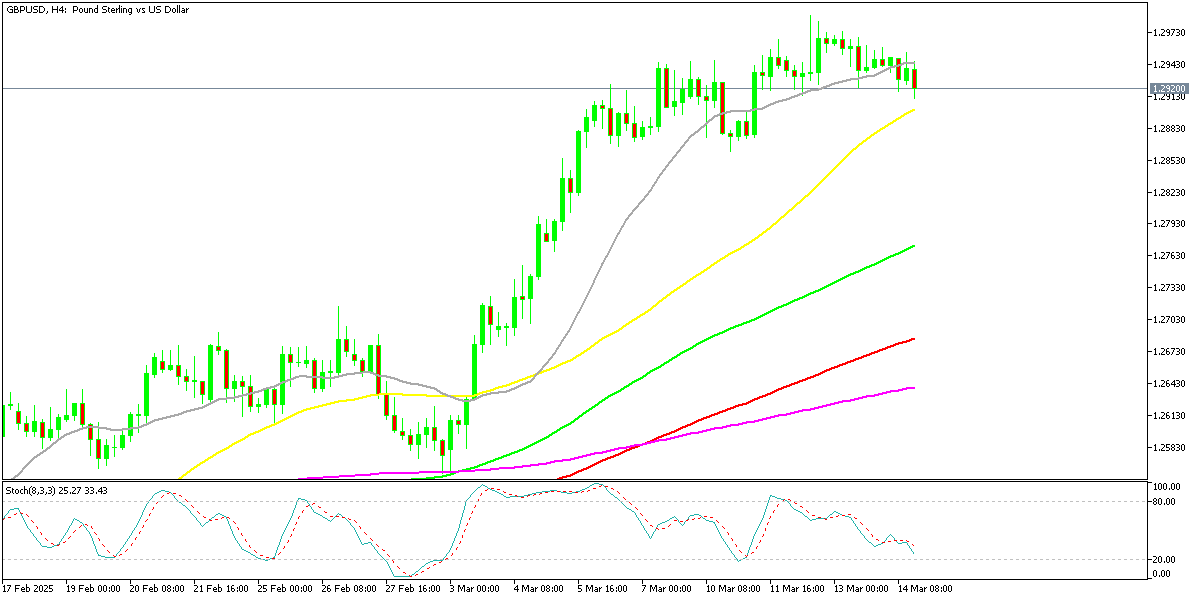

GBP/USD Drops After Weak UK GDP Report

The latest UK GDP report for January came in below expectations, putting pressure on the British pound. GBP/USD had been in a strong recovery phase, nearly reaching 1.30 on Wednesday after rebounding from 1.21 in January. However, today’s disappointing economic data has renewed concerns over the UK’s economic outlook, causing the pair to retreat.

The UK’s economic performance remains fragile, with growth momentum fading after a temporary boost in December due to holiday spending. With the US dollar still showing strength, GBP/USD is struggling to hold its recent gains, signaling further downside risks if UK economic weakness persists.

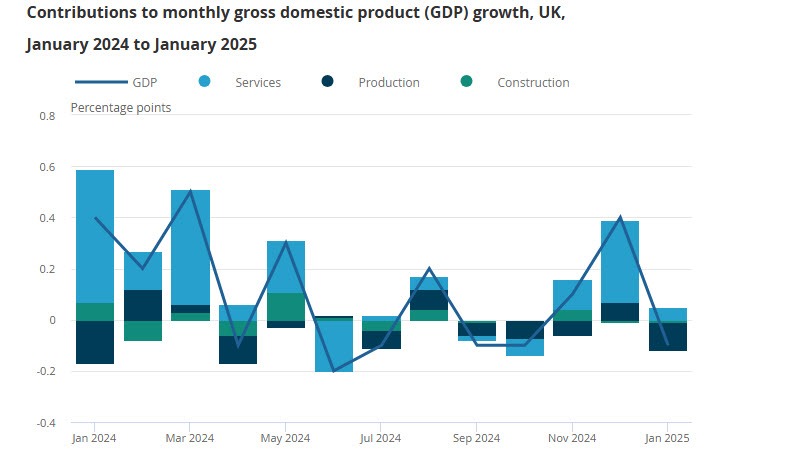

UK January GDP Released by ONS – 14 March 2025![UKGDP]()

Key GDP Figures:

- Monthly GDP: -0.1% vs +0.1% expected (Prior: +0.4%) – Unexpected contraction in economic activity.

- Services Output: +0.1% vs +0.1% expected (Prior: +0.4%) – Minimal growth, meeting forecasts but slowing sharply from December.

- Industrial Production: -0.9% vs -0.1% expected (Prior: +0.5%) – A significant downturn, indicating weakening industrial activity.

- Manufacturing Output: -1.1% vs 0.0% expected (Prior: +0.7%) – Worse-than-expected decline, highlighting pressures on the manufacturing sector.

- Construction Output: -0.2% vs -0.2% expected (Prior: -0.2%) – Continued stagnation in the sector.

Key Takeaways:

- The unexpected GDP contraction was driven primarily by weakness in the industrial and manufacturing sectors, both of which saw sharper declines than anticipated.

- Services output remained positive, growing 0.1% as expected, but this marks a significant slowdown from December’s 0.4% growth, indicating fading momentum in the economy’s largest sector.

- Manufacturing output saw the steepest drop, falling 1.1% month-over-month, suggesting that the sector is under pressure from weak demand, rising costs, and trade uncertainties.

The weaker-than-expected GDP data paints a worrying picture for the UK economy, reinforcing stagflation fears—a period of low growth, high inflation, and weak consumer demand. With industrial and manufacturing sectors struggling, economic growth appears to be losing momentum, raising concerns about the Bank of England’s next steps regarding interest rates.

Conclusion: Further Gains Exepcted in Gold, While GBP to Lose Ground

Gold remains strongly bullish, but the recent dip below $3,000 presents a buying opportunity for traders watching key support levels. Meanwhile, GBP/USD is losing momentum after weak UK GDP data, highlighting ongoing economic struggles. Traders will closely monitor Fed policy shifts and global trade tensions, which continue to be major market drivers.