Silver, Gold Prices Crash As Consumer Confidence Tumbles

Gold prices have lost $60 today, while Silver has tumbled more than $1 lower, as the crash in crypto sends jitters across financial markets.

Live GOLD Chart

Gold prices have lost $60 today, while Silver has tumbled more than $1 lower, as the global economic worries weigh on market and consumer sentiment.

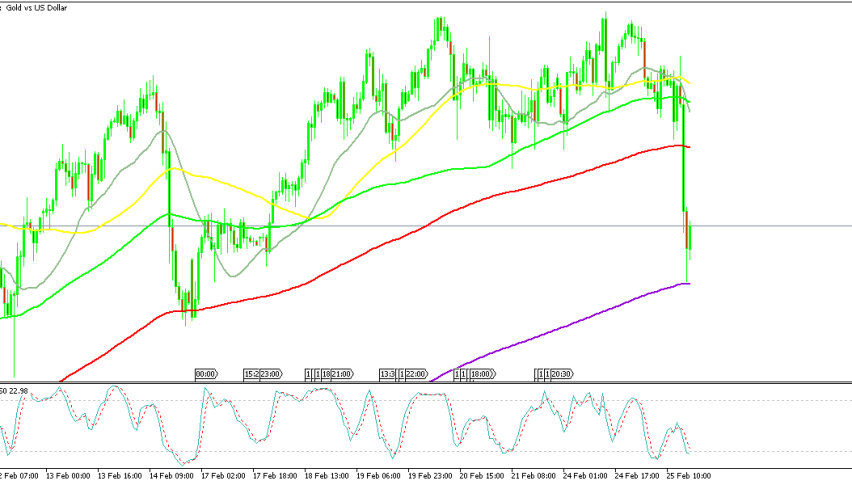

Gold Hits New Highs Before Sudden Drop

Gold surged past $2,956 yesterday, marking another all-time high while finding support at key moving averages. However, a swift bearish reversal triggered a flash crash, dragging the price below $2,900. Over the past year, gold has been on a relentless rally, climbing nearly 50% from around $2,000 at the start of 2024. The trend has been driven by both positive and negative risk sentiment, with buyers continuously pushing prices to new highs.

Despite this strong momentum, gold suddenly dropped by approximately $55 in just a few hours. The decline saw prices breaking below the 20 SMA (gray) and the 50 SMA (yellow), which had provided support since early 2025. However, the price found stability at the 100 SMA (green) on the H4 chart, presenting a potential opportunity for long positions.

Silver Chart H4 – XAG Joins the Decline After Strong Start to 2025

Silver had also been in a bullish trend this year, gaining around $4.50 since early January. Moving averages played a key role in supporting higher lows and keeping buyers in control. However, this week brought a sharp bearish reversal.

By late last week, silver was already showing signs of weakness, struggling to sustain higher levels amid challenging macroeconomic conditions. Today, XAG/USD dropped nearly $1, or about 3%, as it broke below multiple moving averages. The decline paused at the 200 SMA (purple) on the H4 chart, which could act as a crucial support level in the short term.

Outlook for Gold and Silver

While both metals have faced heavy selling pressure, key support levels are still holding. If gold and silver manage to stabilize around these areas, we could see buyers stepping in to resume the uptrend. However, continued weakness could signal a deeper correction in the precious metals market.

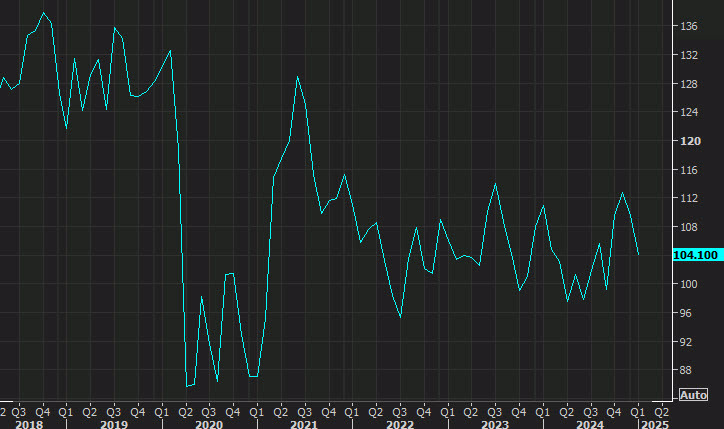

US February 2024 Consumer Confidence Report – Key Takeaways![US consumer confidence]()

Consumer Confidence Falls Sharply

- February Consumer Confidence Index: 98.3 (below the expected 102.5)

- Previous reading: 104.1

- This marks the largest monthly decline in nearly four years.

Breakdown of the Report

- Present Situation Index:

- Increased to 136.5 from 133.1, indicating that consumers still perceive current economic conditions as stable.

- Expectations Index:

- Dropped sharply to 72.9 from 82.2, suggesting growing concerns about the future economic outlook.

- 12-Month Inflation Expectations:

- Increased to 6.0% from 5.2%, raising concerns about persistent inflationary pressures.

Key Concerns and Market Implications

- This is the third consecutive monthly decline in consumer confidence, putting it dangerously close to its lowest levels since 2022.

- The sharp drop may be attributed to ongoing tariff concerns, economic uncertainty, or broader structural weaknesses.

- Rising inflation expectations will likely draw attention from the Federal Reserve, potentially influencing future monetary policy decisions.

- The University of Michigan’s consumer sentiment survey has also shown a decline recently, reinforcing signs of growing consumer pessimism.

Gold Live Chart

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account