DAX Opens week Lower on Tariff Concerns and Political Insecurity

Tariffs concerns begin to outweigh ECB policy as the winning party continues negotiations to form a coalition government.

- Tariff reality begins to bite

- German investors grow weary of coalition talks

- Defense sector stocks continue to shine

The DAX opened down 0.90% to start the week in what might be a reversal of the rally from the beginning of 2025. The reality of tariffs and political uncertainty seem the main drivers.

Tariff Reality Weighs on DAX

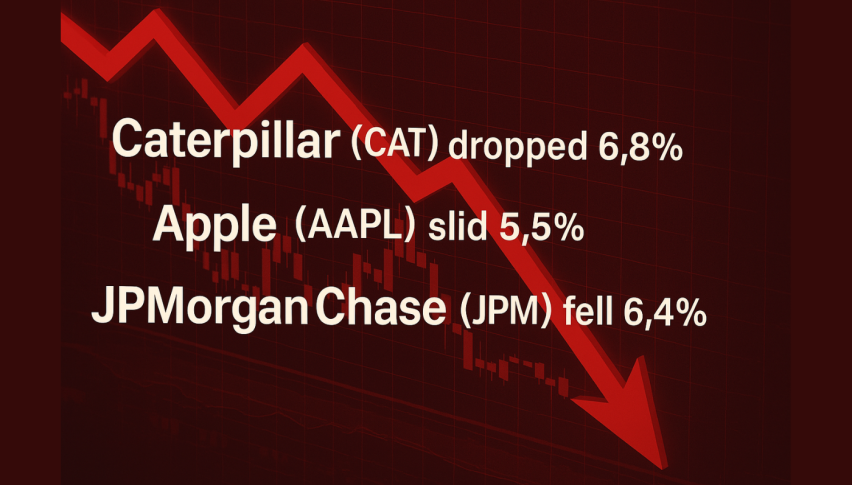

Investors globally are beginning to realize that the threat of a tariff war may become more expensive than previously thought.

The DAX seemed impervious to this risk as it rallied from January 3 by 16%. While other global peers such as the NIKKEI225 or the NAS100 have had negative returns.

Inflation in the EU is receding, and ECB policy has been the main driving factor. Despite the German economy posting 2 years of contraction.

However, the realization that the ECB policy cycle is getting closer to its end and a possible tariff war a beginning to take hold of the market.

DAX Live Chart

Red Tape a Major Hurdle for DAX Companies

Ten executives from various business associations interviewed by Reuters highlighted the need to cut back on red tape.

The CEOs represent sectors from energy and automakers to shipping and manufacturing. The echoing narrative was that red tape is making business more expensive and curtailing expansion and investment.

One executive pointed out how he dropped plans to invest in automation given the strict requirements for fire regulations on new equipment, which would have made the investment a loss.

There is some hope from the CDU, which won the most votes in Germany’s recent election. The conservative party has placed cutting red tape in second place in its 15-point agenda on policies.

Defense Stocks Continue Higher

Defense stocks buck the reverse in trend and maintain sustainable gains thanks to the future coalition leading CDU’s commitment to expand military spending.

Rheinmetall stocks were up 3% this morning, while Renk stocks were up 4.4%. This sector may see an extension in the rally, but hardly enough to save the DAX from lower values on its own.