Markets bet U.S. will likely Fall into Recession

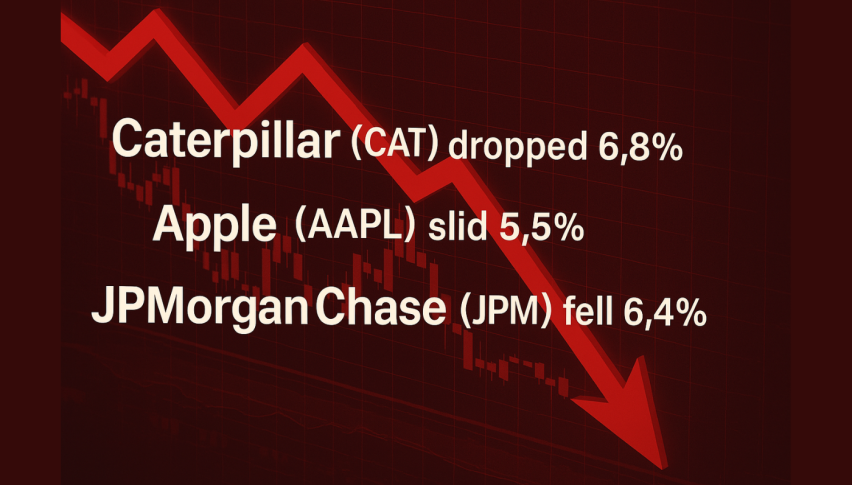

JPMorgan’s economists increased their forecast for the likelihood of a recession from 30% at the start of 2025 to 40% this year despite the White House’s efforts to allay fears amid significant selloffs in tech and cryptocurrency stocks amid high uncertainty in the world’s largest economy.

The Wall Street Journal reported that the analysts stated, “We see a material risk that the US falls into recession this year owing to extreme US policies.”

Additionally, Goldman Sachs analysts increased their 12-month recession probability from 15% to 20%. According to them, if the Trump administration is “committed to its policies even in the face of much worse data,” the prediction may increase even more.

Last week, Morgan Stanley economists increased their expectations for inflation while decreasing their expectations for economic growth. The bank projected that GDP would grow by only 0.5 percent in 2025 and 1.2 percent in 2026.

It comes after one of US President Donald Trump’s top economic advisors resisted calls for a recession. Kevin Hassett, the head of the National Economic Council, told CNBC on March 10 that there were plenty of reasons to be hopeful about the US economy.

“There are numerous reasons to have a very optimistic outlook for the economy in the future. However, there are undoubtedly some anomalies in the data this quarter,” he stated.

Donald Trump stated the US economy was going through “a period of transition” in response to a question regarding the likelihood of a recession.