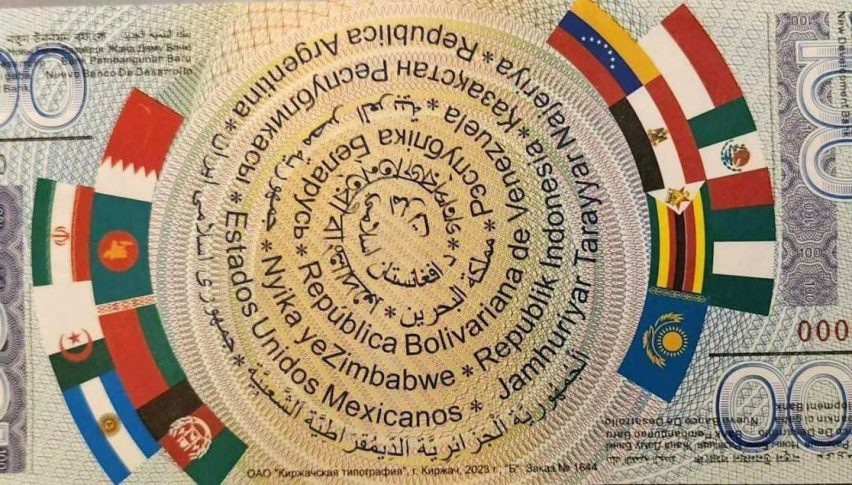

BRICS Launching New Payment System – Brazil’s 2025 Plan Shakes Things Up!

Brazilian President Luiz Inácio Lula da Silva has unveiled his agenda for Brazil’s BRICS presidency in 2025 and it’s all about secure...

Brazilian President Luiz Inácio Lula da Silva has unveiled his agenda for Brazil’s BRICS presidency in 2025 and it’s all about secure and independent payment systems.

At the BRICS Sherpas meeting in Brasília on February 26, Lula said we need financial infrastructure that increases sovereignty and minimizes our reliance on Western dominated networks like SWIFT.

This is part of the broader strategy of the BRICS countries to build an autonomous financial system. For the past few years the bloc – Brazil, Russia, India, China and South Africa – has been looking for alternatives to Western financial systems especially after the sanctions on Russia showed us the risks of over dependence on traditional global banking frameworks.

The #UAE has participated in the first #BRICS Sherpa meeting of 2025, which took place in the Brazilian capital, Brasilia, following #Brazil’s assumption of the group’s presidency for this year#UAE #Brazil #BRICS #UAE_Brazil #UAEATBRICS #الإمارات_في_بريكس @BrasiliaUAE pic.twitter.com/c2ZwRid9P1

— UAE Forsan (@UAE_Forsan) February 27, 2025

BRICS Aims for Financial Independence

Brazil’s 2025 BRICS presidency has the following objectives:

Develop a secure payment framework* that allows transactions between member countries.*

Strengthen trade ties* by increasing bilateral and multilateral trade within BRICS.*

Explore alternatives to the US dollar* for international transactions.*

Lula’s focus on payment systems is in line with BRICS’ long term vision of financial sovereignty. Discussions on alternative mechanisms (blockchain based settlements and local currency trade) are gaining traction. By prioritizing these initiatives Brazil hopes to accelerate BRICS to be able to operate independently in the global financial system.

BRICS is getting dead serious about independent payment networks. Brazil’s 2025 agenda puts the dollar further in the rearview. Digital finance is reshaping global power.

— Degen Hawk (@DegenHawk_) February 28, 2025

Potential for a Common BRICS Currency

BRICS members have been talking about a common currency to facilitate trade and bypass dollar based systems. A fully integrated BRICS currency is a long term goal but Brazil’s leadership can move faster on dedollarization.

China and Russia have been championing the use of local currencies in cross border trade, India and Brazil are slowly warming up to the idea. If Brazil’s push for secure payment infrastructure gains momentum it can pave the way for a more unified financial system among BRICS countries.

With Brazil at the helm in 2025 BRICS will intensify the efforts to reshape global financial systems, transparency, security and less dependency on Western institutions. The next year can be a turning point for the bloc’s economic influence, positioning it as a major player in global finance.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account