Nasdaq Ends Week 1.5% Up, Tesla Stock Finds Support As Predicted

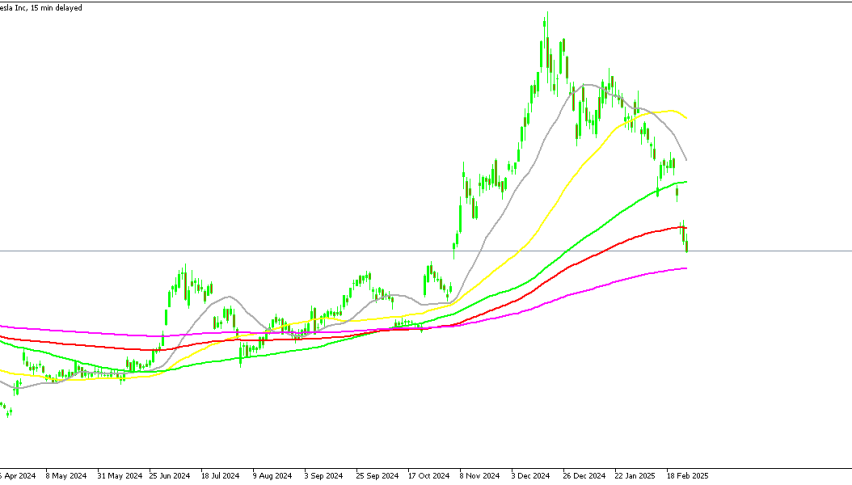

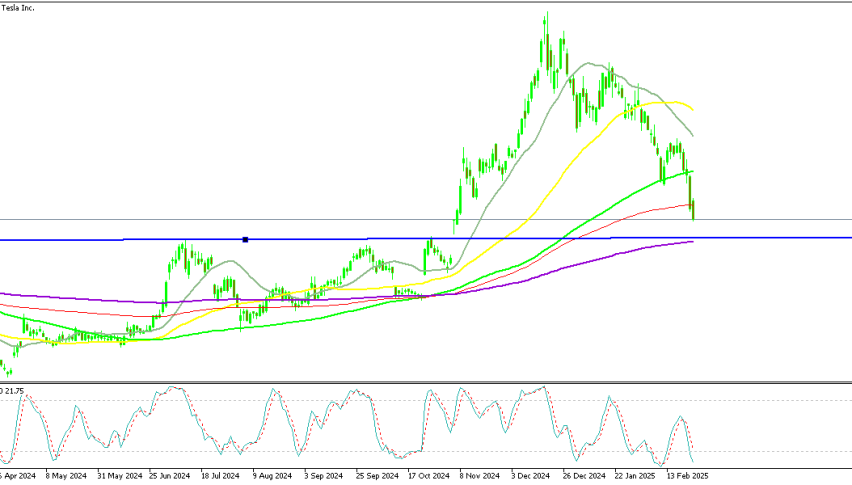

Tesla stock declined 14% this week but managed to rebound on Friday at support, which might be the start of a bullish reversal.

Market Overview and Economic Indicators

The week began with economic data that largely aligned with expectations, painting a picture of a stable inflationary environment. The January trade balance report revealed a sharp increase in imports, reflecting ongoing demand strength.

Meanwhile, the financial markets were closely watching political developments, particularly the meeting between U.S. President Donald Trump and Ukrainian President Volodymyr Zelenskyy. Investors interpreted the discussions as a sign of potential diplomatic progress, fostering optimism despite the anticipated imposition of tariffs on Canada, Mexico, and China starting Tuesday.

Tesla Finds Support Amid Heavy Selloff

Tesla has had a rough year, with its stock down nearly 30% in 2025 and 41% from its December peak of $488. At one point on Friday, the stock was down as much as 44%, wiping out most of its post-election gains. However, the selloff found support at the 200-day moving average around $270, a level we previously identified as a key support zone. Tesla rebounded from this point, closing Friday with a 3% gain after a late-session reversal. Despite this, the stock still ended the week down over 10%.

Looking ahead, Tesla’s prospects may improve as the company rolls out new models. A refreshed version of its best-selling Model Y has already been introduced, and an affordable electric vehicle is expected to debut later this year, which might make up for the decline in European EV sales. Additionally, Tesla is set to begin paid trials for its fully autonomous robotaxi service in Austin, Texas, starting in June. These developments could provide a catalyst for a potential recovery in Tesla’s stock.

The Final Weekly Closing Levels for Main US Stock indices

Dow Jones Industrial Average

- Closed up 346 points (+0.95%) at 43,839.99

- Strong performance driven by gains in blue-chip stocks

- Investors reacted positively to easing inflation concerns and economic data

S&P 500

- Finished up 81.23 points (+1.37%) at 5,954.39

- Broad-based rally with tech and consumer discretionary sectors leading

- Continued investor confidence in corporate earnings and economic resilience

Nasdaq Composite

- Closed up 302.86 points (+1.63%) at 18,847.28

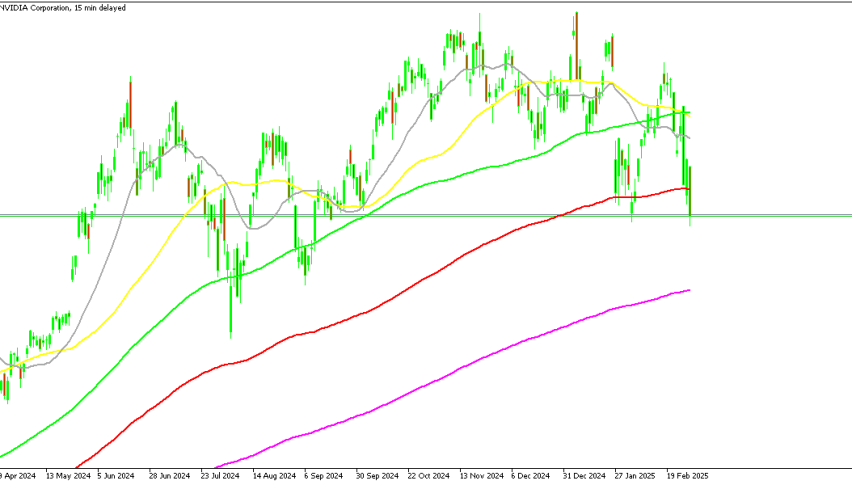

- Tech-heavy index benefited from rebounds in Nvidia and Tesla stocks

- AI-related stocks and semiconductor sector continued to see strong demand

Russell 2000 (Small-Cap Index)

- Declined 37.40 points (-1.47%) to 2,163.06

- Underperformance reflects investor caution toward smaller companies

- Higher interest rates and economic uncertainty weighed on small-cap stocks

Nasdaq 100 Live Chart

Sidebar rates

82% of retail CFD accounts lose money.