Litecoin Surges Past $10B Market Cap as SEC Reviews Third ETF Filing, Technical Indicators Signal Further Upside

Litecoin (LTC) demonstrated remarkable strength in recent trading, surging over 10% to reach $135.52 on Wednesday amid growing optimism

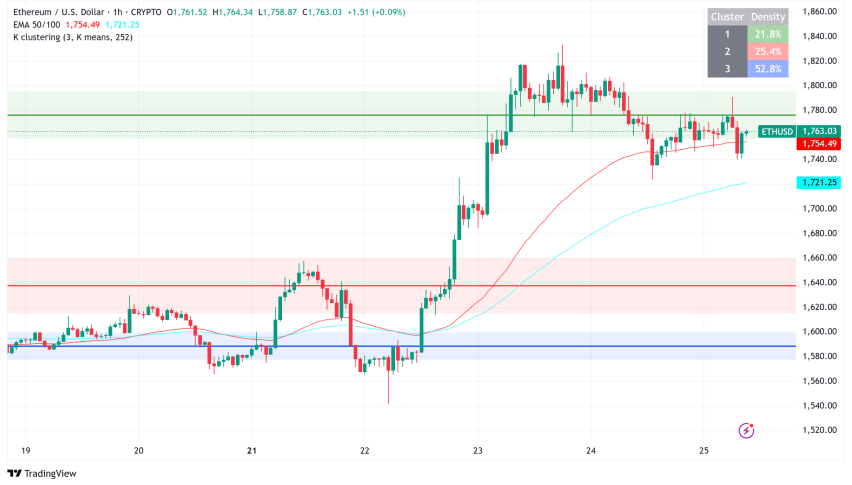

Live LTC/USD Chart

Litecoin (LTC) demonstrated remarkable strength in recent trading, surging over 10% to reach $135.52 on Wednesday amid growing optimism surrounding potential ETF approval and strong technical indicators. LTC/USD, currently ranked 15th by market capitalization, has posted an impressive 18.4% gain over the past week, challenging key resistance levels.

Spot Litcoin ETF Momentum Builds

Third such proposal under consideration is Coin Shares’ spot Litecoin ETF filing accepted by the U.S. Securities and Exchange Commission (SEC). Following past releases from Canary Capital and Grayscale, this presents a progressively hopeful picture for institutional adoption. With a 90% probability of Litecoin ETF approval assigned by Bloomberg’s senior ETF analyst Eric Balchunas, September’s decision is expected.

Market Dynamics and Trading Behavior

Recent data from IntoTheBlock shows a fascinating trend in trading activity whereby market players aggressively trade the range between $100 and $135. With strong buying support developing around the $100 level and the rapid recovery from February’s brief down to $80, this price action has laid a basis for the present consolidation period.

LTC/USD Technical Study Reveals Strength

From a technical standpoint, the latest price activity is really remarkable. Using its 200-week Exponential Moving Average as a basis for its current climb, LTC effectively defended its $87.45 in early February. Suggesting a possible trend reversal, the cryptocurrency has also cracked above a notable declining trendline in place since March 2022.

Litecoin’s Derivatives Markets Signal Growing Interest

The futures market offers maybe the most convincing proof of Litecoin’s revived vigor. Levels not seen since May 2021, open interest has peaked at $887.9 million, four years high. This notable rise from $420.52 million on February 5 points to consistent purchasing pressure and shows notable fresh capital entering the market.

Litecoin Price Analysis: Key Targets

Corresponding to the December 5 high, technical analysts have found $147.06 as the immediate resistance level. A breakthrough above this level might open the path for a $170 drive. Although still below overbought circumstances, the weekly Relative Strength Index (RSI) value of 65 shows great bullish momentum suggesting space for additional gain.

Litecoin Price Forecast

Although the immediate future seems bright, market watchers point out numerous elements that can affect Litecoin’s path:

- The broader cryptocurrency market’s performance, with Bitcoin currently trading around $95,000

- Macroeconomic conditions, particularly Federal Reserve interest rate decisions

- The ongoing 21-day public comment period for the ETF filings

- Potential impact from Grayscale’s holdings of 2.04 million LTC, which could affect market supply

Should present momentum continue, experts advise Litecoin might test its three-year high of $150, last seen in January 2022, with some estimates suggesting an upward movement to $200 by April 2025.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account