Gold Price Hits New Record as USD Weakens, Eyes $3,000 Mark

The volatility in Gold remains enormous, with XAU touching $2,954 today before retreating $30, while the USD has slipped 70 pips lower.

Gold prices continue to climb, setting new records as financial market uncertainties drive strong demand for the safe-haven asset. Earlier in February, gold hit a high of $1,942 before pulling back, but key moving averages provided support, preventing a deeper decline. The ability of gold to maintain higher lows suggests that buyers remain in control, reinforcing bullish sentiment in the market.

Yesterday, XAU/USD surged to an all-time high of $2,947, fueled by escalating concerns over a potential trade war and broader global economic instability. These fears intensified following fresh reciprocal tariff threats from former U.S. President Donald Trump, triggering a strong inflow into gold.

Gold Chart H4 – MAs Continue to Hold As Support

Today, bullish momentum continued, with GOLD reaching $2,955 during the European session. However, the price later retreated by $30 to $2,924, where it found support at the 20-day simple moving average (SMA, gray), effectively halting the pullback. The quick rebound from this level indicates renewed buying pressure, and with the current trend favoring the upside, we are now looking to open a buy signal on gold as market conditions remain favorable for further gains.

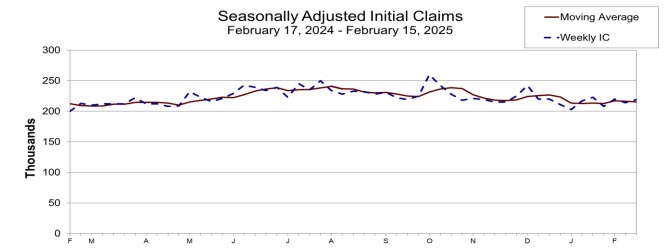

The USD weakness has also helped propel Gold higher in recent weeks. Today we had the latest data on U.S. initial jobless claims which showed a slight increase, with claims rising to 219,000, above the 215,000 forecast. This marks an increase from the 214,000 recorded the previous week, which had been revised up from an initial estimate of 213,000.

US Jobless Claims Report – Slight Increase but Labor Market Remains Steady![Initial claims]()

Initial Jobless Claims

- Latest data: 219,000, slightly above the 215,000 forecast.

- Previous week’s claims: Revised from 213,000 to 214,000.

- Four-week moving average: 215,250, down from 216,250 last week, indicating a stabilizing trend.

Continuing Jobless Claims

- Current continuing claims: 1.869 million, slightly below the expected 1.871 million.

- Previous week’s claims: Revised from 1.850 million to 1.845 million.

- Four-week moving average: 1.863 million, down from 1.870 million, signaling steady job retention.

While initial jobless claims were slightly higher than expected, the overall labor market remains steady, with continuing claims showing a marginal decline. The drop in the four-week moving averages for both initial and continuing claims suggests a resilient job market despite some short-term fluctuations. These figures indicate that employment conditions remain solid, with no significant signs of a downturn in job stability.