Ethereum Sinks 17% to $2,300 as Bybit Hack Resolution and Trump Tariffs Trigger Market Selloff

Ethereum has experienced a dramatic price drop over the past 48 hours, plummeting 17% to trade around $2,300—its lowest level in over 150

Live ETH/USD Chart

Ethereum has experienced a dramatic price drop over the past 48 hours, plummeting 17% to trade around $2,300—its lowest level in over 150 days. This sharp decline comes despite positive developments on Ethereum’s technical roadmap, including progress on the Pectra upgrade, and organizational changes at the Ethereum Foundation.

Bybit Hack Resolution Fails to Restore Market Confidence

Paradoxically, the conclusion of the Bybit hack—which claimed terrorists connected to North Korea’s Lazarus Group stole over 400,000 ETH—has added to market pressure. Ethereum developers angrily rejected ideas for a blockchain rollback, even while Bybit has fully paid impacted consumers and returned over 100,000 ETH to partner exchanges offering emergency liquidity.

Parts of the stolen money were laundered using Solana-based memecoins, according on-chain investigation, which begs questions about complete recovery chances. Along with macroeconomic challenges, this uncertainty has sped Ethereum’s downslope.

Trump’s Trade Policies Add Pressure as Tariffs Loom

Further aggravating Ethereum’s problems is the declaration of increased taxes on Mexican and Canadian imports made by U.S. President Donald Trump, which stoked inflationary worries. Set to start on March 1, these tariffs have caused more general risk-off attitude in crypto markets.

Fascinatingly, rumors surfaced that former President Trump personally keeps accumulating Ethereum amid this downturn, according to cryptocurrency expert Crypto Rover. With trading volumes on significant exchanges rising by 15%, this news momentarily boosted ETH up 3.2% from $2,800 to $2,890 before the more general selloff started.

Ethereum Foundation Leadership Transition Amid Market Turbulence

The Ethereum Foundation announced a leadership change against this difficult market environment, with Executive Director Aya Miyaguchi moving to the position of president beginning February 25. Joined the foundation in 2018, Miyaguchi handled significant events including Ethereum’s 2022 proof-of-stake change.

Months of community criticism preceded the leadership move; some stakeholders claimed poor leadership among Ethereum’s declining developer growth in comparison to rivals such as Solana. Vitalik Buterin, an Ethereum co-founder, has supported Miyaguchi’s contributions by denouncing hostility aimed at her and therefore asserting his power over leadership choices.

Ethereum Pectra Upgrade Faces Testnet Challenges

Regarding technical development, Ethereum’s Pectra upgrade started on the Holesky testnet on February 24 but did not finish in the planned window. Combining 11 main Ethereum improvement ideas (EIPs), EIP-7702 targeted at improving wallet user experience and EIP-7251 would let validators raise their maximum stake from 32 to 2,048 ETH.

The Sepolia testnet is set for next testing on March 5; developers may postpone this depending on the resolution of present problems. Although these technical advancements show great promise for Ethereum’s long-term future, current market issues have taken the stage.

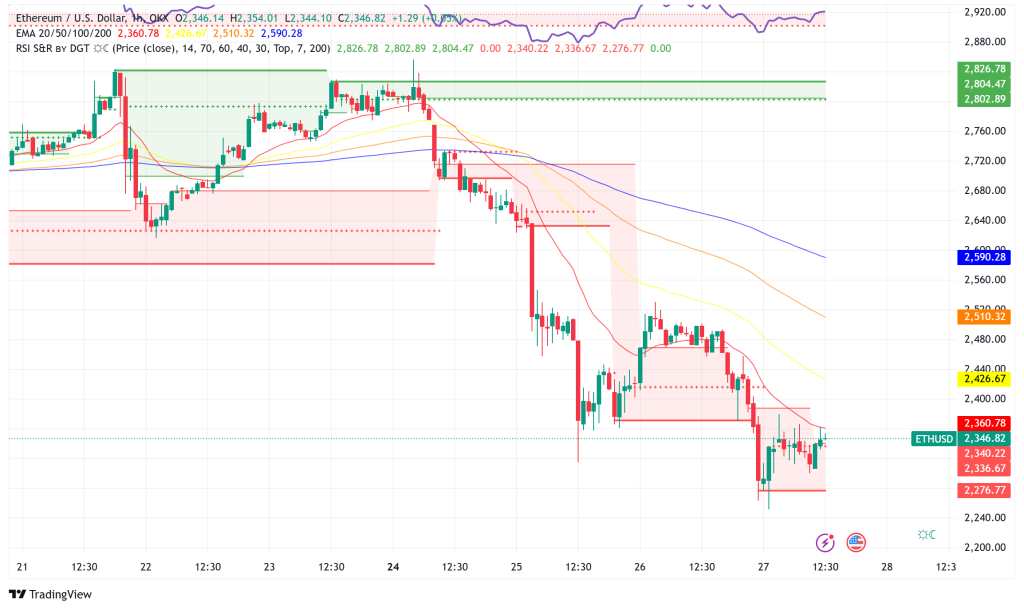

ETH/USD Technical Analysis Points to Further Downside Risk

The technical picture for Ethereum ETH/USD has deteriorated significantly with the formation of a death cross—where the 50-day simple moving average (currently at $2,933) crosses below the 200-day SMA (at $3,264). This bearish technical indicator typically signals sustained downward pressure.

The selloff gained momentum after ETH lost support at its 100-day SMA, with the cryptocurrency now struggling to hold the $2,315 level that previously acted as a pivot point in early January. The Money Flow Index (MFI) at 37.28 indicates dominant selling pressure that hasn’t yet reached oversold territory—suggesting potential for further declines.

A decisive break below $2,250 could expose ETH to a retest of the $2,100 psychological threshold, with subsequent support levels at $2,050 and $2,000.

Ethereum’s Derivatives Markets Show Bulls Taking Heavy Losses

Liquidation data in futures markets shows the degree of Ethereum’s fall-off. Coinglass claims that long-standing traders suffered disproportionately while ETH liquidations rose to $124 million in a 24-hour period. Long liquidations exceeded around $100 million, 75% more than short liquidations, suggesting leveraged bulls were surprised by the fast price decline.

This disparity implies that negative traders currently have the upper hand and might keep pushing their advantage even if ETH fails to recover the important $2,500 level in the short term.

Can Ethereum Price Bounce Back?

Before aiming for the $2,500 barrier zone, Ethereum must firmly recover the $2,400 level. A break above $2,500 might set off a near-term relief movement toward $2,550 or perhaps $2,620.

But given the present market configuration and macroeconomic headwinds, any rebound runs as a “dead cat bounce” inside the larger bearish framework unless ETH can go beyond its 50-day SMA.

As the market navigates this period of heightened uncertainty, traders and investors will be closely monitoring key support levels, particularly $2,250 and $2,100, while watching for signs of institutional accumulation that could signal a potential trend reversal.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account