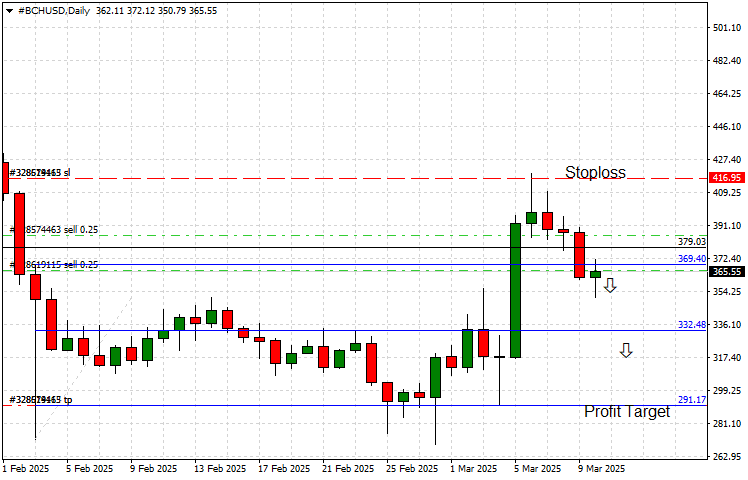

Bitcoin Cash: Resistance Rejection Confirms Further Downside Potential

Bitcoin Cash (BCH/USD) remains under strong bearish pressure after failing to break above the key resistance at $369.40.

This confirms continued downside potential, with $291.20 designated as the next major support and official profit target. Read on for key insights and updated targets.

Bitcoin Cash (BCH) continues to struggle with bearish momentum, as its failure to break above $369.40 reinforces the ongoing downtrend. This resistance rejection serves as a key signal that sellers remain in control, preventing any significant bullish recovery. The inability to reclaim this level suggests that further downside movement is highly probable in the near term.

As of today [10.03.25], Bitcoin Cash (BCH/USD) is trading at $355.60, confirming sustained selling pressure. The next major support zone is $291.20, a level that has historically provided strong demand. This now serves as our official profit target for this newly updated bearish outlook.

Bitcoin Cash Market Dynamics

Bitcoin Cash, a fork of Bitcoin, was designed to offer faster and lower-cost transactions. However, despite its technological advantages, market sentiment and broader macroeconomic conditions continue to weigh on BCH’s price. The recent inability to clear resistance aligns with a broader risk-off environment, reinforcing further bearish sentiment.

Fundamental Catalysts

- Major Resistance Rejection: The failure to surpass $369.40 confirms strong selling pressure and a continuation of the bearish trend.

- Continued Bear Cycle: BCH remains under sustained downside pressure, with $291.20 now in focus as the next key support.

- Market Sentiment Weakens: Investors remain cautious as BCH struggles to reclaim lost ground, fueling further selling momentum.

Key Price Levels

- Previous Resistance (Unbroken): $369.40

- Next Major Support: $291.20

- Bearish Profit Target: $291.20

Looking ahead, Bitcoin Cash’s failure to reclaim resistance levels suggests that selling momentum will likely persist. As long as $369.40 remains intact as a ceiling, the bearish outlook remains in effect. The upcoming test at $291.20 will determine whether further declines are in store or if buyers attempt to stabilize the price at this critical support level. Traders should monitor price action closely for confirmation of continued downside movement.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account