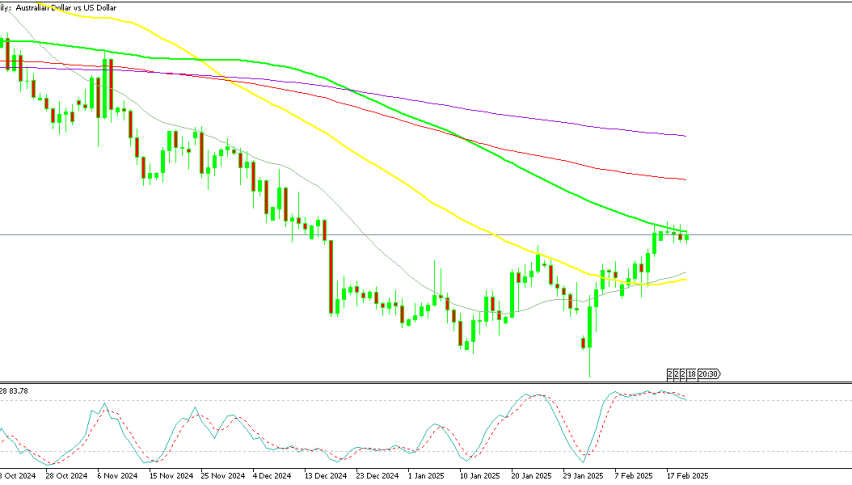

AUDUSD Tests the 100 SMA After the Strong Australian Jobs Report

AUD/USD jumped 20 pips yesterday after another strong employment report from Australia, which confirms the hawkish bias of the RBA.

Live AUD/USD Chart

AUD/USD jumped 20 pips yesterday after another strong employment report from Australia, which confirms the hawkish bias of the RBA, following the 25 bps rate cut.

AUD/USD declined by 8.5 cents in the fourth quarter of 2024 but found support below 0.61 in January before rebounding. Currently, it hovers just under 0.64, awaiting clarity on whether the proposed U.S. tariffs on Australia will be fully implemented, as well as the outcome of ongoing U.S.-China reciprocal tariff discussions.

U.S. President Donald Trump announced a 25% tariff on steel and aluminum, with the official signing expected between today and tomorrow, though the measures may be enacted at a later date. Additionally, he hinted at potential tariffs on imported cars and computer chips, though details remain uncertain, leaving AUD traders in a wait-and-see mode. However, the latest Australian employment report, which showed solid job growth, provided some support for the Aussie overnight.

Australian Labour Market Report – Strong Job Growth and Record Participation

Key Highlights

Employment Growth:

- Increased by 44,000, exceeding the expected 20,000, but lower than the previous 56,300.

- Growth was driven primarily by full-time jobs.

Unemployment Rate:

- 4.1%, up from 4.0% in the previous report.

- The rise is attributed to a surge in the participation rate rather than job losses.

Participation Rate:

- Reached a record-high 67.3%, surpassing expectations of 67.1%.

- Increase largely driven by higher female workforce participation.

Full-Time vs. Part-Time Employment:

- Full-time employment rose by 54,100 jobs.

- Part-time employment declined by 10,100 jobs.

- Previous report: Full-time +80,000, Part-time -23,700.

Australia’s labor market remains strong, with robust employment growth and record-high participation, particularly among women. While the unemployment rate edged higher, it was due to an expanding workforce rather than economic weakness. Full-time job creation remains the driving force behind employment gains, signaling resilience in the job market.

AUD/USD Live Chart

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account