Gold Price Crash Stops – A Good Opportunity to Buy XAU Toward $3,000?

Gold prices tumbled $120 lower this week after printing another record high on Monday, but we saw a reversal right at the end...

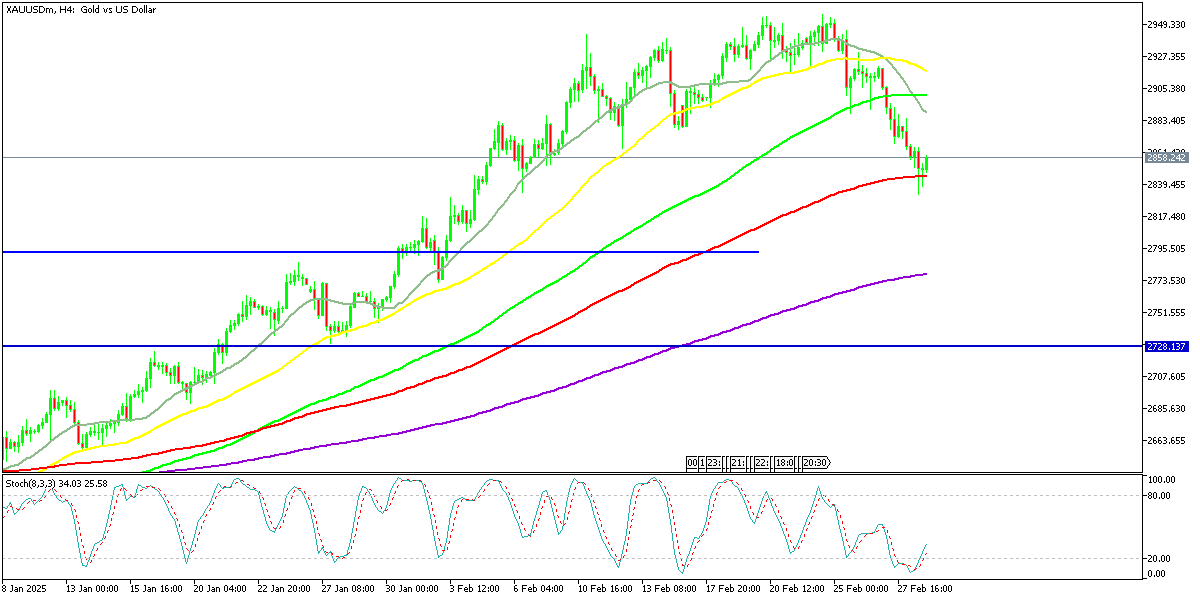

Live GOLD Chart

Gold prices tumbled $120 lower this week after printing another record high on Monday, but we saw a reversal right at the end, which suggests a bullish reversal next week.

Gold’s Pullback and Market Sentiment

Gold experienced a volatile trading week, initially dropping by $120 at its lowest point on Friday before recovering some losses. The metal closed the week down $80, weighed down by a stronger U.S. dollar. However, sentiment improved in the final hours before the weekend, allowing gold to rebound by $25 from the lows, forming a bullish reversal pattern on the weekly chart. This suggests that the recent decline may be a temporary pullback rather than a trend reversal.

GOLD has maintained a strong uptrend since Q4 of 2023, breaking above $2,000 and setting multiple record highs throughout 2024. Earlier this week, it surged past $2,956, reaching another all-time high before experiencing a sharp correction. The flash crash pushed prices below the 200 SMA and under the $2,900 mark, where it ended the week. Despite this decline, gold remains in high demand, continuing to attract buyers during both risk-on and risk-off market conditions.

Gold Chart Daily – Potential for a Bullish Reversal?

The latest dip could offer a buying opportunity for traders looking to re-enter the gold market. The key support level sits around Friday’s low of $2,832, making it a potential entry point for long positions. Technical indicators, such as the weekly stochastic oscillator, suggest that gold is oversold, while the formation of a pin candlestick hints at a possible bullish reversal.

If momentum picks up, the first target for gold would be $2,950, followed by a potential climb toward $3,000 in March. Given the current macroeconomic landscape, including ongoing inflation concerns and uncertainty in global markets, gold’s safe-haven appeal could drive renewed buying interest in the coming weeks.

Gold Live Chart

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account