Solana Price Plummets 50% from All-Time High, What’s Next?

From its all-time high of $295 hit in January 2025, Solana’s native token (SOL) has dropped to $144, half its value. Investors and analysts are worried about the near-term future of the blockchain since the steep decline has sent SOL/USD to its lowest price level since October 2024.

Why is Solana Price Crashing?

Several linked elements influencing the Solana ecosystem can help to explain the sharp drop:

1. Collapsing On-chain Activity

From $12 billion in January to $7.13 billion now, Solana’s Total Value Locked (TVL) has plunged sharply. Important decentralized applications have seen notable drop in usage:

- Raydium saw a 60% drop in activity

- Jupiter DEX declined by 25%

- Jito liquid staking fell by 46%

- Kamino Lending decreased by 33%

These drops have directly impacted Solana’s on-chain volumes, which plummeted from $97 billion weekly in mid-January to just $7 billion this week.

2. Liquidity Migration to Other Chains

Over the past thirty days, around $500 million in liquidity has been bridged away from Solana to rival blockchains; Ethereum, Sonic, and Arbitrum have benefited most. This migration betrays declining faith in the Solana environment.

Miles Deutscher, a crypto analyst, pointed out this change: “Solana’s fee burn dropped to its lowest value of $177,000 in a month,” and remarked that “people are tired of getting burned at the casino, and many are walking away from the tables.”

3. Collapse of Solana’s Memecoin Ecosystem

The Solana-based memecoin sector, which previously reached a collective market cap of $25 billion in December 2024, has contracted to $8.3 billion with a further 23% crash occurring in the past 24 hours alone.

After 7.5 million tokens were launched and $550 million in revenue was generated on Pump.fun, most of these speculative assets are now down 80-90% from their peaks.

4. Imminent SOL Token Unlock Pressure

With 11.2 million SOL tokens—worth over $2 billion—planned to be freed on March 1, 2025, a big bearish catalyst looms. Representing a 10% annualized inflation rate, over 16.1 million tokens will be produced overall between February and May 2025.

Many of these tokens were bought at very cheaper ($64) prices during FTX auctions by companies like Galaxy Digital, Pantera Capital, and Figure, who have little motivation to hang in the present market.

Crypto market maker Wintermute has withdrawn over $38 million worth of SOL from Binance, potentially in anticipation of further downward pressure.

Are Solana ETF Prospects Fading?

The drop in SOL price matches declining hopes for the upcoming approval of a Solana ETF in the United States. Applications for SOL-based ETFs have been filed by Franklin Templeton, Grayscale, Bitwise, Canary, 21Shares, and VanEck among several fund issuers; but, recent events as the Bybit exchange attack and OKX’s US Department of Justice settlement have muddled the regulatory picture.

Overall Crypto Market’s Bearish Mood Weighs on Solana Price

Solana’s slide coincides with a larger market downturn for cryptocurrencies; Bitcoin falls from its all-time high above $108,000 to about $86,000. But SOL’s 17% reduction since February 22 greatly outpaces the 10% drop in the wider altcoin market over the same length of time.

Further souring mood around the Solana ecosystem is the Libra memecoin affair, which saw a Solana-based token drop 90% of its value within hours and spurred charges of fraud involving Argentine President Javier Milei.

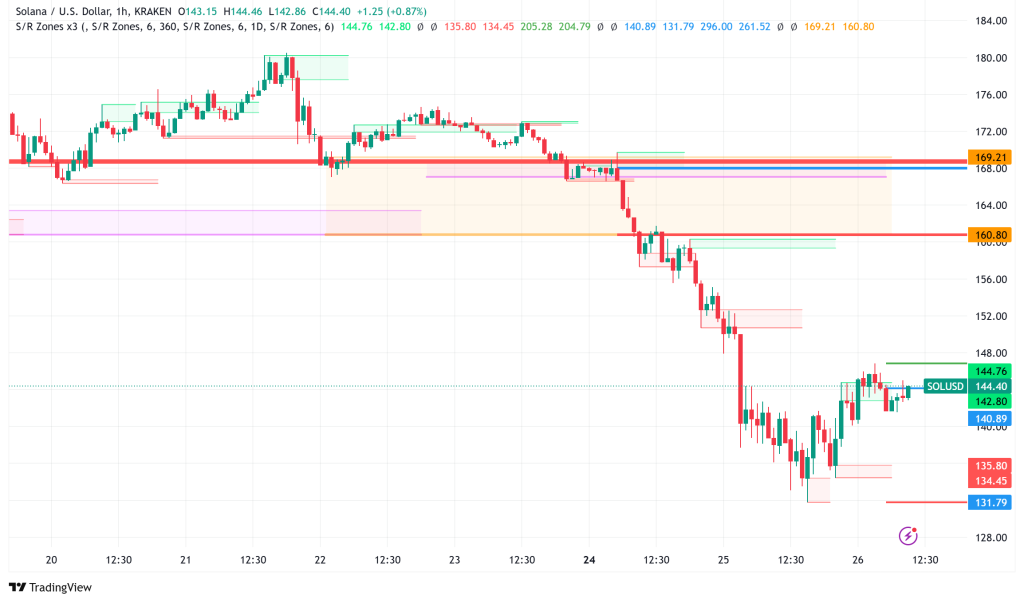

SOL/USD Technical Outlook Still Remains Bearish

From a technical perspective, Solana shows multiple bearish indicators:

- A “death cross” is forming as the 50-day weighted moving average (196.38) crosses below the 200-day WMA (198.63)

- SOL futures have entered backwardation on February 24, indicating increased demand for short positions

- Open interest on SOL futures has declined by 8.5%, from 31.6 million SOL on February 24 to 28.9 million SOL on February 25

The key support zone to watch is between $130-$140, with a potential drop to $120 if this level fails. Resistance stands between $160-$180, aligned with previous consolidation areas.

Can SOL Price Recover to ATH?

Analysts suggest Solana may take longer to regain bullish momentum compared to other cryptocurrencies due to multiple headwinds:

- Significant decline in on-chain activity

- Inflationary pressure from upcoming token unlocks

- Weak derivatives demand

- Reduced probability of imminent ETF approval

While the aggressive sell-off has pushed SOL into oversold territory, which could potentially trigger a short-term relief bounce, any sustained recovery would require SOL to reclaim levels above $160 to shift market sentiment in a more positive direction. For now, Solana’s ecosystem participants are closely monitoring key support levels while bracing for additional volatility ahead of the major token unlock event on March 1.