Ethereum Dodges Liquidation Cliff at $2,000: Will $2,125 Support Spark Recovery?

Ethereum (ETH) faced a dramatic price correction, plummeting 22% in just 48 hours and briefly trading near the critical $2,000 level on Tuesday. This sharp downturn brought the decentralized finance (DeFi) ecosystem to the brink, with a massive $126 million MakerDAO position coming within a mere $80 of liquidation.

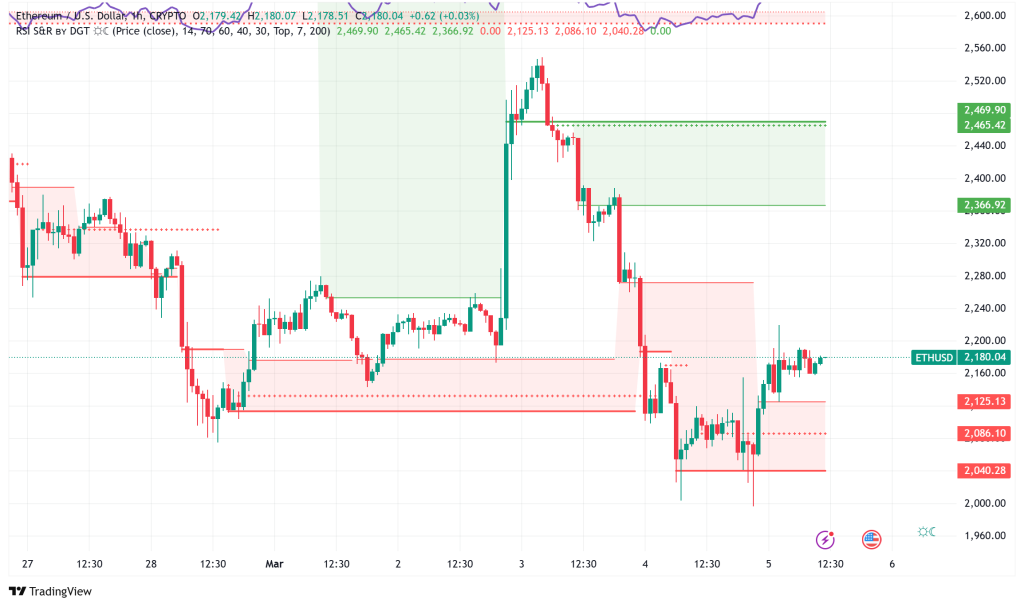

While a fortunate bounce at $2,000 averted immediate disaster, ETH/USD now hovers around $2,170, leaving investors and analysts questioning whether the $2,125 support level can hold and pave the way for a sustainable recovery.

$349 Million in DeFi Positions Teetered on the Edge of Liquidation

DeFi platform data exposed the degree of the liquidation risk. A major MakerDAO vault with $126 million in value neared the liquidation threshold with startling proximity as ETH prices fell. Moreover, DefiLlama data revealed three significant positions with combined worth of $349 million that should be sold should ETH prices fall between $1,796 and $1,929.

As sophisticated trading businesses deliberately target areas of possible supply, market dynamics generally follow these liquidation pricing points. Under DeFi liquidations, collateral—in this case ETH—is auctioned or sold off automatically. For systems like MakerDAO, this ETH is sometimes obtained at a discounted price before being resold in the larger market, therefore aggravating downward price pressure and perhaps causing a liquidation cascade – a domino effect whereby one liquidation starts another. DefiLlama claims that a shockingly $1.3 billion worth of ETH is still liquidable, with $427 million within a 20% range of the current price suggesting continued vulnerability.

ETH vs. BTC: Ether Underperforms Bitcoin Amidst Shifting Market Dynamics

Ethereum has underperformed Bitcoin (BTC) over the recent bull market; the ETH/BTC ratio dropped to 0.0235, much below past cycle highs. Analysts blame this underperformance on things like large institutional inflows into spot Bitcoin ETFs and the rise of other blockchains like Solana and Base, which have taken a chunk of Ethereum’s market share especially in sectors like DeFi and memecoins.

HashKey Global Integrates Ethereum on Base, Aiming for Lower Transaction Costs

Separate developments reveal the integration of Ethereum support on the Base network by HashKey Global, a well-known digital asset exchange under HashKey Group. This calculated approach seeks to drastically down transaction expenses for ETH users moving it from one to another. Now supporting ETH transactions across three networks—ERC-20, Base, and Arbitrum—HashKey Global gives consumers more flexible and reasonably priced choices for engaging with the Ethereum ecosystem.

This integration reflects a larger trend of cryptocurrency exchanges adopting Ethereum Layer 2 scaling solutions including Base, Arbitrum, and Optimism to reduce mainnet congestion and expensive gas fees. Layer 2 networks have also been embraced by exchanges including Binance, OKX, and KuCoin, therefore indicating a rising industry-wide movement toward improved Ethereum scalability and user experience.

ETH/USD Technical Analysis: Watch $2,125 Support, RSI Signals Bearish Momentum

Ethereum’s technical situation stays unstable even with the recent rebound. Analysis shows ETH gained support about $2,125 on Saturday, posting a 13.56% rebound to close above its daily barrier at $2,359 on Sunday. But this increasing momentum proved fleeting; Monday saw a total wipe-off of these advances. ETH most importantly rebuilt support at $2,125 on Tuesday, and right now trades somewhat above this level.

The first concern is this $2,125 support’s strength. Should it be strong, experts advise ETH might perhaps stretch its recovery and retest the $3,000 barrier mark. On Sunday, the daily Relative Strength Index (RSI), which is presently 35 and is around its neutral level of 50, presents a less positive image. This RSI reading points to ongoing bearish momentum, implying that the RSI has to convincingly break above the neutral 50 level if we are to have a continuous positive recovery.

On the other hand, a strong break and daily closing below the $2,125 support level might cause ETH to retest its weekly support level of $1,905 to drop even more. Emphasizing the need of the $2,125 zone as a crucial price battleground, this scenario fits the liquidation levels already mentioned.

Ethereum Price Prediction: Cautious Optimism for $3,000

Right now Ethereum finds itself at a crossroads. The $2,125 support level determines essentially the near-term pricing path. Although the Ethereum ecosystem gains from the HashKey Global integration and Layer 2 adoption, technical indicators and the impending DeFi liquidations point to ongoing volatility and possible negative risk should $2,125 fail to hold.

Traders should concentrate first on tracking price movement around the $2,125 support. A sustained hold over this level and an RSI break over 50 could indicate the start of a comeback toward $3,000. But a break below $2,125 might allow a retest of $1,905 and possibly start more liquidations, therefore aggravating the negative pressure.