TRON’s Bullish Potential: Poised for a Breakout and Expansion

TRON continues to solidify its role as a major player in the blockchain ecosystem, offering fast, low-cost transactions and a highly scalable network.

The platform’s growing integration with decentralized applications (dApps) and increasing adoption in the DeFi sector further strengthen its long-term potential. With continuous ecosystem expansion and developer engagement, TRON remains a dominant force in blockchain innovation.

| Broker | Review | Regulators | Min Deposit | Website | |

| 🥇 |  | Read Review | ASIC, FSA, CBI, BVI, FSCA, FRSA, CySEC, ISA, JFSA | USD 100 | Visit Broker >> |

| 🥈 |  | Read Review | FMA, FSA | USD 50 | Visit Broker >> |

| 🥉 |  | Read Review | FSCA, CySEC, DFSA, FSA, CMA | USD 0 | Visit Broker >> |

| 4 |  | Read Review | SFSA, FSCA, CySec* | USD 5 | Visit Broker >> |

| 5 | Visit Broker >> | Read Review | FCA, CySEC, FSCA, SCB | USD 100 | Visit Broker >> |

| 6 |  | Read Review | FCA, FINMA, FSA, ASIC | USD 0 | Visit Broker >> |

| 7 |  | Read Review | CySEC, FCA, FSA, FSCA, Labuan FSA | USD 100 | Visit Broker >> |

| 8 |  | Read Review | Not Regulated | 0.001 BTC | Visit Broker >> |

| 9 |  | Read Review | ASIC, CySEC, FSCA, CMA | USD 100 | Visit Broker >> |

| 10 |  | Read Review | SVGFSA | USD 5 | Visit Broker >> |

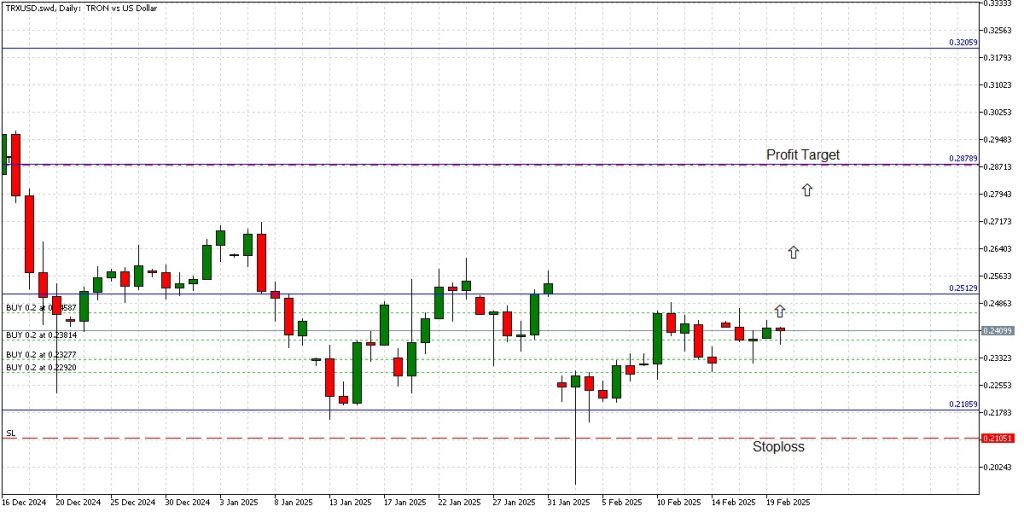

As of today [20.02.25], TRON (TRX) is trading at $0.2410. The asset has shown resilience in recent weeks, maintaining stability above key support levels of $0.2185. A breakout above the immediate resistance zone of 0.2513 could pave the way for further gains, targeting price levels at the next key resistance of $0.2880 and potentially even higher.

TRON’s growing transaction volume and increased staking activity highlight investor confidence and long-term accumulation.

Fundamental Catalysts

- Network Expansion: TRON’s increasing adoption in the DeFi space and integration with major platforms strengthen its position in the market.

- Growing Utility: With rising transaction volume and active addresses, TRON continues to demonstrate high network engagement and real-world use cases.

- Institutional & Retail Interest: TRX’s market dynamics indicate growing confidence from both institutional investors and retail participants, suggesting strong demand for the asset.

Looking ahead, TRON’s market structure and bullish momentum suggest an optimistic trajectory. As long as key support levels hold and adoption continues to grow, TRX could see further upside in the short to medium term, making it a compelling asset to watch in 2025 and beyond.

Sidebar rates

Related Posts

🏆 7 Best Forex Brokers

| Broker | Website | |

|---|---|---|

| 🥇 |  | Visit Broker |

| 🥈 |  | Visit Broker |

| 🥉 |  | Visit Broker |

| 4 |  | Visit Broker |

| 5 |  | Visit Broker |

| 6 |  | Visit Broker |

| 7 |  | Visit Broker |