Stock Market Swings as Nvidia Stock Gains 6%, Dow Jones Industrial Average Drops 2.5%

Today the volatility in the stock market was immense, with Dow Jones Industrial Average ending 2.5% lower, while Nvidia stock surged 6%.

Today the volatility in the stock market was immense, with Dow Jones Industrial Average ending 2.5% lower, while Nvidia stock surged 6% after the 8% dive on Monday.

Nvidia’s Volatile Session Ends on a High Note

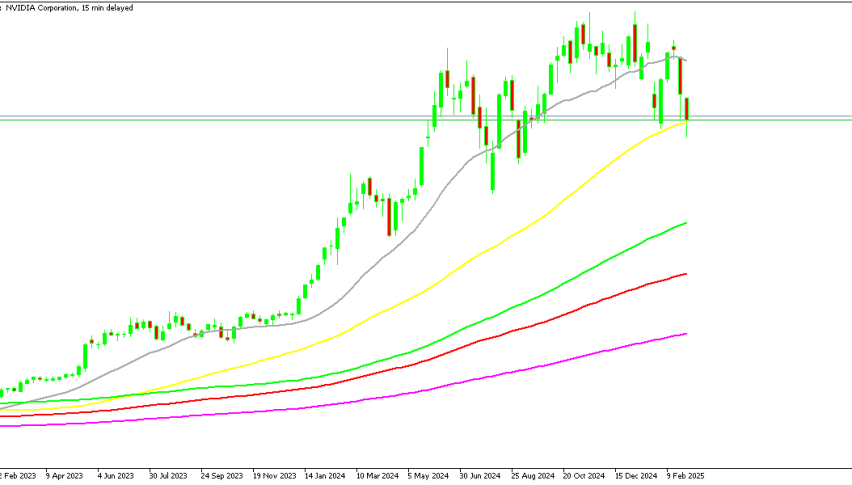

Nvidia’s stock experienced wild swings today, initially surging 5% to $135 following last week’s strong earnings report. However, the rally quickly lost steam, and NVDA opened at $110.70, marking a 20% drop in just a few days. Despite this sharp decline, the stock found support at the 50-day moving average (yellow) and rebounded, closing above $110.

This stabilization helped limit losses in the Nasdaq Composite, which ended the day with only minor declines. The 50-day SMA now appears to be a key support level, potentially offering a buying opportunity for investors looking to enter NVDA stock.

Dow Jones Takes a Hit as Tariff Fears Dominate

Unlike the tech-heavy Nasdaq, the Dow Jones Industrial Average (DJIA) suffered steep losses, dropping 2.5% as tariff tensions intensified. U.S. trade policies under Trump continue to create market uncertainty, with new tariffs imposed on China, Canada, and Mexico fueling volatility.

Senators had hoped for a quick resolution, but no clear signs of a policy reversal emerged. The only potential relief might come from Mexico delaying its retaliatory tariffs until Sunday, coinciding with Canada’s Liberal Party selecting a successor to Trudeau. Market watchers are looking for any signs of de-escalation as global trade tensions remain high.

Possible Tariff Relief on the Horizon?

In after-hours trading, White House economic advisor Lutnick suggested that Trump may soon compromise on tariffs with Canada and Mexico. According to Lutnick, the administration is considering lifting tariffs between the two nations as early as tomorrow. He also hinted that if USMCA trade agreement rules are met, further tariff adjustments could come on April 2.

Market Outlook Ahead for the Week

With tariff negotiations in flux, markets remain highly sensitive to trade developments. If Trump signals a rollback, stocks—especially export-reliant sectors—could stage a strong rebound. However, continued uncertainty and political maneuvering may keep investors on edge in the near term.

US Stock Market Closing Levels – March 6, 2025

Major Indices Performance:

- S&P 500: Closed at 5,778.15, down -71.57 points (-1.22%), reflecting broad market weakness.

- Nasdaq Composite: Ended at 18,285.16, declining -65.03 points (-0.35%), showing relative resilience compared to other indices.

- Russell 2000: Finished at 2,079.53, down -22.70 points (-1.08%), indicating continued pressure on small-cap stocks.

- Dow Jones Industrial Average: Plunged -1,114.43 points (-2.55%), closing at 42,520.99, marking the steepest decline among major indices.

Dow Jones Index DJI Live Chart

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account