Fabrinet Soars 10% on Amazon Deal as AMZ Stock and S&P 500 Decline

Fabrinet stock surged more than 10% today after a deal with AMZN, while the Amazon stock fell 2.5% as stock markets resumed decline.

US stock markets erased yesterday’s gains and more, with major indices posting sharp declines. The S&P 500 is now down 10.18% from its all-time high, while the Nasdaq has fallen 14.35%, signaling a deepening market correction.

With one trading day left in the week, markets are at risk of further losses, unless buyers step in at key technical support levels.

US Stock Indices Erase Gains, Extend Losses Amid Market Selloff

Major Indices Drop Sharply

- Dow Jones Industrial Average: -537.12 points (-1.30%), closing at 40,813.81.

- S&P 500 Index: -77.81 points (-1.39%), closing at 5,521.49.

- Nasdaq Composite: -345.44 points (-1.96%), closing at 17,303.01.

- Russell 2000: -32.77 points (-1.62%), closing at 1,993.69.

- The S&P 500 is now down 10.18% from its all-time high, while the Nasdaq has fallen 14.35% from its peak.

Weekly Performance So Far (One Trading Day Remaining)

- Dow Jones: -4.64% for the week.

- S&P 500: -4.31% for the week.

- Nasdaq: -4.91% for the week.

Market Trends & Key Takeaways

- The market failed to hold onto yesterday’s gains, with stocks extending losses as investor sentiment deteriorated.

- Technology and growth stocks led the decline, weighing heavily on the Nasdaq, which is nearing a 5% weekly drop.

- The S&P 500’s correction deepened, breaking below key technical levels, while the Dow Jones also posted significant losses.

Stock Markets Struggle Amid Trade War Concerns

Financial markets faced another downward session, extending yesterday’s losses as tariff threats continued to weigh on investor sentiment. President Trump warned of a 200% tariff on European wine, champagne, and other alcoholic beverages, should Europe proceed with its planned whiskey duty.

Despite stronger-than-expected US PPI inflation data, the stock market failed to recover, with traders remaining fearful of escalating trade tensions. Former US Treasury Secretary Steven Mnuchin commented that a 5-10% market correction is natural and expected, adding that major indices are down roughly 5% from their highs.

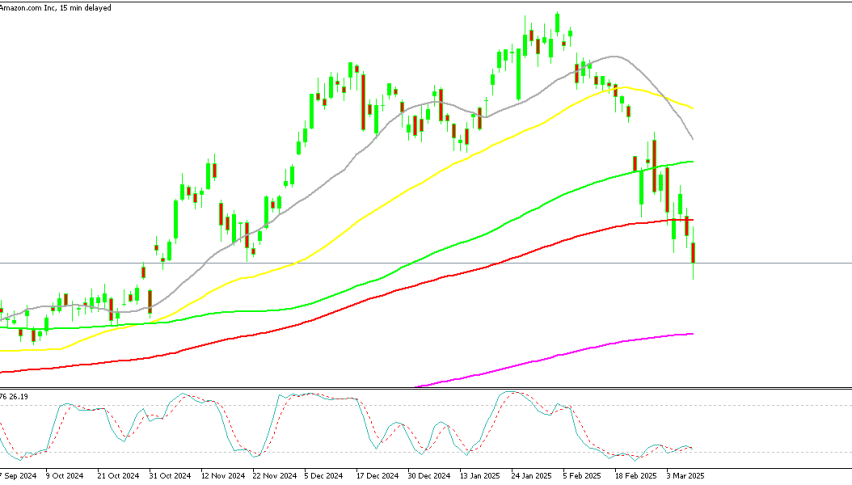

Amazon Shares Face Selling Pressure as Stock Declines 20% from Peak

Amazon (AMZN) has been highly volatile since early February, losing nearly 20% from its peak of $242. The stock remains under pressure due to trade concerns, AI-related expenses, and overall market weakness, despite reporting strong Q4 2024 earnings.

After opening with a bullish gap yesterday, AMZN resumed its decline today, dropping around $5 (-2.5%) as broader markets also weakened. However, US Treasury Secretary Scott Bessent downplayed the volatility, stating on CNBC, “We’re focused on the real economy, and I’m not concerned about short-term market fluctuations.”

Fabrinet Stock Soars 10% on Amazon Partnership

While most stocks declined, Fabrinet (FN) surged nearly 11% after announcing a major agreement with Amazon. The company, known for precision optical and electronic manufacturing services, revealed a deal to sell a warrant to Amazon, allowing the e-commerce giant to purchase up to 381,922 FN shares.

Following the deal, Fabrinet revised its revenue outlook, projecting an additional $4.2 million in revenue—far exceeding Wall Street’s expectations. However, the company also adjusted its earnings per share forecast downward by 12 cents due to a non-cash stock-based accounting adjustment. Despite this revision, the Amazon partnership fueled strong buying activity, driving high trading volumes and positive sentiment toward the stock.

Conclusion: Tech Stocks Diverge as Market Weakness Persists

While Amazon continues to struggle under market pressure, Fabrinet’s Amazon deal boosted investor confidence, driving the stock to double-digit gains. With tariff tensions escalating and market volatility persisting, investors remain cautious about broader trends and economic risks.