Amazon, Intel, Nvidia Stock Lead the Decline in Stock Market Today, on 20% China Tariffs

Today we saw another brutal reversal in stock, with Intel and Nvidia stock leading the decline in the tech sector.

Tech Stocks Face Sharp Declines Amid Tariff Hike and Market Volatility

The U.S. stock market saw a broad decline, with major indices closing sharply lower, led by weakness in the technology sector. The S&P 500, Nasdaq Composite, and Dow Jones all posted notable losses as investors grew more cautious amid ongoing market uncertainties. The Nasdaq, dominated by tech stocks, experienced the steepest drop, driven by a sharp sell-off in semiconductor and e-commerce shares.

The technology sector continues to face significant pressure, with the Nasdaq erasing its entire post-election rally and leading today’s market downturn. The latest blow came after President Trump signed an order raising tariffs on Chinese imports to 20%, further escalating trade tensions.

US Stock Market Closing Levels – March 3, 2025

Major US Stock Indices Performance:

- S&P 500: Closed at 5,849.72, down −104.78 points (-1.76%)

- Nasdaq Composite: Ended at 18,349.31, falling −497.97 points (-2.64%)

- Dow Jones Industrial Average: Finished at 43,191.24, dropping −649.67 points (-1.48%)

Tech Sector Declines:

- Nvidia (NVDA): Closed at $114.06, down −10.86 (-8.69%)

- Intel (INTC): Ended at $22.64, losing −1.41 (-7.4%)

- Amazon (AMZN): Settled at $203.02, declining −10.26 (-5.02%)

- Meta (META): Finished at $652.35, dropping −15.15 (-3.07%)

Trump’s announcement that tariffs will take effect tomorrow, with duties in China being more than anticipated, has totally reversed Friday’s significant surge in US stock markets.

Intel’s Volatile Trading Session

Intel had a turbulent day in the market, starting strong with a 5% bullish gap before facing a sharp reversal that erased all gains. Since reaching a peak of $68 in 2021, Intel’s stock has been in a persistent downtrend. It dropped below $19 by mid-2024, establishing a solid support level before rebounding by nearly 40% in February. However, last week’s decline below the 100-day SMA (red) signaled renewed selling pressure. Despite hope surrounding potential partnerships with Nvidia and Broadcom, Intel remains under stress. The stock ultimately closed 7% lower, reflecting investor skepticism about its long-term recovery.

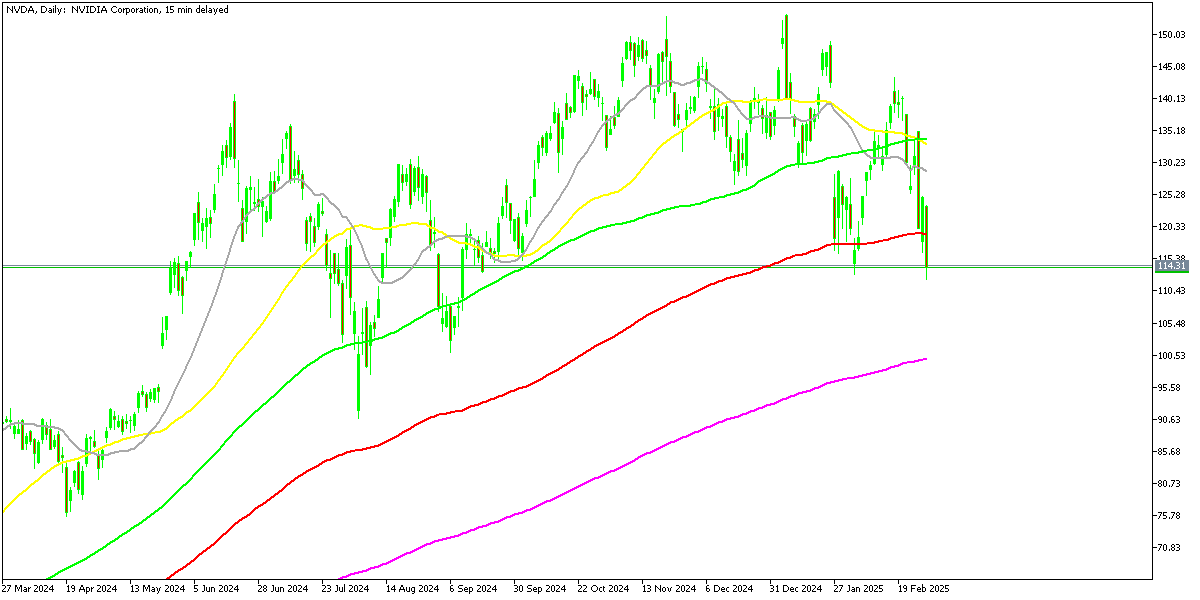

Nvidia’s Growth Faces Short-Term Pressure

As demand for high-performance AI chips surges, Nvidia remains a dominant force in the sector. The company posted another impressive earnings report, with Q4 revenue reaching $39.33 billion and adjusted EPS at $0.89, compared to $22.1 billion revenue and $0.52 EPS in Q3. Nvidia’s remarkable bull run since October 2022 has cemented its leadership in AI, but 2025 has brought increased volatility, with today marking another significant drop. Despite short-term fluctuations, Nvidia’s projected Q1 2025 revenue of $43 billion suggests steady long-term growth compared to $42.07 billion in Q1 2024.

While both Intel and Nvidia face immediate market challenges, Nvidia’s strong revenue expansion and AI dominance offer more resilience, whereas Intel’s struggles with competitive pressures and technical breakdowns leave its future uncertain.

Nasdaq 100 Live Chart

Sidebar rates

82% of retail CFD accounts lose money.