Jerome Powell Can’t Stop Amazon Stock Fall Below $200

Today the Amazon stock AMZN seems to be one of the weakest as it fell below $200, despite positive comments from FED's Powell.

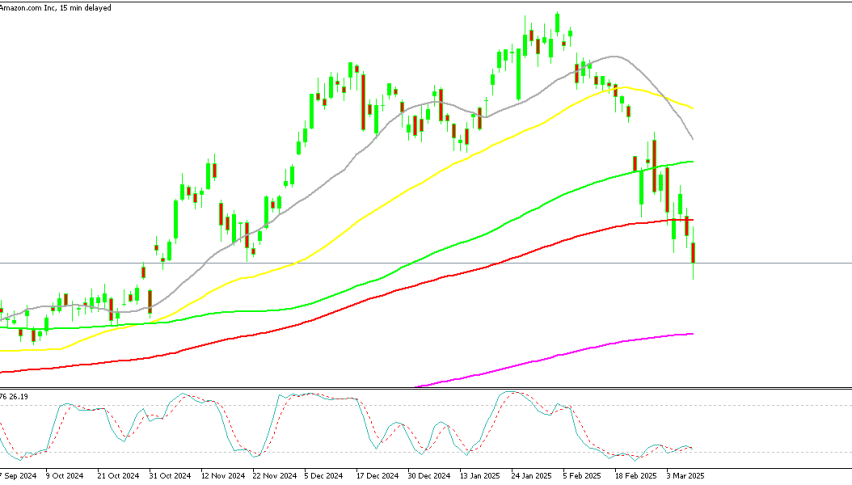

Live AMZN Chart

[[AMZN-graph]]Today the Amazon stock AMZN seems to be one of the weakest as it fell below $200, despite positive comments from FED’s Powell.

S&P 500 and Nasdaq Battle Key Support Levels

The stock market remains under pressure, with both the S&P 500 and Nasdaq falling nearly 1% earlier in the session, reaching fresh lows before staging a modest recovery. The S&P 500 dropped 53.5 points (-1%) to 5,665, while the Nasdaq fell 200 points (-1.10%) to 17,790. However, both indices have since rebounded to trade near flat levels, as the 100-day moving average provided support for the S&P 500, preventing further downside for now.

Amazon Stock Extends Decline, Breaks Below $200

Amazon (AMZN) has seen increased volatility, falling nearly 20% from its early February peak. The stock opened with another bearish gap today, continuing its recent downtrend. A decisive break below the $200 level and the 100-day SMA (red) on the daily chart confirmed further bearish momentum, sending AMZN down another 4% to $192.40.

Despite this decline, Amazon’s stock has surged 300% over the past two years. The company reported strong Q4 2024 earnings on February 6, exceeding forecasts with an operating income of $68.6 billion, up 86% from the previous year. The standout performer was Amazon Web Services (AWS), which accounted for more than half of the company’s total operating revenue.

Investor Concerns Over AI and $100 Billion Spending Plan

While Amazon’s financial performance remains strong, investors have grown cautious due to a planned $100 billion capital expenditure. The rise of AI-driven cloud computing competitors has increased the need for Amazon to invest heavily in expanding its processing capabilities. These concerns have weighed on the stock, pushing it into bearish territory.

Will Amazon Rebound or Face Further Losses?

For investors looking at this dip as a buying opportunity, Amazon would need to reverse higher and reclaim the 100-day SMA near $200 to regain positive momentum. If the stock remains below this key technical level, further downside could be in store.

Given today’s price action, where Amazon is experiencing deeper losses while most large-cap tech stocks are holding steady or in the green, the risk of additional declines remains high in the coming weeks unless buyers step in at current support levels.

Today FED chairman Jerome Powell made some comments which helped stop the decline in most stocks, but not for Amazon shares. The Federal Reserve maintains a patient stance, signaling no immediate need for policy changes despite inflationary pressures or temporary price spikes. While tariff uncertainty remains a factor, the Fed is prepared to adjust its response if inflation expectations shift. For now, the central bank views productivity gains as short-lived, and with low economic risks from caution, it prefers to monitor data before making any significant moves.

Key Takeaways from Fed’s Stance on Inflation and Policy Response

- The Fed sees no need to redefine price stability or adjust its approach to measuring inflation.

- A one-time jump in prices does not necessarily require a monetary policy response.

- There is uncertainty regarding tariffs, including their scope, duration, and potential ripple effects. If tariffs escalate or influence inflation expectations, the Fed may need to react accordingly.

- Being cautious has minimal costs, and the economy does not currently require central bank intervention.

- The Fed is leveraging large real-time data sources, such as credit card transaction data, to better assess economic conditions.

- Productivity growth is being revised higher, but it is largely viewed as a temporary boost rather than a sustained trend.

S&P 500 Live Chart

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account