Silver and Gold Price Today – Calm Before Breakout on NFP Data?

Silver and Gold prices continue to find support on dips, which suggests further upside potential, especially if NFP disappoints today.

Gold has been on an impressive bullish run in 2024, surging nearly 50% from around $2,000 at the beginning of the year to an all-time high of $2,956 in February. Investor demand for safe-haven assets has intensified due to concerns over economic slowdown, trade uncertainty, and rising global debt.

Last week, gold experienced a sharp bearish reversal, triggering a flash crash of more than $130, pushing XAU/USD below $2,900. Despite the dip, gold found strong support at the 100 SMA (red) on the H4 chart, where buyers have repeatedly stepped in to sustain the uptrend.

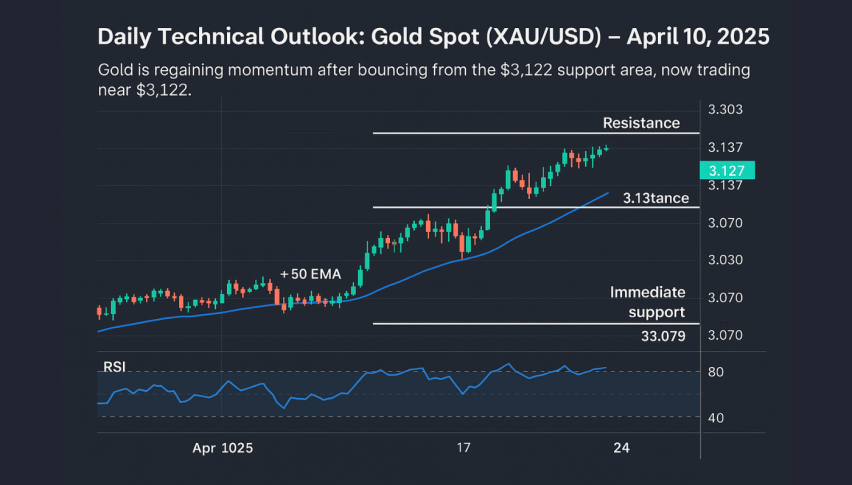

Gold Chart H4 – MAs Holding As Support

With the U.S. dollar weakening amid postponed tariff disputes, GOLD has once again climbed above $2,900, reinforcing its appeal as a safe-haven asset in volatile market conditions. Prices have already gained over 12% this year, and yesterday, we saw consolidation above $2,900. If today’s Non-Farm Payroll (NFP) report disappoints, another push toward record highs could be in store.

Silver Finds Support After Pullback, Eyes Further Gains

SILVER has also followed a strong upward trend in 2024, rising nearly 50% from $22 to $34 by October. This year, XAG/USD has gained $3.50 since January, maintaining its bullish momentum.

However, last week’s market volatility triggered a sharp decline, with silver dropping around 8%, or $2.40, before finding support at the 50-day SMA (yellow) on the daily chart. This key technical level has held, preventing further losses, and silver has already recovered by $2 this week, suggesting that more upside may follow in the coming weeks.

Market Outlook: Will the NFP Report Spark Another Surge?

With both gold and silver consolidating above key support levels, today’s NFP report will be a major catalyst for the next move. A weaker-than-expected jobs report could fuel further upside momentum in precious metals, while a strong jobs number may trigger short-term pullbacks.

Gold remains firmly in an uptrend, with moving averages providing strong support during dips. Silver, too, has held key technical levels, suggesting further gains ahead if buyers maintain control. If risk sentiment remains shaky, both metals could see another breakout toward fresh highs in the near term.