Trump Reiterates to Fill SPR – Gas Prices Rise 20%, Oil Ignores

Natural gas prices have surged 20% in two days, with Donald Trump’s comments to fill up the SPR also helping, while Oil prices slipped lower.

| Broker | Review | Regulators | Min Deposit | Website | |

|---|---|---|---|---|---|

| 🥇 |  | Read Review | ASIC, FSA, CBI, BVI, FSCA, FRSA, CySEC, ISA, JFSA | USD 100 | Visit Broker |

| 🥈 |  | Read Review | FCA, CySEC, ASIC, MAS, FSA, EFSA, DFSA, CFTC | USD 100 | Visit Broker |

| 🥉 |  | Read Review | CySEC, MISA, FSCA | USD 25 | Visit Broker |

| 4 |  | Read Review | ASIC, BaFin, CMA, CySEC, DFSA, FCA, SCB | USD 200 | Visit Broker |

| 5 |  | Read Review | ASIC, FCA, CySEC, SCB | USD 100 | Visit Broker |

| 6 |  | Read Review | FCA, FSCA, FSC, CMA | USD 200 | Visit Broker |

| 7 |  | Read Review | BVI FSC | USD 1 | Visit Broker |

| 8 |  | Read Review | CBCS, CySEC, FCA, FSA, FSC, FSCA, CMA | USD 10 | Visit Broker |

| 9 |  | Read Review | ASIC, CySEC, FSCA, CMA | USD 100 | Visit Broker |

| 10 |  | Read Review | IFSC, FSCA, ASIC, CySEC | USD 1 | Visit Broker |

Trump’s Energy and Tax Proposals: A Closer Look

Plans to Refill the Strategic Petroleum Reserve

Former U.S. President Donald Trump has pledged to rapidly replenish the Strategic Petroleum Reserve (SPR) and lower taxes for domestic gas and oil producers. However, fulfilling this commitment would require an additional 320 million barrels of oil, posing significant logistical and financial challenges.

While Trump’s goal is to reduce energy costs, aggressively refilling the SPR could actually drive oil prices higher in the short term. Following his announcement, oil prices initially dipped, forming a minor bearish gap of 20 pips after breaking through a price vacuum. This movement mirrors past market reactions, such as the drop in crude oil prices on January 20, when Trump declared a national energy emergency, fueling concerns about increased U.S. production in an already oversupplied market.

Oil and Gas Market Trends

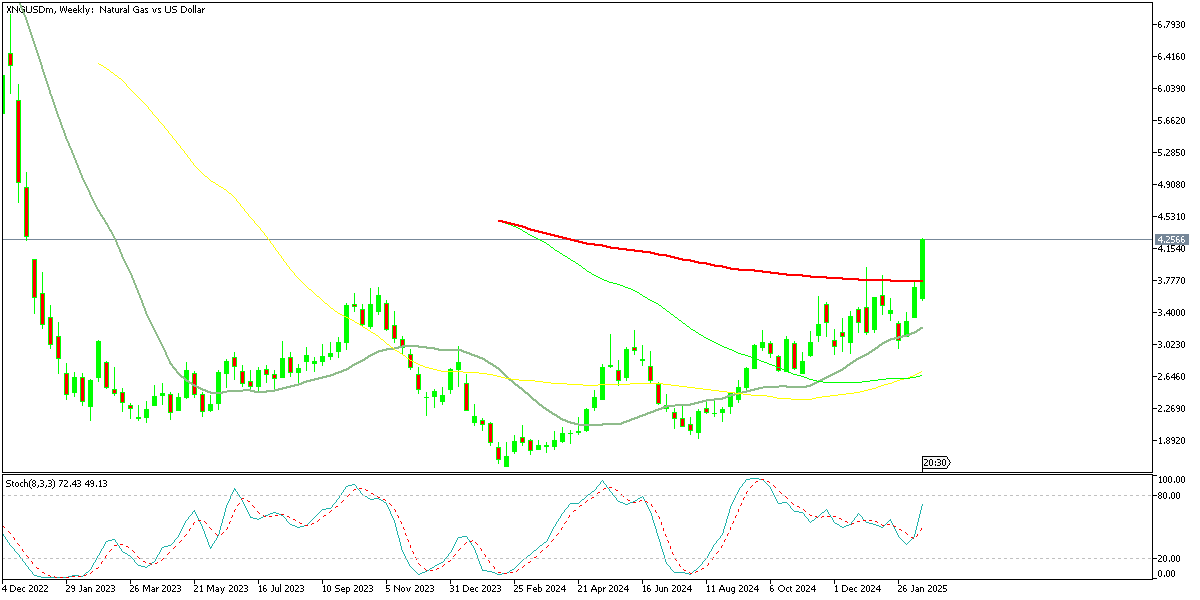

WTI crude remains supported just above the $70 mark, though it continues to make lower highs, signaling ongoing pressure. Meanwhile, natural gas has shown a bullish trend since hitting a low of $1.91 in August. Prices have been steadily climbing, supported by moving averages, with the 20 SMA (gray) pushing lows higher during pullbacks. Although gas prices briefly dropped by $1 in January, they quickly rebounded, resuming their upward trajectory. This week, gas buyers managed to break above the 100-weekly SMA (red), driving the price to 4.25 after struggling with resistance levels.

Tax Reductions and Economic Measures

Trump also stated that, if elected, his administration would implement significant tax cuts, emphasizing that tips would not be taxed. He also hinted at potential changes to Social Security taxes, though specifics were not provided.

Tariffs on Key Industries

In addition to his energy and tax policies, Trump reiterated plans to impose tariffs on various industries, including automobiles, semiconductors, chips, pharmaceuticals, and lumber. He suggested that these measures could be announced within a month or even sooner, claiming they would have a profound impact on the U.S. economy.

According to Trump, major automakers have already begun reaching out, expressing interest in shifting more production to the United States in response to these potential tariffs.

US WTI Crude Oil Live Chart

Sidebar rates

Related Posts

🏆 7 Best Forex Brokers

| Broker | Website | |

|---|---|---|

| 🥇 |  | Visit Broker |

| 🥈 |  | Visit Broker |

| 🥉 |  | Visit Broker |

| 4 |  | Visit Broker |

| 5 |  | Visit Broker |

| 6 |  | Visit Broker |

| 7 |  | Visit Broker |