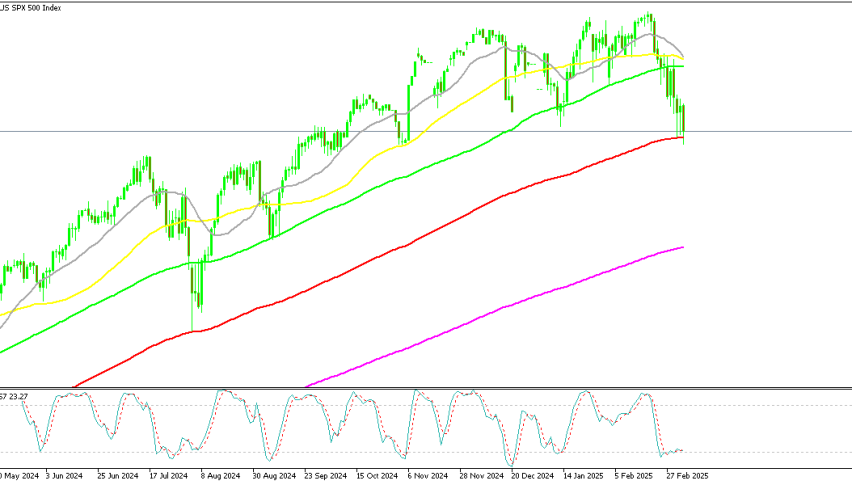

DAX 40 Closes 1.75% Down as S&P 500 Extends Losses to 2.5%

Today Dax 40 was the big loser among Euro stocks, but the US is advancing the declines, with Sp500 2.5% down, and Nasdaq 3.5% lower.

Market Sentiment Turns Bearish

Despite a lack of major headlines this week, global stock markets are off to a volatile start, with investors adopting a more cautious stance. In Europe, the DAX 40 fell sharply, closing below the 20,600 mark after trading above 23,000 points last week. The 1.75% daily drop highlights the increasing uncertainty surrounding Germany’s economic policies.

Germany’s Political Uncertainty Weighs on Markets

- The German Green Party has voiced strong opposition to Friedrich Merz’s debt brake reform and spending plans, adding further pressure on the DAX 40 and the euro.

- This political tension contributed to EUR/USD’s decline, with the pair falling from 1.0860 to 1.0830, before recovering to 1.0850.

- Investors are skeptical about whether Germany can implement the proposed fiscal stimulus and increased spending, leading to a deeper sell-off in German equities compared to other European indices.

The downward movement in European stock markets suggests increased risk aversion, with investors taking profits after recent highs. While profit-taking is natural after record levels, concerns over global trade, inflation, and monetary policy shifts may keep volatility elevated.

Closing Levels for Major European Indices:

- German DAX: -401.79 points (-1.75%) to 22,607.16, after hitting a record high of 23,475.88 last Thursday.

- France’s CAC 40: -73.20 points (-0.90%) to 8,047.61.

- UK’s FTSE 100: -79.64 points (-0.92%) to 8,600.23.

- Spain’s IBEX 35: -174.42 points (-1.32%) to 13,082.69.

- Italy’s FTSE MIB: -366.99 points (-0.95%) to 38,225.81.

Stock markets are experiencing heightened volatility, with Germany’s political uncertainty exacerbating losses in the DAX 40 and US indices following suit with deeper declines. While European markets may benefit from shifting US geopolitical priorities, investors remain skeptical about Germany’s ability to enact its proposed fiscal measures. If uncertainty persists, further downside pressure on both European and US equities is likely in the coming sessions.

US Stocks Continue to Slide

- As European markets closed in the red, US indices extended their losses, with the S&P 500 dropping 2.5%.

- Investors remain focused on US economic data, but broader risk aversion is driving sell-offs across major global indices.

- Weaker US support for NATO and Ukraine may redirect fiscal stimulus efforts in the Eurozone, but uncertainties about Germany’s ability to implement large-scale economic reforms continue to weigh on sentiment.