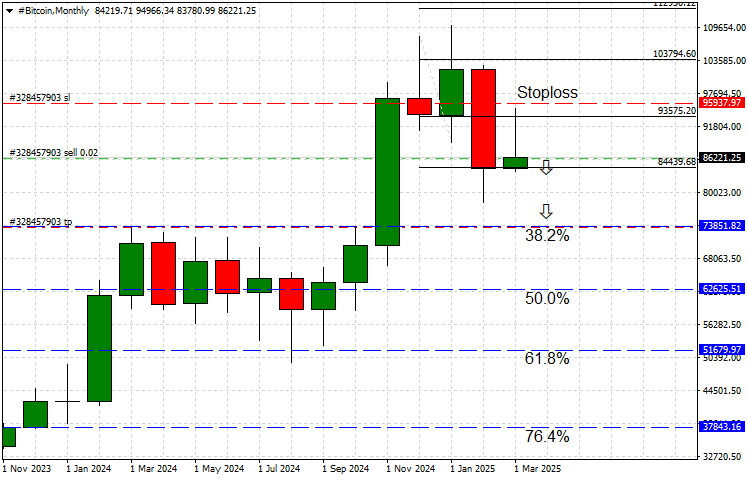

Bitcoin Confirmed Breakdown Signals Extended Correction

Bitcoin (BTC/USD) has shifted into a full on bearish outlook following the February monthly close below $84,440.

A large-scale bear cycle is now unfolding, with the next key support at $73,850, marking a significant Fibonacci correction. Read on for key insights and updated targets.

Bitcoin (BTC) has officially entered a bearish phase after its February monthly close dropped below the crucial $84,440 key support level. This breakdown serves as a major technical confirmation that the bullish structure has failed, paving the way for a broader downside correction. With selling pressure intensifying, Bitcoin now faces the risk of a deeper pullback toward the next key support zone.

As of today [03.03.25], Bitcoin (BTC/USD) is trading at $86,340, remaining under sustained bearish control. The next critical downside target is $73,850, a level derived from the 38.2% Fibonacci retracement, marking a significant profit target for this updated bearish forecast. A stop-loss level is suggested around $95,937, which aligns with a key resistance level from the latest price action.

Bitcoin Technology, Vision, and Mission

Despite its current market downturn, Bitcoin remains the dominant force in the cryptocurrency space. As the first decentralized digital asset, its mission is to redefine global finance by offering an alternative, trustless monetary system. While its price is experiencing a correction, Bitcoin’s adoption among institutions, payment networks, and sovereign nations continues to grow, reinforcing its long-term value proposition.

Bitcoin’s vision remains intact—to become the ultimate decentralized store of value and medium of exchange. Layer 2 solutions, such as the Lightning Network, continue to enhance Bitcoin’s scalability, ensuring its role in the evolving financial landscape.

Fundamental Catalysts

- Major Support Breakdown: The monthly close below $84,400 is a key bearish signal, triggering further downside risk.

- Extended Bear Cycle Confirmation: Bitcoin is now experiencing a large-scale technical correction, targeting $73,850 as the next major support level.

- Market Sentiment Shifts Bearish: With increased selling pressure, traders and institutions are adjusting their positioning to reflect the new market reality.

Key Price Levels

- Previous Support (Broken): $84,400

- Next Major Support: $73,850 (38.2% Fibonacci retracement)

- Stop-Loss Level: $95,937

- Bearish Profit Target: $73,850

Looking ahead, Bitcoin’s inability to reclaim key resistance levels suggests that selling momentum will likely persist. As long as $84,400 remains unchallenged, the bearish outlook remains dominant. The next test at $73,850 will determine whether a larger-scale correction is in play. Traders should closely monitor price action for confirmation of further downside or signs of stabilization at this critical level.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account