Nvidia, Tesla Stock, and S&P 500 Rebound as Tariff Fears Ease

Today we saw a bounce in stock markets, with Tesla stocks bouncing around 2.5% while Nvidia and S&P 500 gained more than 1%.

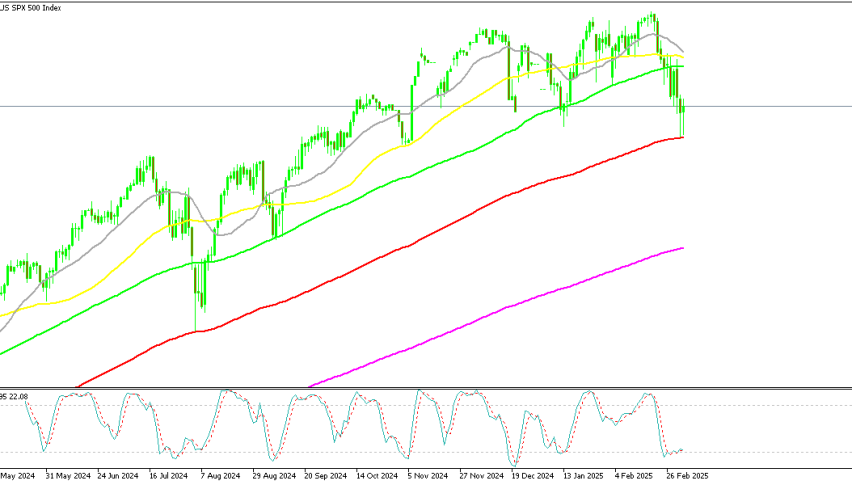

Live SP500 Chart

Today we saw a bounce in stock markets, with Tesla stocks bouncing around 2.5% while Nvidia and S&P 500 gained more than 1%.

The stock market had another volatile session, initially opening flat before dipping lower, then staging a strong afternoon rebound. The delay of auto tariffs by one month helped stabilize sentiment early in the day, but investors remained cautious. However, optimism grew throughout the session, with hopes that Trump might postpone additional tariffs later in the evening, further boosting confidence.

The S&P500 held above yesterday’s lows, sparking bottom-picking by investors. As momentum accelerated, the index gained 68 points (+1.2%), leading to a broad rally in U.S. stocks. While some discussions revolved around potential Congressional tax cuts, the main catalyst for today’s rally appeared to be growing expectations that North American tariffs would be scaled back.

US Stock Market Closing Levels – March 6, 2025

Major US Indices Performance:

- S&P 500: Closed at 5,842.63, gaining +64.48 points (+1.12%), as bullish sentiment returned.

- Nasdaq Composite: Ended at 18,552.73, rising +267.57 points (+1.46%), leading the rally with strong tech sector gains.

- Dow Jones Industrial Average (DJIA): Finished at 43,006.59, up +485.60 points (+1.14%), recovering from recent declines.

- Russell 2000 Index: Closed at 2,100.75, increasing +21.22 points (+1.02%), showing strength in small-cap stocks.

- Toronto TSX Composite: Settled at 24,870.82, climbing +298.82 points (+1.22%), following the broader market rebound.

Key Market Drivers:

- Tech Sector Leads Gains: The Nasdaq’s 1.46% jump reflects renewed buying interest in technology stocks, which had faced selling pressure in previous sessions.

- Broader Market Recovery: The S&P 500 and Dow Jones rebounded, signaling improved investor sentiment amid shifting trade and policy discussions.

- Small-Caps Rebound: The Russell 2000’s 1.02% gain suggests improving confidence in domestic growth-oriented stocks.

- Canadian Stocks Follow Suit: The TSX Composite mirrored US gains, benefiting from energy and financial sector strength.

Tech stocks led the recovery, with the Nasdaq rebounding strongly after a turbulent week. Investors rotated back into growth stocks, fueling a renewed sense of optimism across the market. If this trend continues, equities could see further upside, though traders remain cautious ahead of upcoming trade negotiations, interest rate decisions, and key economic data releases.

Nvidia Stock Finds Support After Sharp Drop

Nvidia’s stock has experienced intense volatility in recent weeks. Following the release of the low-cost DeepSeek AI chip in early February, NVDA shares plunged 25% to $113, finding support at the 50-week SMA (yellow). After rebounding, the stock declined again following last week’s earnings report, dropping to $110.70 before regaining strength.

Despite this steep sell-off, NVDA closed above $117 today, finding key support at the 50-day SMA (yellow). This moving average now appears to be a critical level for buyers, offering a potential buying opportunity for investors looking to enter NVDA stock.

Tesla Shares Rebounds After Hitting Two-Month Lows

Tesla’s stock has been under severe pressure, plunging 46.5% in just two months after peaking at $488 in December. Slowing EV demand globally has weighed heavily on the company, with China—a key market for Tesla—reporting a sharp decline in sales.

Yesterday, Tesla opened lower in pre-market trading due to weak sales data but closed unchanged after forming a bullish doji candlestick, a potential reversal signal. Additionally, the 200-week SMA (purple) provided strong support, and TSLA has already climbed 3% from yesterday’s lows, suggesting that buyers are stepping in at this level. If Tesla maintains momentum, it could see a short-term recovery, but the long-term outlook remains uncertain amid declining global EV sales.

S&P 500 Index Live Chart

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account