Apple Stock Sinks 2% on Siri 2.0 Delay, Dow Jones Falls 1% on Canada Tariffs

Apple stock is crashing lower again today as the release of Siri 2.0 is postponed, while (DJIA) Dow Jones Industrial Average is 1% down, as the tariffs war between the US and Canada escalates.

Stock Market Holds Steady, but Dow Jones Under Pressure

After a turbulent start, the S&P 500 and Nasdaq have regained ground, with the Nasdaq up around 1% so far. However, the Dow Jones Industrial Average (DJIA) continues to struggle, making a bearish break below the 200-day SMA. At one point, the Dow dropped over 1.5% before staging a slight recovery.

Yesterday, tech stocks took a major hit, with heavy losses across the AI and large-cap tech sectors. Among the hardest-hit companies was Apple, whose shares fell 5%, while Tesla led the declines with an 11% plunge.

Apple Stock Falls Again as Siri 2.0 Faces Delays

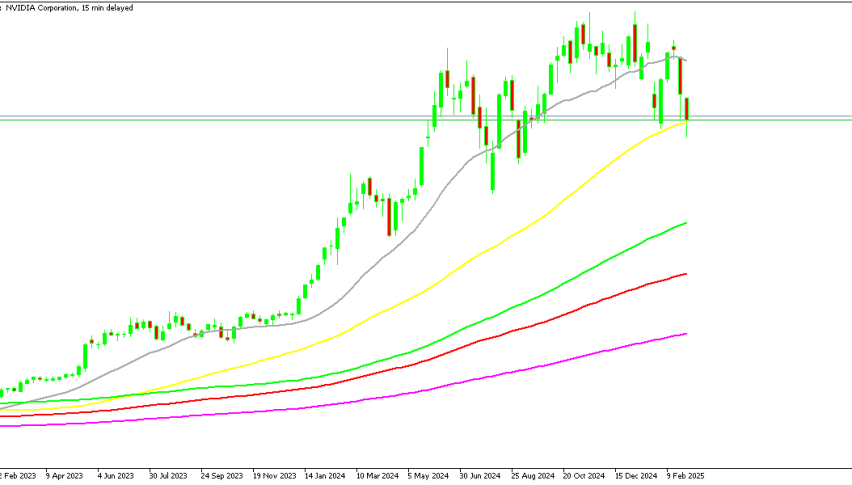

Apple’s stock, which had been in an uptrend for most of 2024, peaked in mid-December at $260 before entering a downtrend. Yesterday, it closed at $227.50, down 5% as part of a broader selloff.

The latest pressure on Apple’s stock comes from reports that Siri 2.0, the company’s AI-powered assistant upgrade, has been delayed indefinitely, according to Bloomberg. This morning, Apple shares opened with a bearish gap, breaking below the 100-day SMA ($224) and continuing lower, now down about 3% for the day.

Market Outlook: Can APPL Shares Recover?

Despite some stability in broader markets, Apple remains under selling pressure, as investors react to uncertainties surrounding its AI strategy and product delays. If market sentiment remains weak and tech stocks continue to struggle, Apple’s support levels will be closely watched for potential rebounds.

Would you like a technical analysis of Apple’s key support and resistance levels?